What are Fixed Assets?

Fixed assets are tangible assets purchased for the supply of services or goods, use in the process of production, letting out on rent to third parties, or for use for administrative purposes. They are bought for usage for more than one accounting year. They are generally referred to as property, plant, and equipment (PP&E) and are referred to as Capital assets. Now let us understand examples of Fixed Assets and Fixed Asset Accounting.

Examples of Fixed Assets

- Machinery

- Furniture

- Land and building

- Computer and its equipment’s

- Machinery

- Vehicles etc.

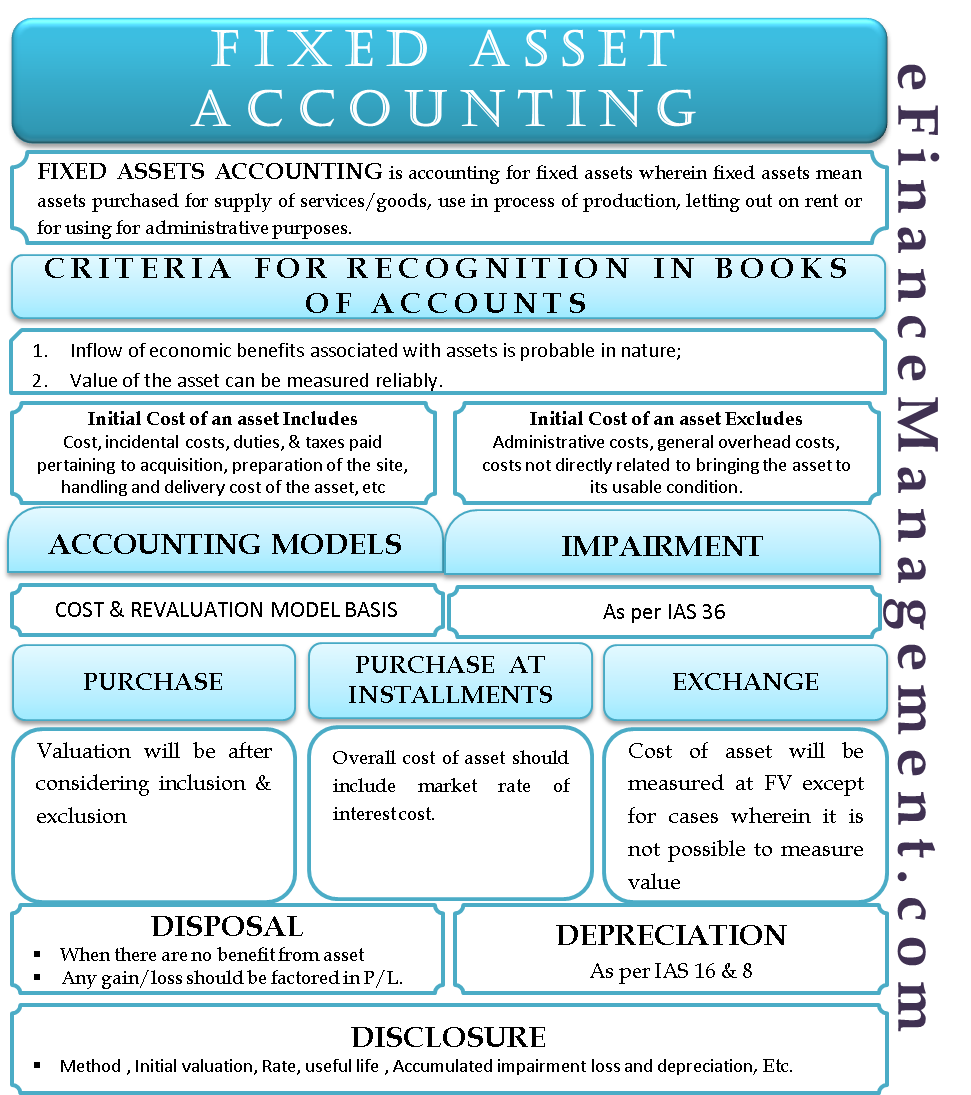

Criteria for Recognition of Fixed Assets in the Books of Accounts

- The inflow of economic benefits associated with the assets is probable in nature;

- The asset can be reliably measured.

Initial Valuation: The initial cost of an asset

Includes

The cost of the asset, incidental costs necessary to bring the asset to its workable condition, duties and taxes paid pertaining to the acquisition of an asset, preparation of the site, handling and delivery cost of the asset, fees pertaining to the installation, cost of dismantling the asset and site restoration.

Excludes

Administrative costs, general overhead costs, and costs not directly related to bringing the asset to its usable condition.

Cost of an Asset

When there is a purchase of an asset

Value of the Asset is at cost considering the above list.

Asset purchased at equated monthly installment

The overall cost of the asset should include the market rate of the interest cost.

Asset exchanged for an asset

The cost of the asset will be measured at fair value except for cases wherein it is not possible to measure the value of either of the assets, or it is not a commercially identifiable transaction. Apart from this, when it is not possible to measure the fair value of the acquired asset, then the value carries the amount of the asset given up.

