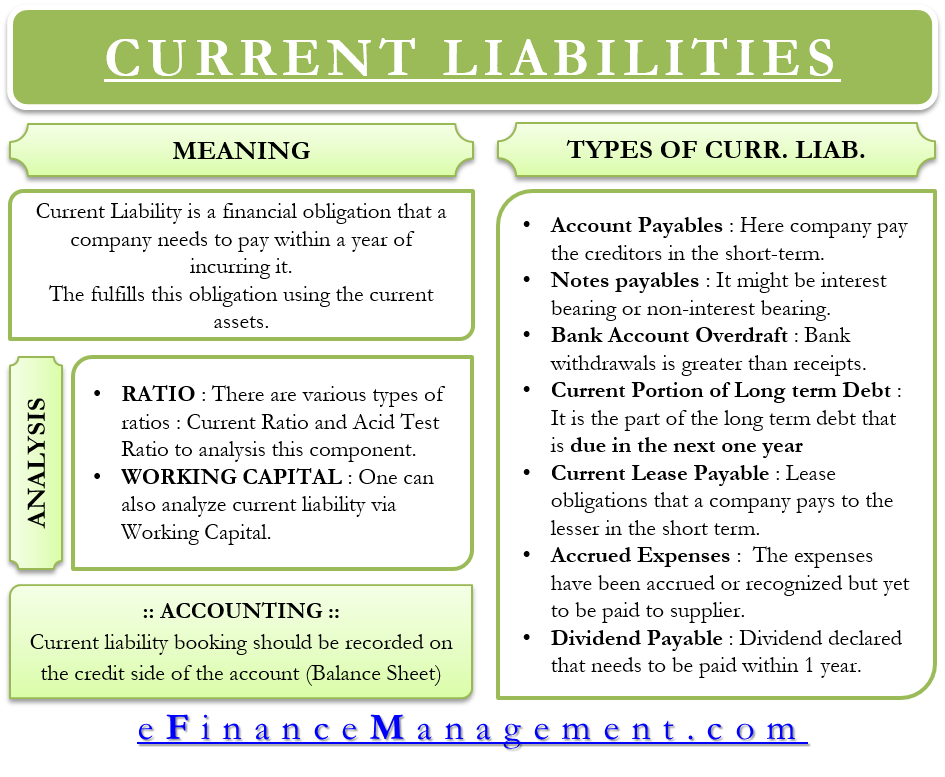

Current Liability is a financial obligation that a company needs to pay within a year of incurring it. Also known as short-term liability, a company fulfills this obligation using the current assets. In the event of fulfilling one current liability, the company might also create another such liability. For instance, to pay the suppliers, the company might decide to avail of a loan from the bank. This, in turn, creates another liability.

Current liabilities are presented in the balance sheet and include accrued liabilities, accounts payable, short-term debt, etc. Accounts under current liability may vary as per industry or government regulations. For instance, in the balance sheet of a bank, there will be a ‘Customer Deposits’ account under the head of current liability.

A current liability is usually due within a year. However, in some cases, it may also include liabilities payable within one business cycle. If a business operates a business cycle beyond a year, then the current liability is due within the duration of the two periods.

How to Present Current Liabilities?

In the balance sheet, current liabilities usually follow a set pattern. For instance, first, the principal portion of notes payable that are due within a year comes, then accounts payable, and then other current liabilities, such as interest payable, income taxes payable, etc.

Also Read: Short-term Liabilities

Also, a company may record current liabilities as per the settlement date. For instance, accounts payable having a settlement date closer to the current date will come first. Such a presentation allows even an outsider to comprehend the accounts easily, calculate various ratios, analyze when debts will become due, or will the company has enough resources to pay the short-term debt.

