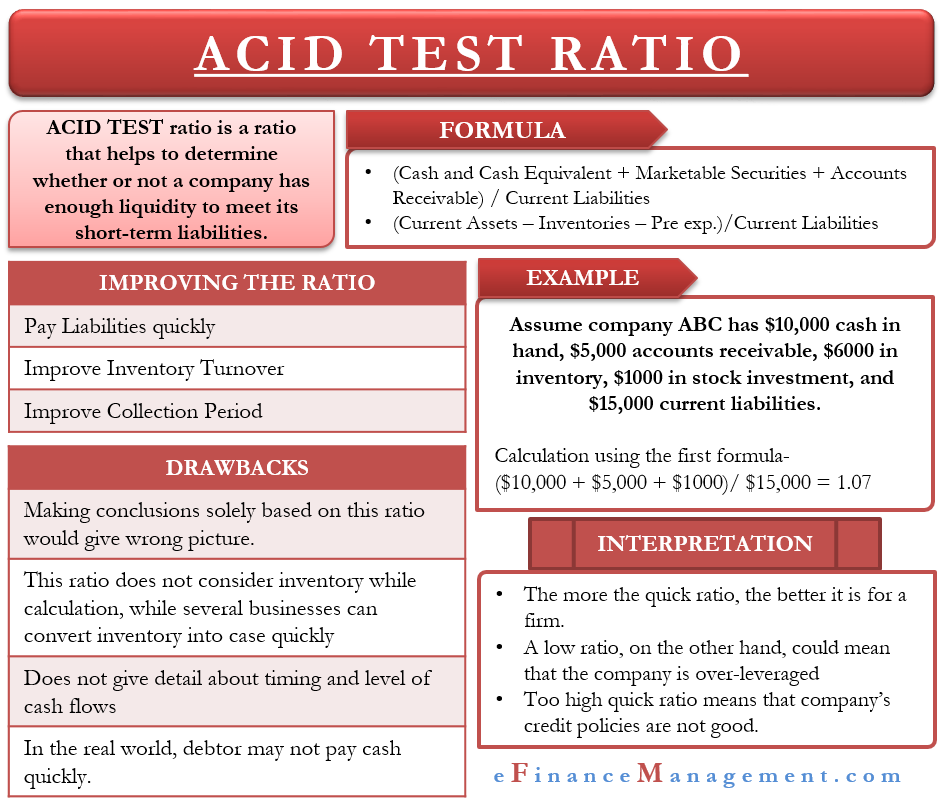

The acid test ratio, or the quick ratio, is a measure of liquidity. This ratio helps determine whether a company has enough liquidity to meet its short-term liabilities. It compares the company’s most liquid assets, such as cash, accounts receivable, and temporary marketable securities, with the current liabilities.

It is a more strict measure of a company’s liquidity than the current ratio. Its calculation is almost the same as the current ratio, except we do not consider inventories and prepaid expenses. This is because converting stocks into cash may take some time, and a company can’t use prepaid expenses to pay its current liabilities.

Acid Test Ratio or Quick Ratio – Formula

Following is the formula for calculating the quick ratio:

Acid test ratio = (Total Current Assets – Inventory) / Total Current Liabilities

Or

= (Cash and Cash Equivalent + Marketable Securities + Accounts Receivable) / Current Liabilities

Note: Bank overdraft and cash credit are usually excluded from current liabilities.

All these items are available on the company’s balance sheet.

Here, cash and cash equivalents are the cash lying with the company and the balance in the savings accounts, T-bills, and a term deposit with a maturity of fewer than three months.

Marketable securities are investments that a company can quickly convert into cash.

As you will be aware, account receivables are the debtors or the money that the company will receive from the customers who bought its goods or services on credit.

Current liabilities include all the debts and obligations that a company needs to pay within a year.

As said above, the acid test ratio is similar to the current ratio. So, we can also calculate it by adjusting the formula for the current ratio. Thus, another method for the quick ratio is

= (Current Assets – Inventories – Prepaid expenses)/ Current Liabilities

Here, current assets include all the assets that a company can convert into cash within a year.

The reason why we don’t consider inventory for the quick ratio is that they are usually slow-moving. Even if a company tries to convert stock into cash quickly, it would have to offer a considerable discount.

Example of Acid Test Ratio

Let us understand the quick ratio calculation with the help of an example.

