What is Fixed Asset Register?

The fixed asset register contains the list of all the fixed assets a business owns. The purpose behind maintaining is to keep track of the book value of assets and depreciation. It can be equally used to maintain the identification of each asset which can serve the purpose at the time of fixed asset verification. You can find the details like its date of purchase, cost, purchase date, salvage value, depreciation rates, specifications, etc.

We should not confuse fixed asset registers with stock registers. The stock register maintains the Inventory of raw materials, semi-finished goods, and finished goods, whereas fixed asset registers are all about fixed assets.

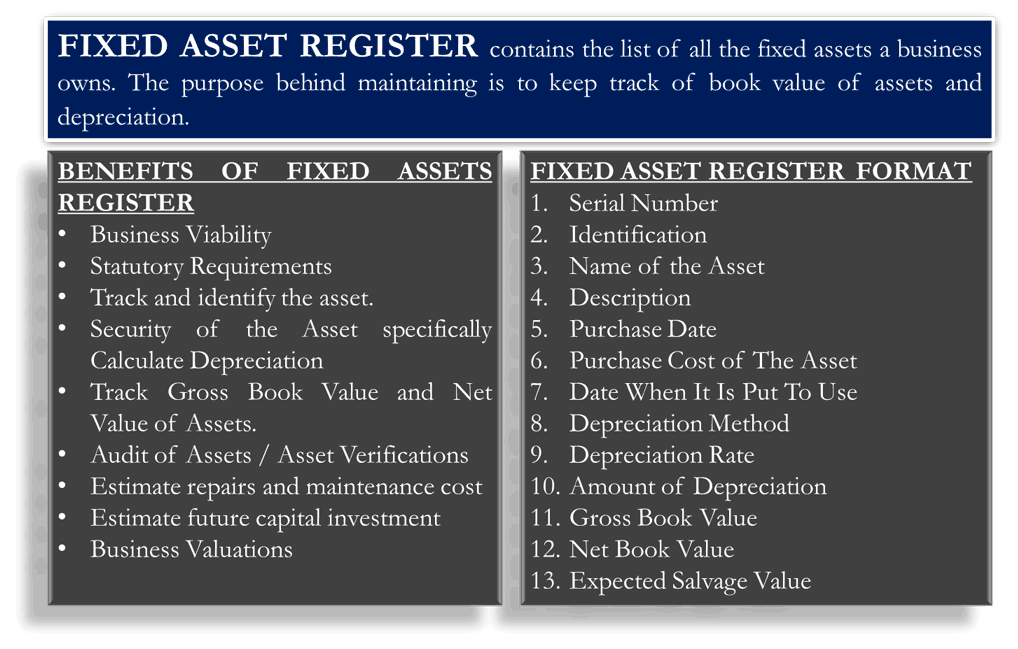

Benefits of Maintaining Fixed Asset Register

- Comply with statutory requirements.

- Track and identify the asset.

- Security of the Asset specifically to prevent theft.

- Calculate Depreciation annually.

- Track Gross Book Value and Net Value of Assets.

- Assists in conducting audits of assets and asset verification.

- Helps in estimating the repairs and maintenance cost.

- Assists in estimating the future capital investment in fixed assets.

- In certain countries, subsidies are allowed on certain assets. The value of assets is determined from fixed asset registers.

- Determining business valuations.

Fixed Asset Register Template / Format

There is no fixed format or template for maintaining a fixed asset register. The extent of details depends on the requirement of the management. There is some primary list of things that should be maintained when maintaining this register is as follows:

- Serial Number: It will show the count of entries.

- Identification: The unique identification code can be mentioned here.

- Name of the Asset: Short name of the asset.

- Description: The description of the asset. It is a free field and can be updated in any detail.

- Purchase Date: The date on which the asset is purchased. It is normally the invoice date.

- Purchase Cost of The Asset: The cost is also mentioned per the invoice. Other expenses related to erection or installation can also be added to the purchase cost and maintain here. This can give the total amount that will be capitalized in the name of a particular asset on the balance sheet. Any indirect tax payment that will be reimbursed will not be added to the value of the asset. If any subsidy is going to be received on the purchase of the asset, it will be deducted in arriving value on which depreciation is to be charged.

- Date When It is Put To Use: The date on which the asset is put to use. This detail has relevance for high-value assets, normally machines whose purchase date and put to use dates are quite distant. Normally, the expenses before the commissioning of such assets are capitalized, and expenses after that become part of the profit and loss account.

- Depreciation Method: Method of depreciation used for financial reporting. As per taxation rules, there can be a separate column or workings for depreciation.

- Depreciation Rate: The percentage rate of depreciation can be mentioned here.

- Amount of Depreciation: The amount that is arrived by applying the depreciation rate is mentioned here.

- Gross Book Value: Value before applying the depreciation.

- Net Book Value: Value after deducting the depreciation.

- Expected Salvage Value: The expected salvage value of the machine if it is to be sold after its life of use.

There can be n number of other details which can be maintained. Maintenance of fixed asset register is compulsory in many countries.

How to Maintain?

There are many ways to maintain a fixed asset register, starting from manual paper registers to sophisticated software. It is maintained using an excel sheet, integrated accounting software, etc.

Also read Fixed Asset Register vs Fixed Asset Schedule.

Quiz on Fixed Asset Register

thank you for your help.

Pls I need some clarification. When a part of an asset is replaced and such replacement meets your capitalization policy, how will it be treated in the asset register?

I wish I can understand more my problem a wanted maybe a way to write or draft a ECD assets policy or should I us the ones you gave examples of.

What is the impact if FAR is not maintained and not filed within 3 months from end of financial Year?

Ideally, you should maintain for your own purposes.