Profit is the most important indicator of the financial health of a company. A company that is not earning a profit is not likely to survive long-term. However, there are different meanings of profits as well that are relevant to different stakeholders. Two such concepts of profits are accounting profit and economic profit. Though the profit that we generally see on the financial statement of a business is accounting profit, the other type of profit is also important. To better understand the relevance of the other type of profit, we must know the differences between accounting profit vs economic profit.

Before we detail the differences, let’s understand the meaning of these two types of profits.

Accounting Profit

We know accounting profits as the net income or the bottom line of the company. A company arrives at this profit after deducting all costs and expenses from its total sales. This figure is shown in the profit and loss account and is in accordance with the GAAP (generally accepted accounting principles). A company calculates the accounting profit either quarterly or annually, or both.

The costs and expenses that are used in the calculation are explicit costs of running or operating the business. The costs or expenses that go into the calculation of the accounting profit are – Raw materials, labor costs, such as wages, Production costs, Transportation costs, and Sales and marketing costs. The revenue sources include – the sale of goods and services, rental income, interest, dividends, and more.

Economic Profit

The concept of economic profit is not very different from the accounting profit as it also makes use of explicit costs. Additionally, it takes into account the opportunity costs as well. Opportunity cost is the income that a business could make from the second-best use of the available resources. A simple example of opportunity cost is a company that reinvests money in the business and foregoes the interest it may have earned by depositing it in a bank. Thus, interest is the opportunity cost here.

Also Read: What is the Best Definition of Profit?

Unlike accounting principles, the economic profit is in accordance with the economic principles. Moreover, it also considers implicit costs, which are the cost of using the resources that the company owns—for example, buildings, Plant and equipment, and more.

We can say that economic profit is the profit that a business makes after factoring opportunity costs or alternative uses of the company’s resources. For example, if a company foregoes project A and chooses project B., Then, the economic profit would be the accounting profit plus how much more or less profit does the company makes by going for project B over project A.

Now that you understand the two types of profits let’s see the differences between them.

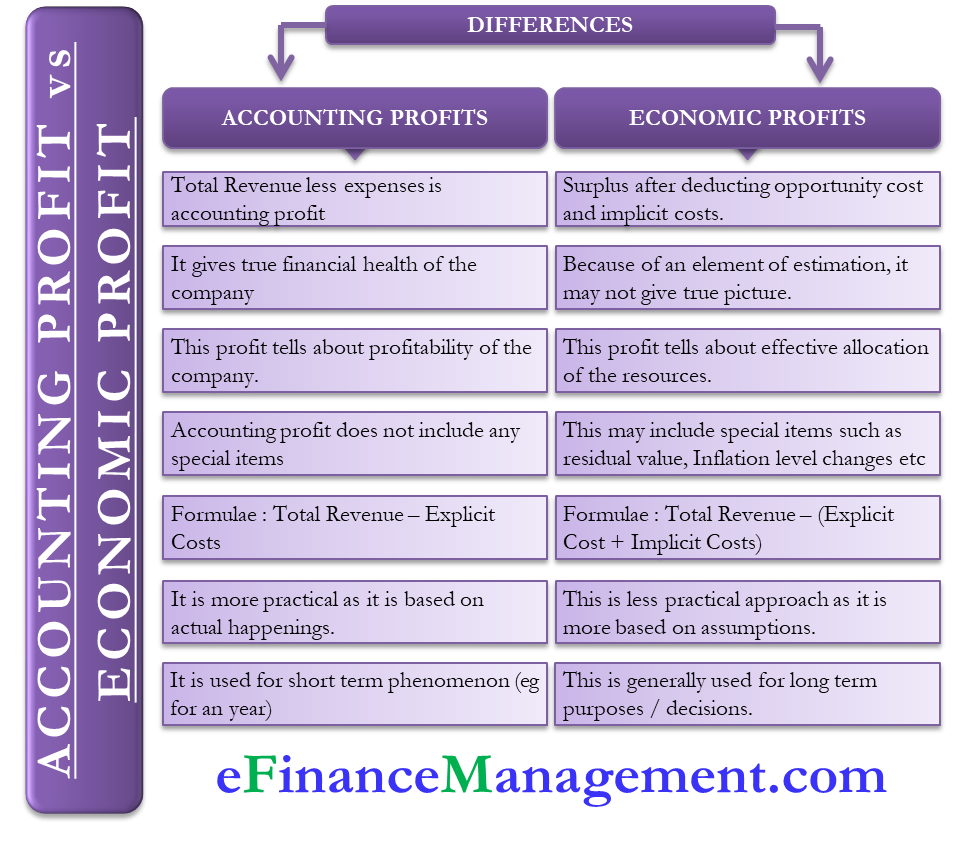

Accounting profit vs Economic profit

Meaning

Accounting profit is the net income after deducting total expenses (explicit) from the total revenue. On the other hand, Economic profit is the surplus after deducting opportunity costs and implicit costs as well.

Relevance

It gives the true financial health of a company. While economic profit may not give a true picture as certain parameters are estimated.

What Does it Tell?

Accounting profit tells about the profitability of a company. On the other hand, economic profit tells whether or not the company is efficiently allocating the resources.

Special Items

Economic profit may also include minimum payment to the shareholders to discourage them from taking back their capital. Other special items it may include are residual value, Inflation level changes, and more. Accounting profit does not include any such thing.

Formula

The formula for calculating accounting profit is Total Revenue – Explicit cost. For Economic profit, the formula is Total Revenue – (Explicit costs + Implicit costs).

Practical

Accounting profit is more practical as it is based on what has actually happened throughout the year or quarter. Economic profit, however, is based on assumptions and reflects the decisions that a company could have taken.

Relevance in Long-run

Accounting profit is basically a short-run phenomenon as it tells the financial health of a company for that year. On the other hand, economists use economic profit to create long-term strategies, such as whether or not a firm should enter or exit a market.

Calculation Example

Suppose Company A reports revenue of $300,000 and incurs explicit costs of $50,000. The accounting profit in this case is $300,000 – $50,000 = $250,000.

Now, if the implicit cost for Company A is $75,000 and implicit revenue is $30,000. In this case, the economic profit will be $300,000 + $30,000 – $50,000 – $75,000 = $205,000.

Other Minor Differences

Apart from those mentioned above, there are a few minor differences between accounting profit vs economic profit that you should know:

- Accounting profit is the real profit, while economic profit is the abnormal profit. By abnormal profit, we mean the profit in excess of the normal profit to cover the expenses, such as opportunity cost.

- Usually, accounting profit is more than the Economic profit as the latter includes a few more categories of income and expenses.

Final Words

As an investor, you may be more concerned about the accounting profit to know the financial health of a company. On the other hand, economic profit could be used by management internally to assess their decision on the projects foregone. Even though the calculation of economic profit involves a few assumptions, it could give management an idea of where they are heading.

Continue reading – What is the Best Definition of Profit?

Good Evening Mr. Sanjay, I have started browsing your FM Concepts

The concepts are very informative & required in my day to day accounting

I was in construction accounts for 15 years in India & abroad

Now out of job due to my Cardiac health . May start work after Doctor’s clearance

I appreciate your sincere efforts for submitting your concepts

I wish you all success

Best Regards