Meaning of Revaluation of Fixed Assets

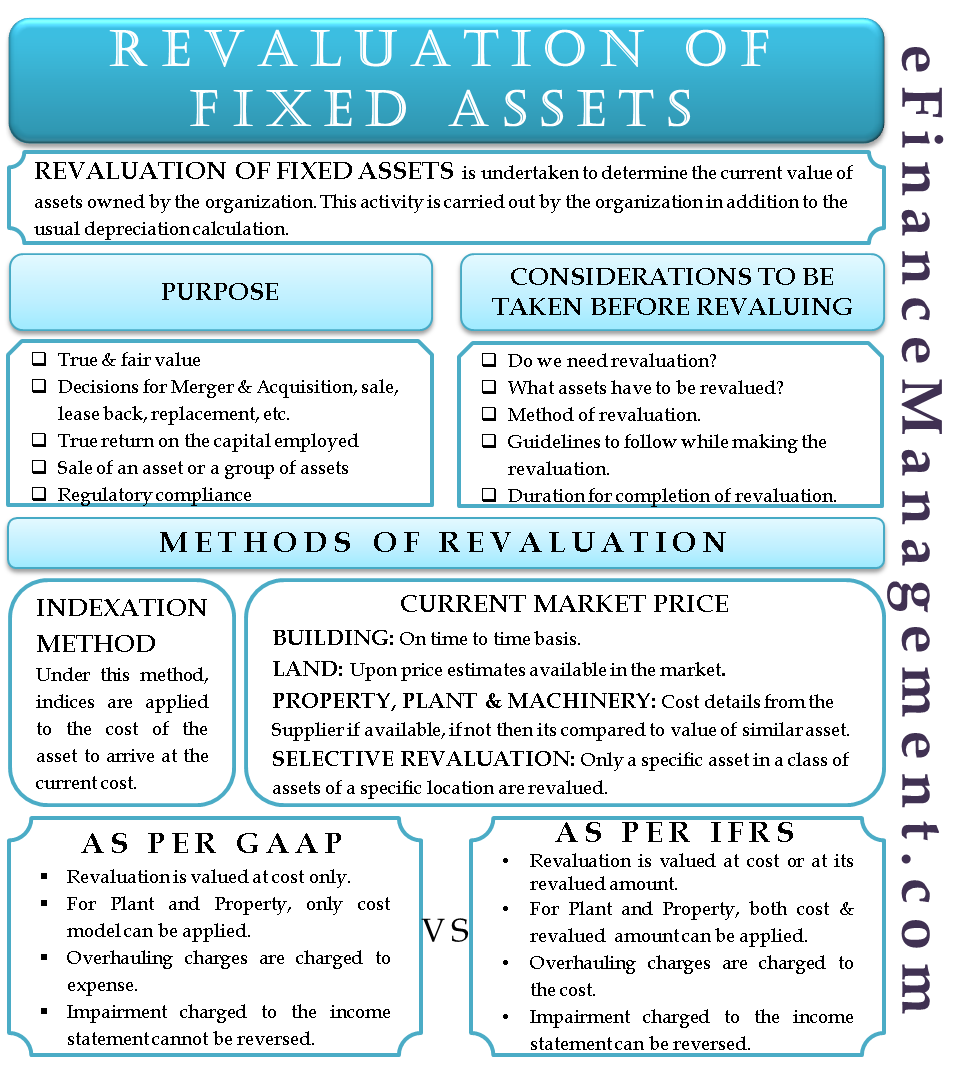

Revaluation of fixed assets is undertaken to determine the current value of the assets owned by the organization. The organization carries out this activity in addition to the usual depreciation an asset goes through during its useful life.

As per IFRS, one should record fixed assets initially at the cost, but subsequently, one can revalue at either the cost model or revaluation model.

- Meaning of Revaluation of Fixed Assets

- Purpose of Revaluation of Fixed Assets

- Journal Entry for Revaluation of Fixed Assets

- Depreciation Post Revaluation

- Impairment Post Revaluation of Asset

- Methods of Revaluation

- Considerations before Undertaking Revaluation

- Revaluation of Fixed Assets: IFRS vs. GAAP

- Conclusion

Purpose of Revaluation of Fixed Assets

One of the main reasons to regularly carry out the revaluation is to determine the asset’s fair market value. Apart from this, below mentioned are the reasons for the revaluation of fixed assets:

- Showcase the true and fair value to the stakeholders;

- For the negotiation of true and fair value before undertaking any merger and acquisition;

- The true return on the capital employed by an organization in the business;

- Provision of necessary funds in the business for replacement of old assets at the end of their useful lives. This is needed to replenish them with new assets.

- To arrive at a fair value to carry out a sale and leaseback transaction of an asset;

- Sale of an asset or a group of assets;

- Regulatory compliance also mandates the revaluation of assets from time to time basis.

