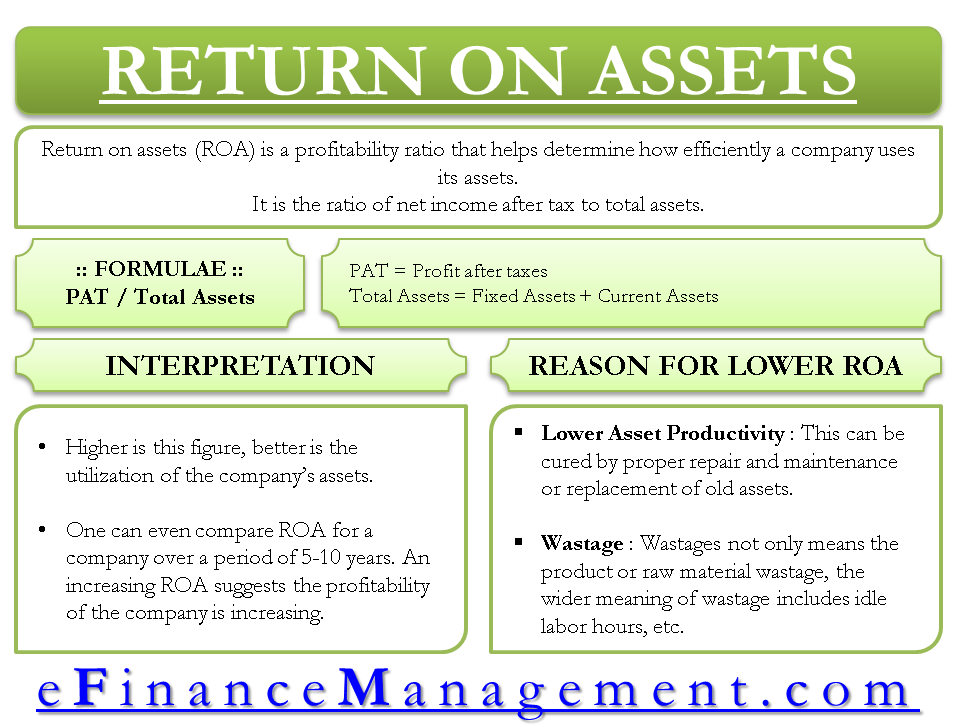

Return on assets (ROA) is a profitability ratio that helps determine how efficiently a company uses its assets. It is the ratio of net income after tax to total assets. In other words, ROA is an efficiency metric explaining how efficiently and effectively a company is using its assets to generate profits.

Calculate Return On Assets (ROA) Using Formula

The formula for ROA is very simple, which is expressed below:

| Return on Assets = Profit after Taxes / Total Assets |

- The numerator is the profit considered after deducting the costs, depreciation, tax, etc.

- One important thing to keep in mind while arriving at this figure is to consider the profits generated using such assets. There is one more metric called the basic earning power ratio to calculate operating returns on assets.

- Incomes generated from activities in which there is no contribution of these fixed assets should be excluded for this purpose.

- The denominator comprises fixed as well as current assets.

- A more accurate version of ROA is when average total assets are considered, i.e., the average of the opening assets at the start of the accounting period and closing assets at the end of the accounting period.

A different expression of the ROA formula can be as follows, giving a better and deeper insight into this ratio.

| ROA = (Profit after Tax/Total Revenue) * (Total Revenue/Total Assets) = Profit Margin * Asset Turnover Ratio |

A company can make out what is driving its ROA from this expression. Is it because of higher profit margins or due to higher asset turnover? Say, a 20% ROA can result from a 10% margin * 2 times asset turnover or 5% margin * 4 times asset turnover.

Return On Assets (ROA) Example

Below is a sample of financial figures for ABC Co.

All figures in USD. The accounting period under consideration is Financial Year 2011-12.

| Net Profit after tax | = | 20000 |

| Assets | ||

| Non-current Assets | ||

| Tangible Assets | = | 50000 |

| Intangible Assets | = | 10000 |

| Current Assets | ||

| Inventory | = | 20000 |

| Cash | = | 15000 |

| Accounts Receivables | = | 5000 |

| Total Assets | = | 100000 |

| Return on Assets | = | Profit after Tax / Total Assets |

| = | 20,000/100,000 | |

| = | 0.2 |

From the above illustration, ROA is 0.2 or 20%. From this, one can conclude that every dollar invested in the assets of ABC Co results in a profit worth 20 cents. In other words, to create 1 unit of profit, 5 units need to be invested in the company’s assets.

Interpretation of Return on Assets (ROA)

Return on assets is a measure of how effectively a company uses its assets. Higher is this figure, the better is the utilization of the company’s assets. E.g., a company may earn profits worth 1 million with an investment of 10 million, giving a ROA of 10%. On the other hand, another company can provide the same profit with an investment of just 5 million, giving a ROA of 20%. The second company certainly utilizes its resources better because although both are generating the same profits, the second company is doing it with half the investment. It’s easier to generate profits if you pump in a huge amount of money. But one needs to consider the cost of capital and the opportunity cost as well with every investment being made.

Also Read: Return on Equity (ROE)

Thus, investors can use the ROA figure to analyze which company has efficient utilization and make an informed choice before investing in a company. One can even compare ROA for a company over a period of 5-10 years. An increasing ROA suggests the profitability of the company is increasing. On the other hand, a decreasing ROA can indicate that the company’s performance is deteriorating.

Reasons For Lower ROA

Lower Asset Productivity

Lower productivity of the assets is the key reason for lower ROAs. This can be cured by proper repair and maintenance or replacing old assets. The techniques of capital budgeting may help solve such dilemmas.

Wastages

Too much wastage could also be inferred as a reason for lower ROA. Reducing wastage is a major challenge in most manufacturing companies. Wastages not only mean the product or raw material wastage; the broader meaning of wastage includes idle labor hours, etc. Proper production planning and the process of testing the products at every stage can significantly reduce wastage.

Other reasons could be the higher cost of machinery, higher interest rates, etc.

Caution While Using ROA Ratio

The return on assets of different companies can be compared only to companies within the same sector. Comparing ROAs of companies belonging to different sectors can be misleading. This is because some sectors require a huge initial investment and have long gestation periods. For such companies, ROA will be relatively low. E.g., companies belonging to the infra and airlines sector.

Read more about other PROFITABILITY RATIOS.

Quiz on Return on Assets.

This quiz will help you to take a quick test of what you have read here.

good