Meaning of EBITDARM

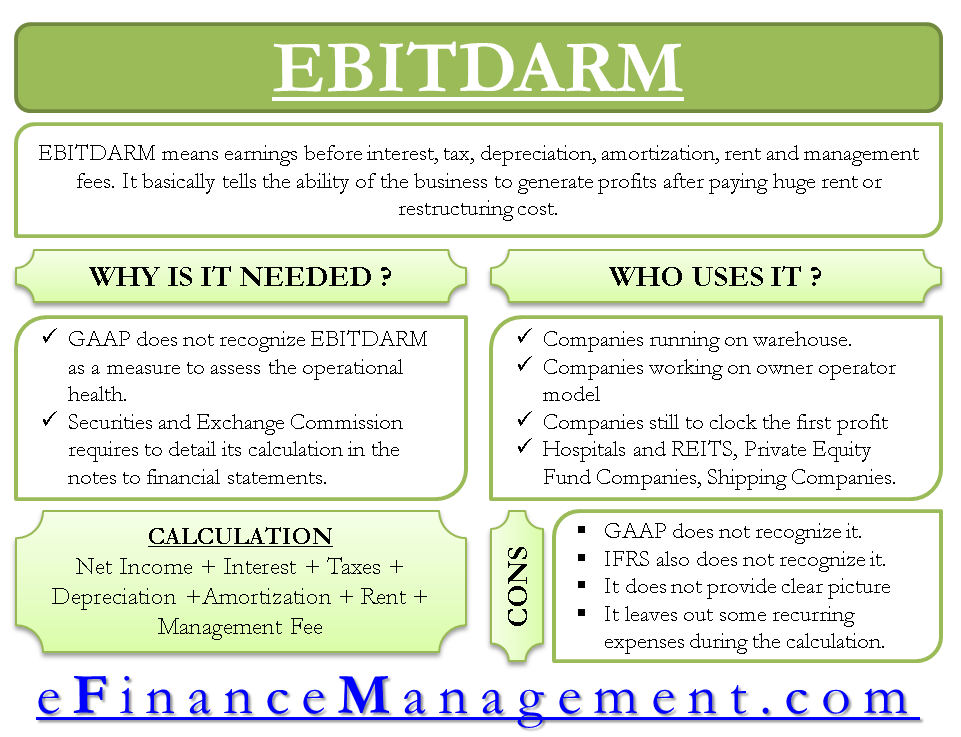

EBITDARM is the full form of Earnings before Interest, Tax, Depreciation, Amortization, Rent, and Management fees. It is a measure of financial performance like EBIT (earnings before interest and taxes) and EBITDA (earnings before interest, taxes, depreciation, and amortization). It basically tells the ability of the business to generate profits after paying huge rent or restructuring costs.

Organizations use various methods to arrive at a profit, and the selection of the method depends on the line items they have in their books. For some organizations, rent and management fees form a major portion of their operating costs. Therefore, they replace the more conventionally used EBITDA with EBITDARM.

The use of such custom parameters is important to effectively analyze the company’s efficiency at an operating level. Further, their calculation is equally important to ensure the proper implementation of management’s strategies.

Why is it Needed?

It is worth noting that GAAP does not recognize EBITDARM as a measure to assess the company’s operational health. However, the SEC (Securities and Exchange Commission) requires companies that use this metric to detail its calculation in the notes accompanying their financial statements.

Also Read: EBITDA

Though GAAP does not recognize it, a company may calculate EBITDARM for their in-house analysis of operational efficiency or internal assessment. Also, organizations might use this profitability measure for presenting before investors and creditors.

Often analysts prefer this metric over EBITDA to come up with pure operating cash flows. At times, credit rating agencies use the method to analyze if the company is in good health to service its debt and other obligations.

Who Uses EBITDARM?

- Several companies require massive storage space or infrastructure to run. A company that runs on the warehouse entirely would usually use EBITDARM to calculate the profitability.

- Companies that work on the owner-operator model pay a lot in terms of management fees. Further, the use of EBITDARM becomes significant to ensure that the future operator does not pay inappropriate fees in case the current owner is not there.

- Also, industries such as healthcare, where hospitals acquire a large portion of land on a lease, generally pay huge rent. Calculating operating profit by excluding both these items would not reflect the true profit.

- Often companies that are still to clock their first profit calculate EBITDARM to give an idea of their cash flow.

- Even within the same industry, there might be companies with different nature of operations. For example, a company operating from their own property would not have to pay the lease or the rent. This might give the impression that the company is more efficient from an operational point of view.

- Apart from the hospitals, one would find REITs using this metric largely in their financial statements.

- Private equity firms also use it to evaluate an investment in a particular company.

- Shipping and airline companies also use this as they pay huge rent every year.

Calculation of EBITDARM

Formula

EBITDARM is Net Income + Interest + Taxes + Depreciation +Amortization + Rent + Management Fee

Before using this formula, one must calculate the following items:

- Calculate NET INCOME by subtracting TOTAL EXPENSES from TOTAL INCOME.

- After that, calculate each component of the formula separately, such as Income Tax, Interest and Depreciation Cost, and more.

- Similarly, the company would need to assess the Amortization, Rent, and Management fees that they are paying.

- Once the company calculates all these numbers, all they need to do is put those in the formula above.

Shortcomings of EBITDARM

- The biggest drawback is that GAAP does not recognize the metric.

- Not just GAAP but EBITDARM is also not recognized as a useful metric by International Financing Reporting Standards (IFRS). Both GAAP and IFRS are of the view that it does not give the real picture.

- The cons of EBITDARM are similar to that of EBITDA, i.e., both do not provide a clear-cut picture of cash flow.

- It leaves out some recurring expenses during the calculation. This, in turn, encourages manipulation while preparing accounts.

Conclusion

Even though both GAAP and IFRS do not recognize EBITDARM, companies and analysts widely use it for internal purposes. However, accounting experts believe that organizations should use this metric in conjunction with other financial metrics to get a clearer picture.

Some of the metrics that one can use along with are net earnings, EBIT and EBITDA. Although EBIT and EBITDA are also non-GAAP measures, they are perceived as more refined metrics.