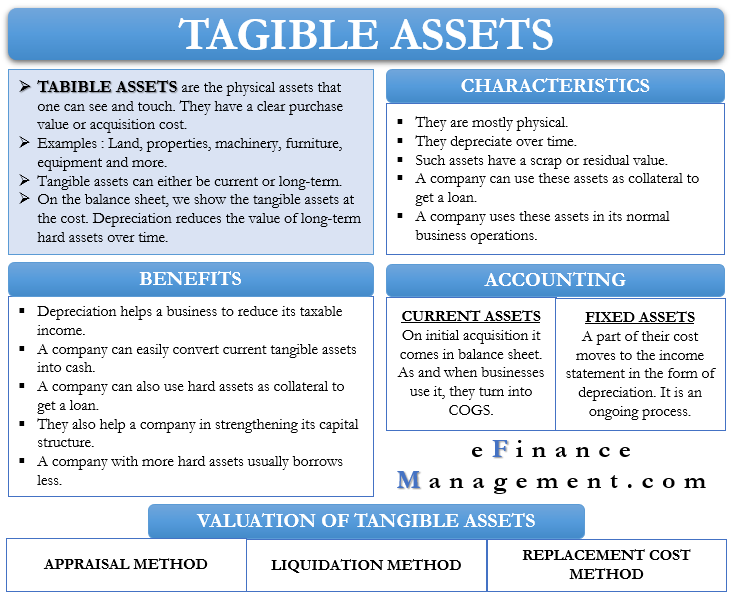

Tangible Assets or hard assets are very crucial for carrying out business operations. They are the main type of assets for any company that one can easily understand and value. Usually, they are physical assets that one can see and touch. Their most significant distinguishing factor is that they have a clear purchase value or acquisition cost.

A few examples are land, properties, machinery, furniture, equipment, and more. One can quickly know the value of tangible assets a company has by going thru the balance sheet.

A company with high Capex would have more hard assets on its balance sheet. A few examples of such companies are car manufacturers, oil and gas companies, and more. On the other hand, service companies, such as Microsoft will have fewer hard assets.

Tangible assets can either be current or long-term. Some existing hard assets may lack a physical onsite presence. However, such assets do have a definite transaction value. Some examples of hard current are cash, accounts receivable, investments, and more.

Also Read: Meaning and Different Types of Assets

On the balance sheet, we show the tangible assets at the cost. Depreciation reduces the value of long-term hard assets over time.

Characteristics of Tangible Assets

Following are the characteristics:

- They are mostly physical.

- They depreciate over time.

- Such assets have a scrap or residual value.

- A company can use these assets as collateral to get a loan.

- A company uses these assets in its normal business operations.

Benefits

Following are the benefits of hard assets:

- Depreciation on the hard assets is a non-cash expense. Thus, it helps a business to reduce its taxable income.

- A company can easily convert current tangible assets into cash. It gives the company more liquidity and hence, reduces risk. Moreover, it also helps the company to remain solvent.

- A company can also use hard assets as collateral to get a loan.

- They also help a company strengthen its capital structure. A company with more hard assets usually borrows less.

Accounting

As said above, the hard assets come on the balance sheet at the original cost. But finally, all these assets find their place in the profit and loss account, either by way of depreciation or conversion to debtors and cash, etc.

Current assets – On the balance sheet, the assets come in order of how easily they can be converted into cash. The most liquid assets come at the top. As businesses use the current assets, they turn into the cost of goods sold (COGS). The cost price of these assets doesn’t just include the purchase price but additional charges as well, such as transportation, insurance, and more.

Fixed assets – Their value is spread over their useful life. A part of their cost moves to the income statement in the form of depreciation. It is an ongoing process where the cost of the assets transfers to the income statement over the lifespan of the asset.

Valuing Tangible Assets

Following are the popular methods to value tangible assets:

Appraisal Method

In this, a company employs an appraiser that comes up with the actual market value of the asset. To arrive at the fair value, the appraiser would consider factors like the condition of the asset, demand of the asset, wear and tear, and the value of similar assets in the market.

Liquidation Method

In this, the company tries to find out the cash it would get if it sells the asset now. For this, the company hires an assessor who works to determine the price that an auction house, bulk buyer, or equipment seller would be ready to pay for the asset.

Also Read: Real vs Financial Assets

Replacement Cost Method

Insurers generally use this method to get the value of the asset. The objective of the insurer is to find the cost to replace the asset.

Net Tangible Assets

It is the difference between the fair market value of the tangible assets and the fair market value of all liabilities. In other words, net intangible assets are the fair value of total assets after subtracting the fair value of all the intangible assets and the fair value of all the liabilities.

The net tangible asset helps with the valuation of the company. It tells whether or not the company’s share is overvalued by comparing the current share price with the per-share price based on net tangible assets. A company with a positive net asset value is less risky because of high liquidity.

Tangible vs Intangible Assets

Apart from tangible, the other type of assets is intangible assets, such as goodwill, patents, and more. Such assets usually don’t have a may or may not have a transactional exchange value. Together, tangible and intangible assets make up the total assets of a company.

Intangible assets are non-physical ones and usually can not be touched or seen. This value is based on the company’s calculations. The registration and renewal costs of such assets help to value them. On the balance sheet, we record Intangible assets under long-term assets.

Unlike tangible assets, a company can’t sell intangible assets in the open market in the ordinary course. Instead, another company, usually a competitor, acquires these assets. Moreover, they are crucial at the time of acquisition as well.

Final Words

Tangible assets are significant for a business without which it couldn’t survive for long. There are several benefits of owning hard assets, but the biggest is making the company more liquid and less risky.

Quiz on Tangible Assets