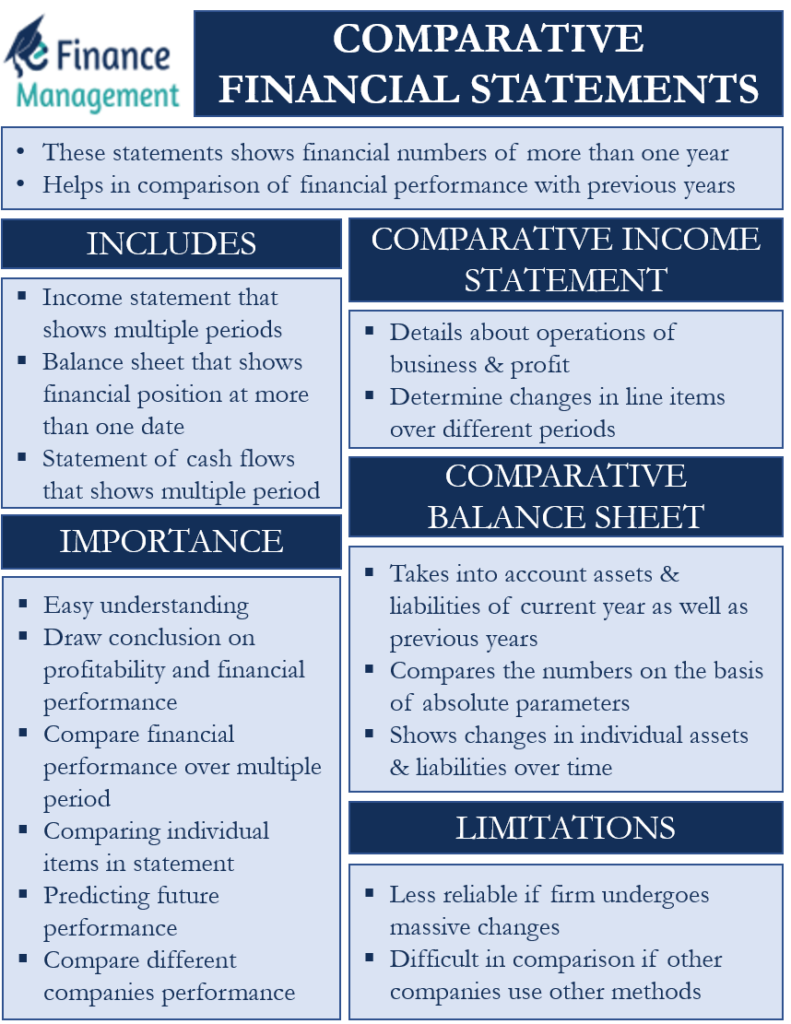

Comparative Financial Statements, as the word suggests, are the statements that show the financial numbers of more than one year (consecutive periods) of an entity. Moreover, such a type of presentation allows the reader to compare the financial performance of the company with previous years. Generally, a company‘s comparative statements show the results of the most recent three years. In such a statement, the previous period’s financial numbers come along with the current period numbers. And they are grouped and presented in a similar sequence and format for ease of reading and understanding.

One important point to note and appreciate is that this is a way of presenting the financial information and performance for all the stakeholders at large. Presentation or no such presentation does not in any way comes in the way of operations of the firm. But such financial statements make it very straightforward and simple to examine the performance of the entity. If a firm does not have such statements, then one would have to flip previous records to compare the results.

What all is there in the comparative financial statements?

Comparative Financial Statements may include the three most important statements apart from other information which the company would like to share. And these three common statements are:

- The income statement, which shows the operating and net income status of the company for multiple accounting years.

- The balance sheet, which describes the financial position of the company at the end of the accounting period day for multiple periods.

- And, finally the statement of cash flows, which shows the movement of cash and sources thereof (like operating, investing and financial) for multiple accounting periods.

However, in some cases, the companies generally provide only the first two comparative statements that are only the Income Statements and Balance Sheets.

Such statements usually come with extra columns showing the variance (absolute change) and percentage change between periods. There can be another type of comparative financial statement as well. Instead of showing results of the recent three years, it may show results of recent months or on a quarterly basis.

Also Read: Types of Financial Statements

In the U.S., the SEC (Securities and Exchange Commission) makes it compulsory for public firms to include comparative statements in their 10-K and 10-Q report.

Importance of Comparative Financial Statements

The following points bring out the importance of such comparative statements:

- By bringing financial numbers for two or more years at a glance and side by side, then it becomes quite easy to understand and interpret those numbers.