Types of Current Liabilities

The most common current liabilities found in a balance sheet are:

Accounts Payable

As the name suggests, the company needs to pay the creditors in the short term. Therefore, all such liabilities come under Account Payable. Usually, in a business, suppliers give some time to their clients to settle the dues. Clients or companies record these dues as Accounts Payable in the balance sheet. Accounts Payable is typically the largest current liability account on the company’s financial statements.

Notes Payable

Again these come under current liability because of their nature of being a short-term financial obligation. These notes payable might be interest bearing or non-interest bearing. Further, the accounts manager adds these as notes or loans payable under current liabilities.

Bank Account Overdraft

Overdraft on the bank account occurs when a person withdraws more than the balance they have in the bank account. Banks give such a facility to a few customers only and negotiate an overdraft limit beforehand.

Also Read: Meaning and Types of Liabilities

Current Portion of Long term Debt

As the name suggests, it is part of the long-term debt due in the next 1 year. If the company has a higher current portion of the long-term debt compared to cash, it would be a risky business. Therefore, investors should always watch the current portion of the long-term debt and take necessary precautions if it increases consistently.

Current Lease Payable

Lease obligations that a company pays to the lesser in the short term also come under current liability. There are two types of leases – Capital Lease and Operating lease. The nature of the lease depends on the risk and benefits.

Accrued Expenses

These are the expenses that have been accrued or recognized but are yet to be paid to the supplier. A company keeps a record of accrued expenses under current liabilities and pays them off as and when it becomes due.

Dividend Payable

Also known as dividend declared, it is a liability for the company and has to be paid within the due date. The value of the liability would depend on the amount that the company declares and the due date on which the company pays it. Unless the company pays it, it comes on the liability side of the balance sheet.

Unearned Revenue

It is the advance payment made by the customer. The customer of the company might have made some milestone payment or advance payment before the company completes the work. Therefore, the company cannot put it in the category of revenue. Unless the company completes the work and justifies the advanced payment, the unearned revenue comes on the liability side of the balance sheet.

Accounting of Current Liability

After a company gets an economic benefit, which it must pay for within a year, then it must record a credit entry (journal entry) for a current liability. For instance, a company needs to pay external auditors $10,000 in the next 60 days for the tax preparation services. Initially, the company must record a debit entry for $10,000 to the audit services expense account. The company will pass the corresponding credit entry to other current liabilities accounts. After the company makes a payment of $10,000, it needs to pass a debit entry for other current liabilities accounts and a credit to the cash account.

Analysis of Current Liability

We can analyze current liability using Ratios and Working Capital;

Ratios

To assess the total current liability in comparison to the current assets, there are different types of ratios, such as current ratio and Acid test ratio. These ratios help analysts and stakeholders understand the adequate amount of current assets that a company has to meet its current liability obligation. However, these ratios do not give a complete picture of the health of the business.

For instance, if an account payable is due to be paid in the near term but account receivables are not due as of now. In this case, although the cash balance of the company would start depleting as they have to honor the accounts payable. But the ratio would still show favorable health of a business.

Current ratio = Current Assets/ Current Liabilities

Quick Ratio = Current Assets – Stock/ Current Liabilities

We do not consider stock/Inventory while calculating the Quick ratio. The purpose is to ensure that the company has ready resources to meet the short-term obligations without having to wait to sell off the inventory.

Working Capital

One can also analyze current liability via Working Capital. The formula of Working Capital is Current Assets – Current Liabilities. Positive working capital means the level of assets is higher than the current liabilities. One can also see this excess capital as being blocked in the assets. A company can invest this excess capital to generate more returns rather than keeping it idle.

On the other hand, negative working capital means a company doesn’t have enough assets to meet its liabilities. This may impact the smooth functioning and credibility of the company.

Final Words

Recording and classifying current liabilities gives crucial information about the health of a business to lenders, financial analysts, owners, and others. One can use this information to analyze liquidity and working capital management. One can also compare it with other firms in the industry. Also, since current liabilities are a part of working capital, they help calculate the free cash flow of a firm.

Read Meaning and Types of Liabilities to learn more.