Debt and Liabilities are two very crucial accounting concepts—even those who do not have an accounting or finance background use both terms regularly. In general, both can mean the same things. But, in the accounting and finance world, the two words are different from each other and have their own significance. Thus, it is very important for investors, managers, and other stakeholders to know and understand the difference between debt vs liabilities.

Before we detail the differences between the two, let us take a look at what the two terms mean.

Debt vs Liabilities – Explanation

In simple words, debt means the money that one borrows or the loan. On the other hand, Liabilities are the financial responsibilities that a company needs to take care of. In a way, we can say that debt is part of the liabilities.

In accounting terms, liabilities represent the firms’ obligation due to past transactions. A few common examples of liabilities are Accounts payable, Bonds payable, Deferred revenues, and more.

Debt usually refers to the amount that a company or individual owes, such as loans (both short and long term). It basically represents the amount that a company borrows or raises from outsiders. A borrower always has to pay interest on the debt also.

Also Read: Meaning and Types of Liabilities

Liability is a broader concept and includes debt. It will not be wrong to say that the difference between debt vs liabilities is primarily for companies. For an individual, both the terms could mean the same thing. Usually, when individuals talk about their liabilities, they are very likely to refer to the debt they owe. However, for a company, the two terms are different.

Now let us look at the difference between debt vs liabilities.

Debt vs Liabilities – Differences

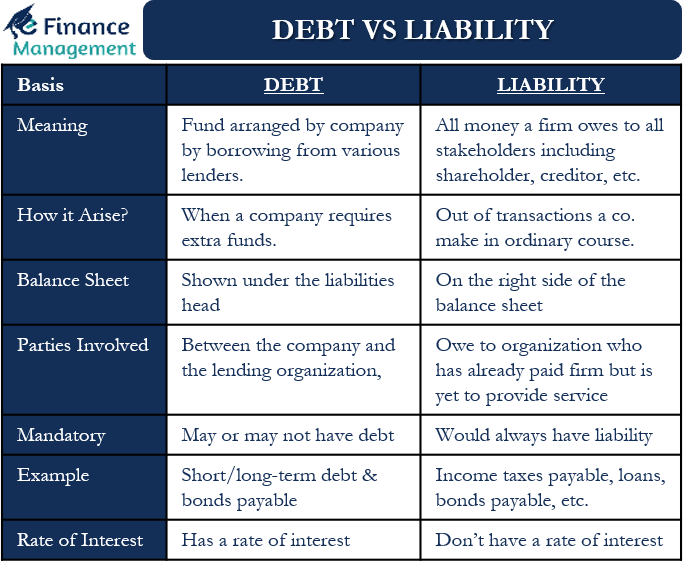

Following are the differences between debt vs liabilities:

Definition

Liabilities refer to all money that a firm owes to all stakeholders, including shareholders, creditors, and more. On the other hand, debt is the funds arranged by the company through borrowings from various lenders/channels.

How it Arise?

Liabilities arise because of the transactions that a company makes while normally carrying its business, like buying goods on credit. Similarly, these are various expenses that fall due at a certain frequency – immediate, fortnightly, monthly, quarterly, half-yearly, and so on. Examples could be rent, salaries, administrative expenses, electricity and water charges, etc. Also, it may arise because of not-so-regular transactions, such as raising funds by issuing shares, loans, and more.

Debt, on the other hand, arises when a company requires extra funds, such as for buying assets, meeting working capital requirements, and more.

Where they come in the Balance Sheet?

Liabilities usually come on the right side of the balance sheet. Since debt is also a part of liabilities, they are shown under the liabilities head.

Also Read: Assets vs Liabilities – All You Need To Know

Sub-categories

In a balance sheet, usually, there are two sub-categories of liabilities. These are current or short-term liabilities and non-current or long-term liabilities. Each of these sub-categories has further sub-categories.

On the other hand, debt could come under both short and long-term liabilities. The long-term debt will come under long-term liabilities, and the short-term debt will come under short-term liabilities.

Ratios

Liquidity ratios assist in assessing whether or not a company would be able to meet its short and long-term obligations (or liabilities). On the other hand, we use debt ratios to assess the debt level of a company. Such ratios reveal how much a company is dependent on debt—for example, the debt to equity ratio.

Parties Involved

A firm owes liabilities to other organizations that have already provided services to the firm, but the company has yet to pay them. A firm also owes liabilities to other organizations, who have already paid the firm, but the firm is yet to provide them with services. On the other hand, debt is generally between the company and the lending organization, such as a bank or a financial institution.

Mandatory

A company may or may not have debt on its balance sheet. If a company does not have any debt component, then there is no need to show it on the Balance Sheet. However, we can not do the same for liability because a company would always have some liabilities.

When Paid?

Generally, liabilities are flexible in nature, and a company usually pays them at its discretion. On the other hand, debt is mandatory, and a firm needs to pay it at a set time. If a firm fails to pay the debt, it impacts its creditworthiness.

Example

A few examples of liabilities are income taxes payable, loans, bonds payable, creditors, and more. Debt can be both short or long-term and bonds payable.

Rate of Interest

Most liabilities don’t have a rate of interest. However, debt has a rate of interest, and thus, it results in a regular cash outflow for a company.

Secured and Unsecured

Usually, the debts that a company takes are all secured. Of course, there are instances of unsecured borrowings also. On the other hand, most liabilities of a company are unsecured.

Final Words

When talking about the financials of an individual, both debt and liabilities may mean the same things. But, when we talk about a company, debt and liability mean different things. Thus, it is crucial that all stakeholders know if they are talking about debt or liabilities. For various long-term financial and investment analyses, mostly borrowings are the key values taken into consideration. Short term ratio calculation, of course, the current liabilities do become the important value.