Meaning of EBITDA

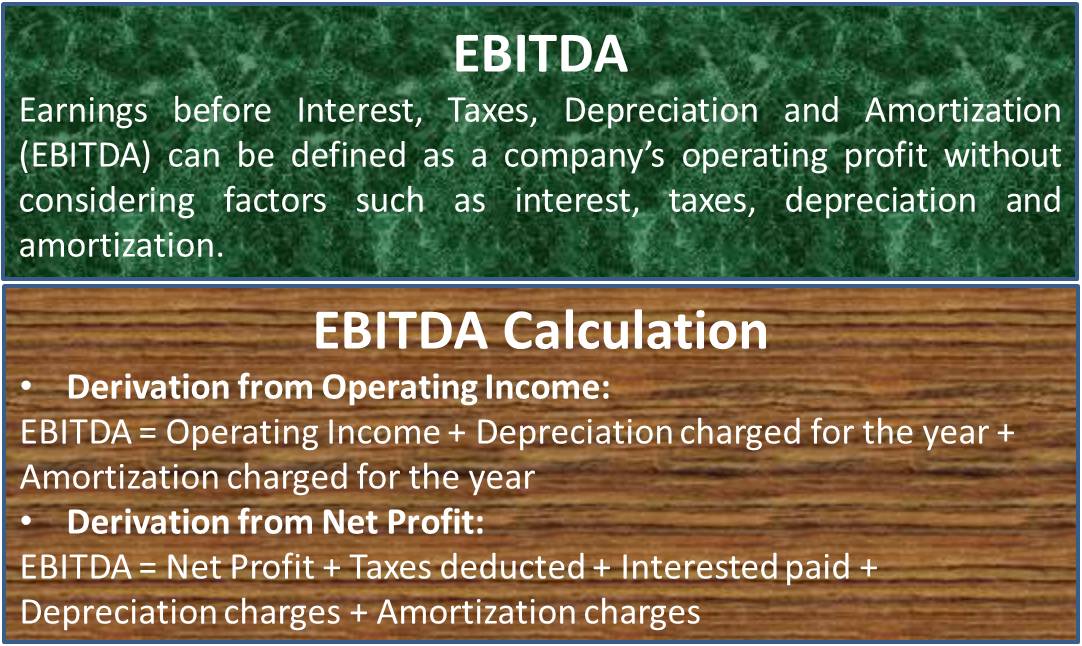

Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) can be defined as a company’s operating profit without considering factors such as interest, taxes, depreciation, and amortization.

This is one of the simplest non-GAAP (Generally Accepted Accounting Principles) metrics used to inspect a company’s financial position and strength. Hence, the use of EBITDA as a profit indicator is somewhat controversial. It is the most useful metric for manufacturing companies with heavy machinery to depreciate. The earnings show a huge difference in figures post deductions of the former.

Description of EBITDA

The corporate accountants, investors, and members analyze the financial statements of a company to study and gauge its overall profitability and health. The Balance Sheet and Statement of Income and Expenditure consist of many such parameters to observe, and EBITDA is one of the simpler ones. This is because it is closely related to a company’s cash flow required to run its business on a day-to-day basis. For manufacturing companies, it is very convenient to use this metric due to the huge depreciation charges per annum. It is also used by companies that possess huge intangible assets to be amortized over the years.

If we add the rent and management fees to the earnings before interest and along with Taxes, Depreciation, and Amortization, it becomes EBITDARM which stands for Earning before interest, tax, depreciation, amortization, rent, and management fee. For more concept clarity, you can visit our article EBITDARM.

One such term is EBITDAR. Click to know more about it.

The calculation of EBITDA is not officially controlled. Therefore, several companies use it to window-dress their financial condition. This manipulation of profits to show a better position will be explained in the next section below.

EBITDA Formula

There are two methods of calculating the EBITDA of a company.

Derivation from Operating Income

EBITDA is closely associated with the operating profit of a company. Technically, the only big differences between EBITDA and operating income are depreciation and amortization charges. Therefore, both are added back to the Operating Income mentioned in the Income statement.

EBITDA = Operating Income + Depreciation charged for the year + Amortization charged for the year

Derivation from Net Profit

Some companies take the term EBITDA literally such that expenditures and incomes not associated with the core operations form part of this metric. This method involves using Net Profit and working the formula upward by adding back taxes, interests, depreciation, and amortization charges. This method does not remove earnings from other investments and non-core operations and singular payments on the sale of assets.

EBITDA = Net Profit + Taxes deducted + Interested paid + Depreciation charges + Amortization charges

Point of Controversy

We learn that both the EBITDA calculations shall differ from the above-mentioned formulas. Companies use it strategically to show higher profits. They justify the difference as the sale of huge assets or investment profits. Companies also switch between methods in alternate years to show growth in profits.

Also Read: EBIT – Meaning, Importance And Calculation

Read more on EBITDA Margin.

Conclusion

EBITDA matters because it is a widely used metric of financial fitness. Financial analysts prefer this because it does not include incomes and expenses related to non-operating transactions, focusing only on the core aspect of the business. This helps investors and members understand the company’s actual performance, especially while comparing the industry standards to the company’s current figures.

Since there is no GAAP regulation on EBITDA, it has variable calculations that lead to accounting inaccuracies and discrepancies. Companies should adopt a standard method of calculation that is consistently followed over the financial years to come.

Also read – EBIT (Earnings before Interest and Taxes).

I am a research scholar and a few days back in relation to my topic I got to know about your website link. It is helpful in many aspects. This article content is in very simple and lucid language. I will like to continue with your upgrades and also expect to help me out in relation to my topic in near future