Fixed Asset Turnover Definition

Fixed asset turnover is the ratio of net sales divided by average fixed assets. This ratio is one of the efficiency ratios that analysts use to determine the overall effective utilization of the resources by a company. It measures the productivity of the company’s fixed assets to generate revenue. In other words, it indicates how efficiently the management has been able to put to use its fixed investments to earn more and more revenue.

Every company has some amount of fixed assets. However, the manufacturing companies use this ratio mostly because all manufacturing concerns have significant investments in fixed assets like building and machinery for producing the goods.

It provides useful information to investors, lenders, creditors, and management on whether the company utilizes its fixed assets optimally and adequately. Whether over the period, the company has improved the efficiency of its fixed assets over a period or not. The improvement in efficiency indicates that no asset is lying idle and are put to best use.

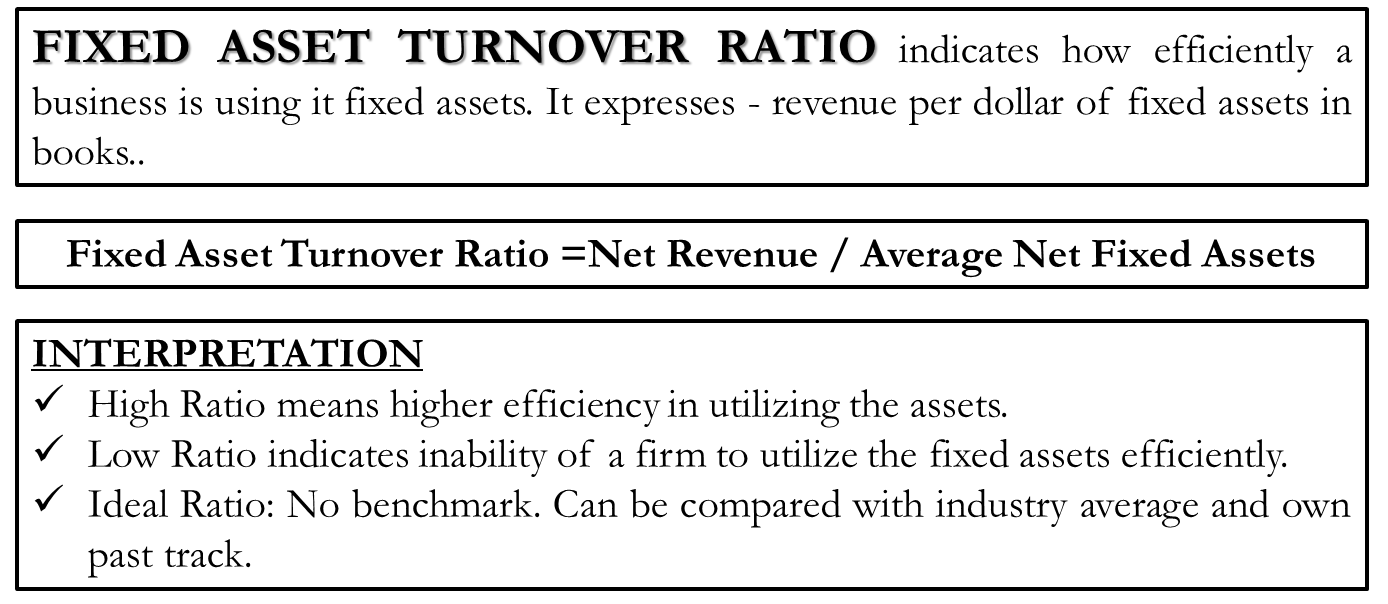

Fixed Asset Turnover Ratio Formula

The equation to calculate the fixed asset turnover ratio is:

| Fixed Asset Turnover Ratio =Net Revenue / Net Fixed Assets |

Net revenue

This figure is available in the companies’ annual reports and income statements. The net revenue or sales after deducting all sales returns is taken into consideration for the purpose.

Also Read: Turnover Ratios

Net Revenue = Gross Sales – Sales Returns

Net Fixed Assets

This figure again is taken from the annual report of the companies.

Net Fixed Assets = Gross Fixed Asset – Accumulated Depreciation

Some experts prefer the average fixed assets instead of the net fixed assets at the end of the accounting year. However, unless there is a significant entry or exit of fixed assets during the year, net fixed assets fulfill the objective mostly. So from the simplicity and maintain uniformity across companies for comparisons, the net fixed assets figure is used.

Fixed Asset Turnover Ratio Calculator

Example

A company manufacturing tubes has fixed assets worth $100,000 with accumulated depreciation of $30,000. The sales of the company in the current year are $280,000.

Fixed asset turnover ratio = $280,000 / ($100,000 less $30,000) = 4.

The example above suggests that the company has achieved A ratio of 4, i.e., it has used fixed assets four times in the financial year.

Interpretation & Analysis

The fixed asset turnover ratio measures the company’s efficiency in utilizing fixed assets to generate revenue.

High Ratio

If the ratio is high, it indicates that the company utilizes its fixed assets efficiently. The return on capital would likely be higher in such cases, and it is taken positively by the investors and lenders.

