In one of our articles titled ‘What’s the best definition of profit’ we have understood what is the definition of profit and there are many ways to look at the ‘profit’ of the company. Hence, now we shall attempt to explore the presentation and interpretation of those profits figures at various stages, for various purposes, and for various stakeholders. And one such abbreviation is ‘EBITDAR’. It means earnings of the company before interest, tax, depreciation, amortization, restructuring, and rent costs.

EBITDAR: Meaning

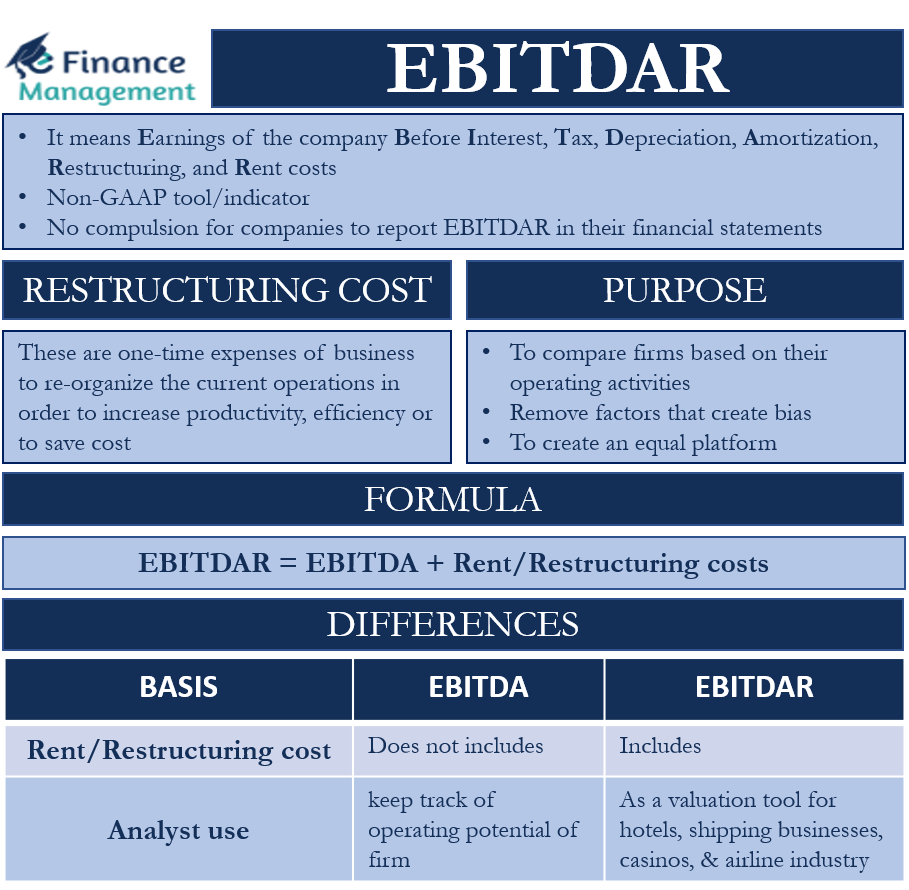

It means earnings of the company before interest, tax, depreciation, amortization, restructuring, and rent costs. EBITDAR is a non-GAAP tool/indicator. Therefore, there is no compulsion for companies to report EBITDAR in their financial statements. The balance sheet and income statement are the sources for identifying heads like rent and restructuring costs.

Purpose

The purpose of EBITDAR is to iron out the differences that come in the way of comparing firms in the same industry. In the case of EBITDA, the intention is to compare firms based on their operating activities. It removes the factors that are unique which can create a bias in the analysis. Similarly, in EBITDAR, if we are comparing a firm based in Washington and other in Texas, the rent costs will vary significantly. By adding the rent costs back, we can easily compare the firm with its peer and assess its performance based on its core activities. Also, if a firm has undergone restructuring, then adding the one-time costs removes the bias in higher costs and low profits. The main aim is to create an equal platform for fair comparison for companies in a specific industry.

EBITDAR is for companies that have exceptional, non-recurring costs like rent, restructuring, taxes, and other non-cash expenses.

Rent/Restructuring Cost

Rent is fairly easy to understand. A firm pays rent for various purposes, either it rents out offices for the employees to work or it can pay rent for certain manufacturing premises. However, as EBITDAR also includes restructuring costs, it is important to understand what exactly do restructuring costs mean. So restructuring costs are one-time expenses of business to re-organize the current operations in order to increase productivity, efficiency or to save cost. Moreover, they are operating expenses as the costs incurred right now is to amplify the operating activities and will accrue long-term benefits. Hence, the overall goal is to elevate the current working status to achieve goals and long-term plans.

Also Read: EBITDA

For example, if a firm is currently facing a hard time in attracting efficient human capital, the firm invests in attracting new employees that fit the job. The purpose is to create a better situation under prevailing circumstances. Being a one-time expense, it is added to restructuring costs.

Formula

EBITDAR = EBITDA + Rent/Restructuring costs

EBITDAR is primarily used for analysis for companies that have undergone some form of restructuring. Restaurants, pubs, shopping centers, Airlines incur peculiar rent costs and restructuring costs as it is a service industry.

Example

So for example, If a firm is earning a revenue of $ 200,000 and incurring operating expenses of $ 50,000. Then the Earnings before interest comes to $ 150,000. As depreciation and rent are included in operating expenses, we will add back the amount to EBIT.

Depreciation = $ 5000

Rent = $ 10000

Restructuring cost = $ 15000

EBITDAR= EBIT+Depriciation+Rent+Restructuring cost

EBITDAR = 150000+5000+10000+15000 =$180000

Who commonly use EBITDAR?

Airlines commonly use EBITDAR to value the operating profits without considering rent costs. Companies in the airline industry use different methods of assets acquisition, financing including terms of lease agreements, etc. Hence, EBITDAR serves as a right tool to understand the overall potential of the firm.

Also Read: What is the Best Definition of Profit?

Difference between EBITDA and EBITDAR

EBITDA is a very common tool in understanding the operating profits of a firm. Analysts use EBITDA to keep a track of the operating potential of the firm. The difference between EBITDA and EBITDAR is the exclusion of rent and restructuring costs in EBITDAR. Restructuring costs are non-recurring expenses. Hence, EBITDAR removes one-time expense that is ‘restructuring cost.’EBITDA does not exclude rent and restructuring costs. Analysts use EBITDAR as a valuation tool for hotels, shipping businesses, casinos, and the airline industry.

We might think that rent is an important component of any business and why is it excluded from the operating expenses. The basic aim is to understand the operating potential of the firm. When we talk about Airline companies, the industry is rent-heavy. Firms are constantly dependent on leases and rents for aircraft or parking spaces. As the expenditure is huge and on paper the firm is making a loss, but analyzing its revenues and excluding rent costs will help one to understand the long-term potential.

Another benefit is to understand what portion of total expenses the rent and restructuring cost represents. If it is better than the industry average then definitely the company is managing well that single most important cost. On the other hand, if it is more than the industry average, one needs to understand the operating stage (early, mid or old) of the company. And accordingly, the management needs to take corrective action to cut down on rent and leases.

Thank you for sharing your knowledge.