Journal entry for purchase of an Asset

| Particulars | Debit | Credit |

| Fixed Asset A/C | – | |

| To Cash/Bank/Creditor A/C | – |

Accounting Models for Measurement of Asset post its Initial Measurement

Cost Model Basis

The valuation of the asset is at its cost price less accumulated depreciation and impairment cost.

Revaluation Model Basis

The valuation of the asset is the fair value less its subsequent depreciation and impairment.

Valuation of assets should be carried out regularly because there should not be much of a difference between the carrying value of the assets and their fair value. If the cost of one asset in a group undergoes revaluation, then it applies to the entire class of assets to which the asset belongs.

Also Read: Fixed Asset

Revaluation of Assets

In the case of revaluation of an asset, the differential increase in the value of an asset is classified under the head Reserves and Surplus under the category Revaluation Reserve in the balance sheet. On account of the disposal of the assets, one should transfer any amount lying down in the revaluation reserves to retained earnings.

| Particulars | Debit | Credit |

| Fixed Asset A/C | – | |

| To Revaluation Reserve | – |

After the revaluation, if the carrying amount is more than the fair value, the differential is charged to the Revaluation Surplus account.

| Particulars | Debit | Credit |

| Revaluation Reserve A/C | – | |

| To Fixed Asset A/C | – |

When there is an increase in the valuation of the asset, there is a transfer of the differential to the revaluation reserve. After the upward revaluation, when there is a downward revaluation, the same is first written off against the balance in the revaluation reserve. And if there is any leftover balance, one should charge it to the income statement.

| Particulars | Debit | Credit |

| Revaluation Reserve A/C | – | |

| Impairment loss A/C | – | |

| To Fixed Asset A/C | – | |

| To Accumulated Impairment Loss A/C | – |

Depreciation

- Treatment for Depreciation remains the same for the assets classified under the cost model and under the revaluation model.

- As per IAS 16, the cost of the asset less the residual amount should be allocated in a systematic manner over the useful life of the asset.

- As per IAS 8, one should estimate the useful life and the residual life of the asset at the end of each financial year to factor in any changes over the year and have a better disclosure.

- The decision of the depreciation method should be based upon the consumption of the economic benefits of the asset by the organization.

- During the life of the asset, one can change the depreciation method only once. This forms a part of the disclosure in the financial statement of the organization. (Board, 2017)

Depreciation is based upon the Straight-line method of depreciation. The value of the asset is spread over the useful life of the asset. Therefore there will be only a downward movement in the value of the asset. Whereas when the organization switches to the revaluation model, there can be a movement both upwards as well as downwards.

Journal Entry for Depreciation

| Particulars | Debit | Credit |

| Depreciation A/C | – | |

| To Accumulated depreciation A/C | – |

Impairment in the Value of Assets

As per IAS 36, there has to be accounting for any type of impairment in the assets so that the carrying value of the assets shall not be more than its recoverable amount.

Disposal of Assets

- When the future benefits from assets are zero, they should be removed from the balance sheet.

- Recognize the Gain or loss on sale in the profit and loss statement.

- An organization providing assets on rent ceases to offer them, then transfer these assets to Inventory at their then carrying values.

Entire value of the Asset is depreciated:

| Particulars | Debit | Credit |

| Accumulated Depreciation A/C | – | |

| To Fixed Asset A/C | – |

In case of Loss on Sale of an Asset

| Particulars | Debit | Credit |

| Cash A/C | – | |

| Accumulated Depreciation A/C | – | |

| Loss on sale of Asset | – | |

| To Fixed Asset A/C | – |

In case of Gain on Sale of an Asset

| Particulars | Debit | Credit |

| Cash A/C | – | |

| Accumulated Depreciation A/C | – | |

| To Gain on sale of Asset | – | |

| To Fixed Asset A/C | – |

Disclosure

Below mentioned are the disclosures related to fixed assets in the financial statement of the organization:

- Initial valuation of the asset for determining the carrying amount;

- Method of depreciation adopted

- Rate of depreciation

- The useful life of the asset

- Accumulated impairment loss and depreciation

- Revaluation reserve balance at the end of each financial year

- Changes in the value of the carrying amount of the assets due to any sort of additions or reductions during the year. It should even include acquisitions, disposals, net foreign exchange impact on the value of the assets, etc.

- There has to be a disclosure of any change in the value of assets due to revaluation. It should be along with all the upward and downward movements and their impact on the carrying amount of the assets.

Quiz on Fixed Asset Accounting

Let’s take a quick test on the topic you have read here.

what would be the journal entry to purchase fixed assets from retained earnings ?

This is a good write up. You have explained the topic in very understandable manner.

Please what are the journal treatment for a fixed asset amount that doesn’t tally with the cashbook?

Absolutely amazing write-up. Explained the whole IAS related points in so simple terms yet makes the reader fully understand and grasp it. Lovely!!