Too High Ratio

If the fixed assets turnover ratio is too high, it may indicate that the company is not investing more in fixed assets. In other words, there may be an opportunity to expand with more fixed assets, and the company is ignoring it. It could be the non-availability of enough funds. On the other hand, it could be that the machines have depreciated over the years, and the netblock has reduced substantially. Hence, showing a higher ratio. One more possible reason could be that the company has outsourced part of the process. Therefore, the turnover and revenue are looking higher where no capital investment is involved.

Too Low Ratio

If the ratio is too low, it indicates that the company is investing more in fixed assets but not utilizing them efficiently. It is of particular attention to top management. If the management does not address it, the company may enter into losses due to high depreciation costs and lower utilization of assets.

As we discussed, for too high a ratio, too low a ratio may also indicate that it has made a massive investment. That could be in acquiring new assets, expansion is underway, or full capacity is yet to become operational.

Other Important Points

Reinvestment in Fixed Assets

If a company does not reinvest in the fixed assets every year, this ratio is bound to rise every year because the denominator will keep reducing. It does not necessarily indicate a good sign because it may not raise its capacity for future growth opportunities.

Age of Fixed Assets

On similar lines, when the assets are too old and hardly have any book value after accumulated depreciation. This ratio will be very high or as good as the net revenue.

Massive Investment in Fixed Assets

As we discussed, for too high a ratio, too low a ratio may indicate that the company has recently made a heavy investment. And that investment could be in acquiring new assets, expansion of capacities is underway, or the company has embarked upon diversification. And all these new capacities or assets are yet to become operational.

The Difference with Asset Turnover Ratio

As the name suggests, the asset turnover ratio is a ratio for total assets a firm owns vis-a-vis its net revenue. And the total assets also include the fixed assets of the firm. In other words, in this ratio, the efficiency of all the fixed and current assets taken together to understand the utilization efficiency. It is another way to judge whether the capital investment is high or low compared to its peers or industry averages.

Therefore, the main difference between the two is, for asset turnover, we take the total assets possessed by the business. However, in the case of fixed assets turnover ratio calculation, we carry only fixed and long-term assets of the firm into consideration.

Asset Turnover Ratio Calculation Formula

The following is the equation to calculate the total asset turnover ratio:

Asset Turnover Ratio =Net Revenue / Total Assets

The definition and calculation of Net Revenue will remain the same as for Fixed Asset Turnover Ratio.

Equation to calculate total assets is as below:

Total Assets = Total Fixed Assets + Total Current and Other Assets (including cash and bank balances) – Accumulated Depreciation & Amortisation.

Example of Asset Turnover Ratio

Suppose company A has a total yearly sales of $ 2000000, sales returns of $150000, fixed assets of $850000, accumulated depreciation of $150000, accumulated amortization of $50000, and other assets of $250000. Now let us calculate the Net Revenue, Total Assets, and the Ratio.

Net Revenue = 2000000-110000 = 1890000.

Net Fixed Assets = 850000-150000-50000 = 650000

Total Assets = 650000=250000= 900000

Asset Turnover Ratio = 1890000/900000 = 2.1 whereas Fixed Asset Turnover Ratio would be =1890000/650000= 2.91

For calculation, you can use our Fixed Asset Turnover Ratio Calculator.

Benchmark or Standard Fixed Asset Turnover Ratio

It is very challenging to derive and put a thumb rule for this ratio. It varies from industry to industry and depends upon what kind of products and services the company is providing. The quantum of assets and thus, the ratio also depends upon several factors like:

(a)the length of the production process;

(b) production time and stages involved,

(c) at what stage do the raw materials or inputs enter into the production process,

(d)whether the product is of general consumption or custom made

(e)moreover, whether the firm belongs to capital intensive and long gestation projects or not.

The requirement of fixed as well as other assets vary based on the above factors. Again the ratio between both the types of assets – fixed and current or other assets. It may happen that in capital-intensive and large manufacturing companies, the fixed assets have a higher proportion as compared to current assets. On the other hand, in the service industry or mass production units, the proportion of current and other assets remains more than the fixed assets. Like in hospitals, hotels, power plants, etc., the fixed assets form a substantial portion of the total assets. And sometimes, it may extend even up to 75-80% of the total assets of the company.

Therefore, it would be futile to decide the standard ratio or proportion of fixed and current assets and compare across the industry segments. It is better to use this ratio and analysis within peers and the same industry group.

Conclusion

Fixed Assets Turnover Ratio and Assets Turnover Ratios are important ratios used by analysts, investors, and lenders. It indicates whether assets built are being appropriately utilized. A higher fixed asset turnover ratio is always looked at positively. However, the use of ratios again should be comparison within the same industry segment.

As the ratio depends on various factors like the nature of the product, capital intensive industry, new capacity creation, change in the technology, change in the demand pattern of the company’s products, supply and operational time of the fixed assets, age of fixed assets, outsourcing feasibility, etc. Any management decision should base on a thorough analysis of all these factors, along with other financial indicators. Management should not take any decision in isolation or by seeing this ratio only.

Refer to EFFICIENCY RATIOS for its other types.