Journal Entry for Revaluation of Fixed Assets

ABC Limited has been maintaining the assets at a cost to date. On 31st January 2018, it decided to revalue the assets. The original cost of acquisition of the asset was $30,000, and its carrying amount as on date is $20,000. Revalued value of the asset on 31st January 2018 is $ 25,000. Therefore, we shall pass this entry to record the same:

Also Read: Revaluation of Long-Lived Assets

| Particulars | Debit Amount | Credit Amount |

| Asset A/C | 5000 | |

| To Revaluation Surplus A/C | 5000 |

As per IFRS, upward revaluation is not a gain in the usual course of business, and hence we shall record the same under the Revaluation Surplus account.

Depreciation Post Revaluation

In post-revaluation, the revalued amount is the new base for calculating the depreciation over the balance useful life of the asset. In this case, $25000 is the value on which depreciation will be calculated.

Impairment Post Revaluation of Asset

If there is any downward revaluation subsequent to the previous upward revaluation, we shall first charge the balance lying on the balance sheet to the Revaluation Surplus. Apart from this, if there is any surplus, we shall then charge it to the income statement as an impairment loss.

For instance, on 31st January 2019, if ABC Ltd revalues the asset and finds out the fair value to be $ 22000. Here carrying amount less 1-year depreciation is $ 23560. The carrying amount now exceeds the fair value, so it has to be reduced by that much amount. We already have a balance of $5000 in Revaluation Surplus, so there will not impact the income statement account.

| Particulars | Debit Amount | Credit Amount |

| Revaluation Surplus A/C | 1560 | |

| To Asset A/C | 1560 |

Here if the revalue amount was $18000, then the impact will be as mentioned below:

| Particulars | Debit Amount | Credit Amount |

| Revaluation Surplus A/C | 5000 | |

| Impairment Loss A/C | 560 | |

| To Asset A/C | 5000 | |

| To Accumulated Impairment Loss A/C | 560 |

Methods of Revaluation

Indexation Method

Under the indexation method, indices are applied to the cost of the asset to arrive at the current cost. These indices are published by the XXXX authority to carry out the revaluation of assets.

Current Market Price

Revaluation of Building: Real estate valuers conduct the valuation of buildings on a time to time basis.

Land revaluation: Brokers, licensed appraisers, and valuation agencies carry out the valuation of land-based upon the price estimates available in the market.

Property, Plant, and Machinery: Estimation of the property, plant, and machinery is carried out based upon the cost details taken from the Supplier. At times these details might not be available due to shut down of the Supplier companies, outdated machinery, changes in the market requirements, etc. In this case, the valuation is carried out based upon the value of the new similar asset compared to the asset’s remaining useful life given upon the asset’s overall useful life.

Selective revaluation: Under this method, only a specific asset in a class of assets or a group of assets at a specific location are revalued. However, due to this practice, only a specific class of assets or assets at a specific location are revalued, which leads to few assets being shown at revalued amounts and the balance at historical costs. Therefore this method isn’t recommendable in the usual course of business.

Considerations before Undertaking Revaluation

- Do we need revaluation?

- What assets have to be revalued?

- Method of revaluation.

- Guidelines to follow while making the revaluation.

- Duration for completion of the revaluation.

Revaluation of Fixed Assets: IFRS vs. GAAP

IFRS permits to record the asset at cost or its revalued amount. So once there is a revaluation, its application has to be for the complete class of the assets as it does not permit selective revaluation. At the same time, US GAAP permits recording the asset at cost only.

For Plant and Property, IFRS permits usage of both the cost and revaluation model, whereas GAAP permits only the cost model.

On an upward revaluation, IFRS permits its impact on Revaluation Surplus. First, we should zero the Revaluation Surplus and then transfer only the balance to the income statement on a subsequent reduction. Hence treatment under IFRS is complex, so it recommends taking up revaluation once in 3 to 5 years with the help of an Expert Appraiser.

Impairment of Assets also differs in the case of IFRS compared to US GAAP. Under GAAP, once there is an impairment of the asset, one has to charge in the income statement. This cannot be reversed. Whereas under IFRS, post a downward revaluation, if there is an upward revaluation, then the recent charge to the income statement can be reversed.

Any major overhauling charges are charged to expense in the case of GAAP. IFRS permits to add to the cost of the asset.

Conclusion

Treatment under GAAP is very stringent for fixed assets compared to the treatment under IFRS. This is because IFRS permits taking advantage of the revaluation of long-lived assets, and GAAP doesn’t allow it. While the initial switch from GAAP to IFRS will lead to a lot of change at the base level, it will be beneficial in the long run considering the benefits.

Also, read – Impairment of Long-Lived Assets.

When assets tend to increase their numerical figure through inflation, can it be called a revaluation? Does inflation has impact on revaluations? We should be informed about this with regard to the aspect of revaluation.