What is Share Based Compensation?

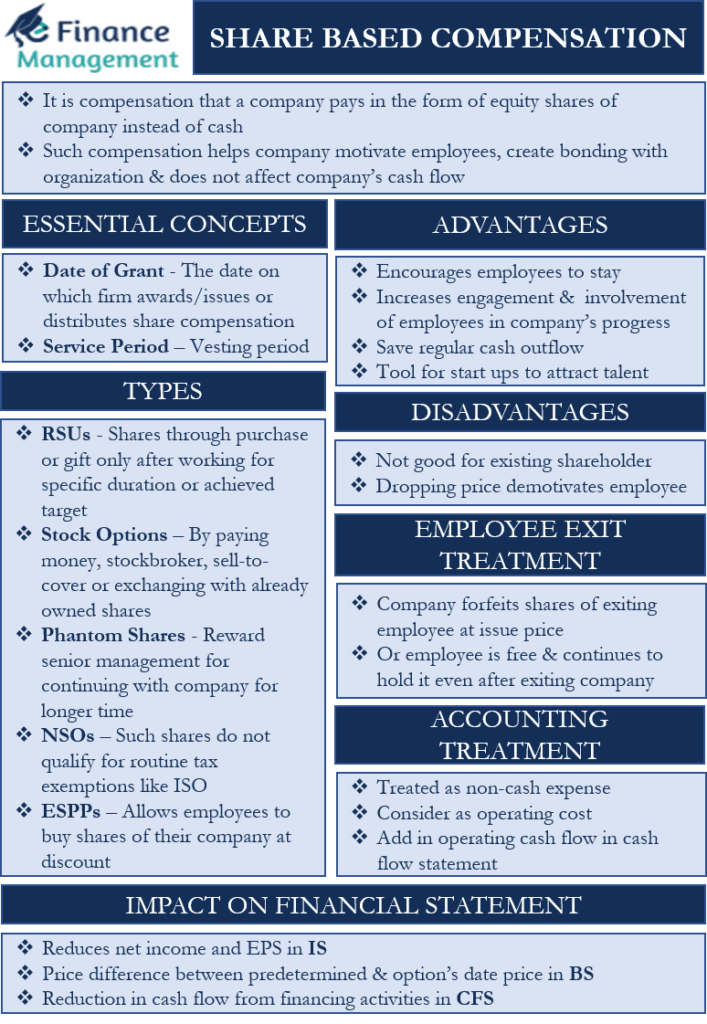

As the word suggests, Share-Based Compensation is compensation that a company pays in the form of equity shares of the company instead of cash. A company can distribute its shares to reward workers, executives, and directors. Such compensation helps a company motivate employees, create a bonding with the organization, and does not affect the company’s cash flow.

The shares that a company issues as compensation come with a vesting period. The vesting period is a sort of deferment period. And before the expiry of this period, the recipients can not sell those shares. In other words, the recipient has to wait for the vesting period to be over before he can sell or transfer the shares given to him as part of this process. Further, the vesting period could be the same for all the recipients, or it can vary depending upon the individual performance or targets or group of employees, etc.

Startups use such a practice of distributing or allotting shares as compensation to attract and retain employees. This is because they generally do not have much cash at the start or the initial stage; they can not afford to pay heavy compensation. Many big companies use such compensation as well to motivate their employees. For instance, Amazon paid $4.2 billion in compensation to its employees in 2017. This is to create more engagement and involvement of the management and employees in the company’s overall well-being.

Share Based Compensation: Essential Concepts

We need to know two essential concepts to understand share-based compensation better.

Date of Grant

It is the date on which the firm awards/issues or distributes the share compensation. Usually, it is the date on which the compensation approves the award as per the corporate governance and share issue regulation requirements. Some companies may also take it as a date when the recipient starts to benefit from such compensation. Or when the firm’s stock price moves upward from the issue price and the recipient begins to benefit from this up move.

Service Period

The second essential concept is the service period. Usually, the vesting period is the service period. However, a service period may differ based on facts and circumstances of the arrangement and/or as per the terms of issuance.

Types of Share Based Compensation

The equity that a company gives as compensation can be in the form of shares, RSUs (Restricted Share Units), ESOP (Employee Stock Ownership Plan), Stock Options, and Phantom Shares.

Restricted Stock Units

RSUs (restricted stock units) allows employees to get shares through purchase or gift but only after working for a specific duration or achieving certain performance targets.

Stock Options

A recipient can exercise the stock options by paying the money (can be in installments), going for a same-day sale with the help of a stockbroker, using a sell-to-cover transaction, or exchanging with the already owned shares. However, we need to understand that all these options may not be available for all companies. The utilization of the option would depend upon the specific arrangement set forth by the issuer company. And usually, all the companies insist on a waiting period before the option holder can sell his holdings. Thus there can be, and mostly there remains a gap between the payment and acquisition of options on the one hand and the final sell-off on the other hand.