Assume company ABC has $10,000 cash in hand, $5,000 in accounts receivable, $6000 in inventory, $1000 in stock investment, and $15,000 in current liabilities.

Putting the values in the formula, we get ($10,000 + $5,000 + $1000)/ $15,000 = 1.07

Now, let’s calculate the quick ratio with another formula. Assume Company XYZ has current assets of $20,000, current liabilities of $15,000, inventory of $2,000, and prepaid expenses of $500. The quick ratio, in this case, will be ($20,000 – $2,000 – $500)/$15,000 = 1.16

Acid Test Ratio Interpretation

This liquidity ratio tells the ability of the company to meet its current liabilities without selling the inventory. Since the calculation does not include inventory, the quick ratio is a more conservative estimation of a firm’s liquidity.

Usually, the more the quick ratio, the better it is for a firm. For instance, an acid test ratio of 2 implies that a company has $2 worth of assets for each dollar of current liabilities. It would mean that the company will be able to convert receivables into cash or cover its financial obligations and is witnessing robust growth. Moreover, companies with a high quick ratio usually have faster inventory turnover and cash conversion cycles.

On the other hand, a low ratio could mean that the company is over-leveraged, or paying creditors too early, or realizing debtors too slowly, or is facing issues in growing its sales and may have problems if somewhere the cycle breaks.

However, a too-high quick ratio is also not suitable for a company. A high ratio may mean that a company has excess cash, which is not put to productive use. Also, a very high ratio (if due to very high accounts receivables) may mean that the company’s credit policies are not very good.

Talking of an ideal acid-test ratio, a common rule of thumb is that a ratio of more than 1 is sufficient. But, it is not one size fits all. Thus, the ideal ratio may vary from industry to industry and the nature of the company’s business. For instance, a low quick ratio could be ideal for an established business, but it could mean trouble for a new business with less and fluctuating revenue.

How to Improve Acid Test Ratio?

As said above, a quick ratio of more than 1 is generally safe. However, if a company has a low ratio, then it could improve it by using the following three ways:

Pay Liabilities Quickly

Keeping liabilities under control could help a business improve its quick ratio. Remember, in the formula for a quick ratio; the current liabilities come in the denominator. So, if the current liabilities amount is less, it would increase the quick ratio. A business can improve its current liabilities by paying creditors and reducing the loan repayment terms.

Improve Inventory Turnover

Even though inventory is excluded for calculating the quick ratio, a company can improve the ratio by improving its inventory turnover ratio. A company can improve the inventory turnover ratio by increasing cash sales. That, in turn, would increase cash in hand for the company.

Improve Collection Period

A company must have clear collection terms with the debtors. It must try to minimize the collection period. That would help boost cash flow, reduce bad debts, and eventually improve the acid test ratio.

Drawbacks of Acid Test Ratio

Like with every financial metric, this financial ratio also suffers from a few drawbacks:

- This ratio alone is not enough to compute a company’s liquidity position.

- Doesn’t consider inventory which might give wrong results.

- It doesn’t give details about the level and timing of cash flow.

- It considers account receivables to be a liquid asset which may not always be possible.

- Ignores working capital requirement for operation, assuming that the company liquidates its current asset to pay the current liability.

For more detail, refer to the Disadvantages of the acid test Ratio.

Benefits of Acid Test Ratio

- Exclusion of inventory states proper liquidity position as inventory is associated with inflation and deflation.

- Does away with the calculation of inventory which is quite tricky.

- This ratio is more reliable in terms of measuring payment capability.

For more detail, refer to the Advantages of the acid test Ratio.

Final Words on Acid Test / Quick Ratio

The acid test ratio is a stern measure of liquidity. However, many factors may affect its calculations, such as payment and collection policies, provision for bad debt, the timing of asset purchases, and more. All these factors differ from industry to industry. So, it is always recommended that we use this ratio to compare firms within the same industry. Moreover, the quick ratio must be used along with other liquidity ratios to arrive at a meaningful conclusion.

Well explained, but I have a question and that is ,what about firms who don’t have inventories, like the service provider (law firms, consultancy firms,) and others, if they don’t have inventories, then do they need an acid test? or they can simply interpret current ratio as the quick ratio. or there are no need for quick ratio assessment for non-inventory firms.

Yes, service and consulting firms do not have inventory hence this step becomes redundant from that aspect. In their case, the acid test ratio and the current ratio becomes look alike. So they need not calculate the acid test ratio.