- Further, the presentation of comparative statements helps to draw conclusions with regard to the profitability and financial performance of the firm.

- These comparative statements also helps us to compare the financial performance of the company over number of years. This, in turn, helps to determine trends, accounting errors, and more.

- It helps in comparing individual line items in all the statements. Also, it helps in comparing the proportions of various items over multiple reporting periods.

- Such type of statements also helps in predicting future performance.

- Such statements also help in comparing the performance of different companies but only if they follow the same accounting principles.

Comparative Income Statement

Such a statement provides details about the operations of the business and the profit it makes over a period of a few years. Moreover, it also assists in determining the changes in the line items over different periods. One can also use the statement to compare the income, expenses, and bottom line with the competitors.

When analyzing a comparative income statement, the focus must be on the following points:

- Comparing the fall or rise in sales in relation to the COGS (cost of goods sold). A rise in sales does not always mean more profit. Thus, studying the sales in relation to the COGS would give a clear image on the gross profit margin and the trend over the years.

- Analyzing the operational profits that an entity makes.

- Reviewing the overall profitability by studying the fall or rise in the net profit.

- Reviewing the component of cost of goods sold and its proportions thereof to the total cost. This will give an idea where the cost is increasing and what can be done to restrict or contain that increase.

One needs to follow the below steps to prepare the comparative income statement:

- Present all the absolute numbers of the income statement in a sequential and systematic manner for all the periods for which comparative statement is being drawn.

- Calculate the absolute changes in value terms in the line items in relation to the previous year.

- Determine the percentage change in the items on the basis of the previous year numbers.

Comparative Balance Sheet

As we know Balance Sheet is a consolidation of the various assets and liabilities of an entity as on the ending date of the accounting period. Therefore, a comparative Balance Sheet also showcases the details of the assets and liabilities of the firm over the various accounting periods. It usually compares the numbers on the basis of absolute parameters. This way shows the changes in the assets and liabilities of the entity over multiple accounting periods. Moreover, it also shows changes in individual assets and liabilities over time.

One needs to keep the following factors into consideration while reviewing or scrutinizing the comparative balance sheet:

- The current liquidity position, i.e. changes in working capital over the periods. Whether the trend is increasing or not as compared to the sales value increase.

- Critical changes in the composition of assets and liabilities as well as changes in the absolute financial position over a period of time. One can study the long-term financial position by analyzing the changes in long-term liabilities and fixed assets, as well as changes in capital.

- Profitability of the entity. To study the profitability, one needs to check the changes in retained earnings, as well as reserves and surpluses.

- Changes in the owners’ equity.

Follow the below steps to prepare a comparative balance sheet:

- Calculate the absolute value of assets and liabilities for related accounting periods.

- Calculate the absolute changes in the balance sheet items for accounting periods in question.

- Determine the percentage change in assets and liabilities by comparing the amounts of the current year with that of previous years.

Example

We share here a typical example of the assets side of the comparative balance sheet:

XYZ International Balance Sheet

|

Current Asset |

As of 31st Dec, XXXX |

As of 31st Dec, YYYY |

As of 31st Dec, ZZZZ |

|

Cash |

$500 |

$600 |

$700 |

|

Accounts Receivable |

$200 |

$300 |

$400 |

|

Inventory |

$100 |

$200 |

$300 |

|

Total Current Assets |

$800 |

$1,100 |

$1,400 |

|

Total Fixed Assets |

$1,000 |

$1,200 |

$1,500 |

|

Total Assets |

$1,800 |

$2,300 |

$2,900 |

Limitations of Comparative Financial Statements

Following are the limitations of comparative statements:

- Such statements are less reliable if a firm undergoes massive changes. These changes could be a new acquisition, entering a new market and more.

- It may get difficult to compare the results of different companies if they do not follow the same accounting framework.

- If the entity does not wish to fully disclose all the material information. Or if the entity makes changes in its disclosure policy in between the comparative periods.

Final Words

Comparative Financial Statements are very useful for all the stakeholders. It allows them to see the change from one period to period, as well as the movement of cash from one period to another. It helps to show the impact of business decisions on the bottom line, as well as identify the trend and the managerial performance. Additionally, such statements also come useful in assessing the performance of new lines of business and new products easily. So seems a simple statistical exercise of putting figures side by side for various accounting periods. However, it throws light on several key factors and sometimes becomes an eye-opener and trigger for improvement of the performance. A very key exercise and statement, should be reviewed seriously.