EBIT and EBITDA are the two most common profitability indicators. EBIT is the total earnings of an entity derived before deducting the interest and taxes of an entity. While EBITDA is the total earnings of an entity before deducting interest, taxes, depreciation, and amortization. If we look at both terms, the difference between the two is only ‘DA’ (depreciation and amortization). Thus, many use both terms to convey the same thing. However, in reality, the two terms are very different from each other. To better understand these two terms, we need to understand the differences between EBIT vs EBITDA.

EBIT vs EBITDA – Differences

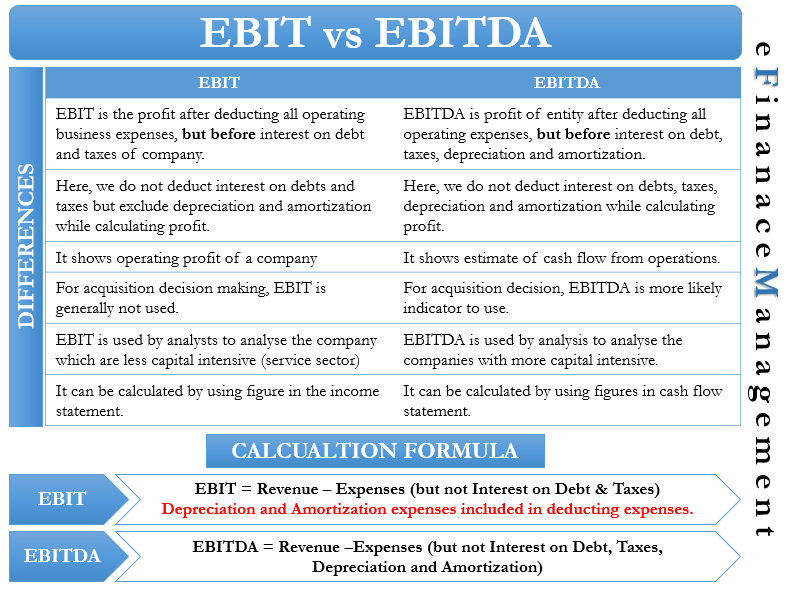

Following are the differences between EBIT vs EBITDA:

Meaning

EBIT is the profit after deducting all operating expenses of a company. The only expenses that we don’t consider while calculating EBIT are interest on debt and taxes. It helps to study the performance of the company’s core operations sans any influence of the capital structure.

On the other hand, EBITDA is the profit of the entity after deducting all operating expenses, excluding depreciation and amortization. EBITDA figures indicate and give us a real glimpse of the operating efficiency of the entity. It is because depreciation and amortization are non-cash items that remain with the company. Or, there is no cash outflow for these items.

What’s Included or Excluded?

For EBIT, we include depreciation and amortization but not interest on debts and taxes. By excluding the interest and taxes, we separate the financial aspects from the operations of a business. In other words, we can say that it separates the impact of the company’s capital structure on the core operational performance.

Also Read: EBITDA

For EBITDA, we don’t consider depreciation and amortization, as well as interest on debt and taxes. By removing these two additional items over and above EBIT figures (depreciation and amortization), we take out non-cash expenses also from the operating income.

What do they Represent?

EBIT is an approximation of a company’s operating profit, or it gives accrual basis results of operations. On the other hand, EBITDA is an estimate of the cash flow from the operations.

Why Calculate?

EBIT gives an overview of the company’s core activity performance or business operations. There are cases when interest and taxes distort the financial picture. The net income figure may not give an accurate picture of a company with profitable operations but a poor capital structure. Thus, EBIT is the best measure to know how well a firm handles its core business operations.

On the other hand, EBITDA is also an indicator of a company’s operational health but excludes notional expenses. Depreciation is one such example of notional expenses, as there is no actual cash outflow. So, if one needs to understand and evaluate cash flows and operational performance, EBITDA is the go-to measure.

Also Read: EBIT – Meaning, Importance And Calculation

How to Calculate?

We can calculate both EBIT and EBITDA in multiple ways.

Following are how we can calculate EBIT:

EBIT = Total Revenue – All Operating Expenses (including depreciation and amortization)

or EBIT = Revenue – Cost of Goods Sold (COGS) – Operating Expenses

or EBIT = Net Income +Interest + Taxes

We can calculate EBITDA in below-mentioned ways:

EBITDA= Operating Profit +depreciation and amortization

or EBITDA = Net Income + Interest + Taxes + Depreciation and Amortization

or EBITDA = EBIT+Depreciation+Amortization

Popular Amongst Analysts

EBIT is popular among analysts when analyzing a company that is less capital intensive, such as a tech firm. On the other hand, analysts prefer EBITDA when analyzing capital-intensive sectors or firms that amortize the massive amounts of tangible assets, such as Real Estate and Aviation. If we use EBIT for such firms, then a large amount of depreciation and amortization could overshadow the operating profits. Nevertheless, the decision to use EBIT or EBITDA for capital-intensive companies is of the analysts.

Acquisition

An analyst is more likely to value the target company using EBITDA for acquisition purposes. It is because valuation is generally based on cash flows.

Easier to Calculate

EBIT is relatively easier to calculate than EBITDA using the income statement. It is because depreciation and amortization numbers may not always appear clearly in the income statement. The best way to calculate EBITDA is by using the cash flow statement.

Example

Let’s take an example to better understand the differences between EBIT and EBITDA. In this, we will also see the use of EBIT and EBITDA for capital-intensive and less capital-intensive companies.

There are two companies – Company A (a service company) and Company B (a manufacturing company). Both companies have identical revenue and expenses at $50,000 and $30,000, respectively. Since Company B is a capital-intensive firm, it has a depreciation and amortization expense of $15,000. Company A is a service company that does not have any such costs.

In this case, EBIT and EBITDA for Company A and B will be:

EBIT Company A = $50,000 less $30,000 = $20,000

EBITDA for Company A will also be $20,000 as it does not have a depreciation and amortization expenses.

EBIT for Company B = $50,000 less $30,000 less $15,000 = $5,000

EBITDA for Company B = $50,000 less $30,000 = $20,000

Even though both companies have the same revenue and operating expenses, the presence of non-cash costs made a considerable difference to the EBIT of both.

EBIT and EBITDA – Limitations

Following are the limitations of using EBIT vs EBITDA:

- GAAP does not consider both as a standard measure to report financial numbers. It is because firms can misuse them to conceal their actual financial numbers.

- Companies with high capital expenditures may have a considerable difference between the EBIT and the actual cash flow. Moreover, using EBIT as a measure for such businesses could fail to give an idea of the important capital expenditures for a business to sustain. Thus, analysts should use both EBIT and EBITDA for capital-intensive companies.

- Warren Buffett does not favor EBITDA. Buffett believes that companies use it to window dress their finances.

Final Words

Even though both EBIT and EBITDA are an essential part of the financial analysis, they do not come in the income statement. Because GAAP (generally accepted accounting principles) standards do not provide for this. Therefore, business or analyst needs to calculate it separately as they are not part of the financial statements.

Also read – EV to EBITDA.