Also Read: Restricted Stock

Phantom Shares

This methodology is generally used to reward the senior management for continuing with the company for a longer time. Under this arrangement, the employee gets all the benefits of owning the company’s stocks without actually owning and paying for them. At the end of the waiting period or on completion of the targets, etc., the employee is awarded or given a cash award/bonus that equals the value of a specific number of shares. The quantum of shares is discussed and agreed upon initially. Such shares are called phantom shares, which remain only in the agreement or arrangement. Actually, there is no issue of shares, and thus there is no change in the equity capital or the number of equity shares of the company.

Non Qualified Stock Options

The compensation can also be in the form of NSOs (non-qualified stock options). In the case of NSOs, the employee needs to pay the income tax on acquiring and selling those shares. So such shares do not qualify for routine tax exemptions like ISO. Such NSOs can be given to employees and the vendors, contractors, and other stakeholders to recognize their contribution to the company’s growth. The tax calculation happens on the differential between the prevailing market price of the stock and the option price. Recipients’ can get ISOs as well, and these are available only to employees and offer special tax advantages.

Employee Stock Purchase Plans

Another option is ESPPs (Employee stock purchase plans) that allow employees to buy shares of their company at a discount. Companies can also use SARs (stock appreciation rights), where the value of the already decided number of shares is paid either in cash or shares.

Companies can use performance shares for share compensation as well. In this, employees get shares only after specific company-wide measures are met. These measures could be target EPS (earnings per share), target return on equity (ROE), and more.

Advantages and Disadvantages

Let us now discuss the positives of shared based compensation plans:

- It encourages employees to stay with the firm at least until the shares’ vesting period is over.

- Such and arrangement increases the engagement and involvement of the employees in the company’s progress. As through this the interest of both the parties are synced. Employees would also want the share price to go higher and that depends upon the constant growth of the organization.

- It allows a company to save regular cash outflow and for recipients, it could result in massive wealth creation overtime.

- This is an important tool for the start ups to attract and retain talent which they could otherwise not able to afford.

As usual, such an arrangement has its drawbacks also:

- Such compensation is not good for existing shareholders as it reduces their ownership.

- If a company’s share price is dropping, then such a company may fail to motivate employees. In fact the employees may not go for stock option and the scheme per share will fail.

Share Based Compensation Accounting

We treat stock-based compensation as an expense, specifically a non-cash expense for accounting purposes, and consider such compensation as an operating cost.

We add this expense to the operating cash flow in the cash flow statement. The treatment is similar to depreciation. Since share compensation is a non-cash expense, we add it back in the cash flow statement. And this improves the operating cash flow.

Share Based Compensation: Treatment on Employee Exit

If the recipient exits the company before the vesting period, there remain two options that may be decided and agreed upon at the time of allotment or distribution. Either the company forfeits the shares of the exiting employee at the issue price. Or in the alternative, the employee is free and continues to hold it even after exiting the company. The company will not forfeit those shares once allotted. And then, as per his will, the exiting employee is free to sell in the open market after the vesting period is over. Moreover, a similar situation continues, i.e., if the recipient stays with the company, they can hold those shares indefinitely or sell them after the vesting period as per their wish.

Impact on Financial Statements

Share-Based Compensation impacts both the Income statement and Balance Sheet. Let us see how it affects:

Income Statement

Since it is a non-cash expense, we take it in the income statement as an expense. This reduces the net income. Another way it impacts is by diluting the earnings per share (EPS). When the recipient exercises the stock options, the company has to issue new shares to the recipient. Thus the overall number of shares increases. And the EPS takes a hit to that extent proportionately.

Balance Sheet

If there is a price difference between the predetermined price and the price on the option’s date, the company has to pay the difference. It could pay the difference in cash or through shares. If it pays in cash, it reduces the cash on the assets side and the owner’s equity.

Another impact is when a company issues more shares to honor stock options. And that increases the paid-up capital but reduces the owner’s equity.

Cash Flow Statement

When the company pays the difference in price in cash, it comes as a cash outflow from Financing Activities. That will lead to a reduction in the cash flow from financing activities. However, if the company issues shares to pay the price difference, there is no impact on the Cash Flow Statement.

Final Words

Share-Based Compensation is widespread in the corporate world. A company can award such compensation in various forms, such as RSUs, ESOPs, etc. Such compensation is a very simple and convenient tool for startups and mature companies to attract and retain employees. The biggest plus for this arrangement is that it makes the interest of the organization and management/employees in sync. Existing shareholders, however, may not like such compensation because it dilutes their ownership. But indirectly, it adds value to them also, as with the increase in the company’s growth, increasing the stock price.