A liability is a debt or legal obligation of the business to another individual, bank, or entity. There could be both short-term liabilities as well as long-term liabilities.

Liability is a type of borrowing that creates an obligation of repayment to the other party involved. It is an outcome of past events or transactions and results in the outflow of resources. Therefore, it involves future sacrifices of the economic benefits of the firm.

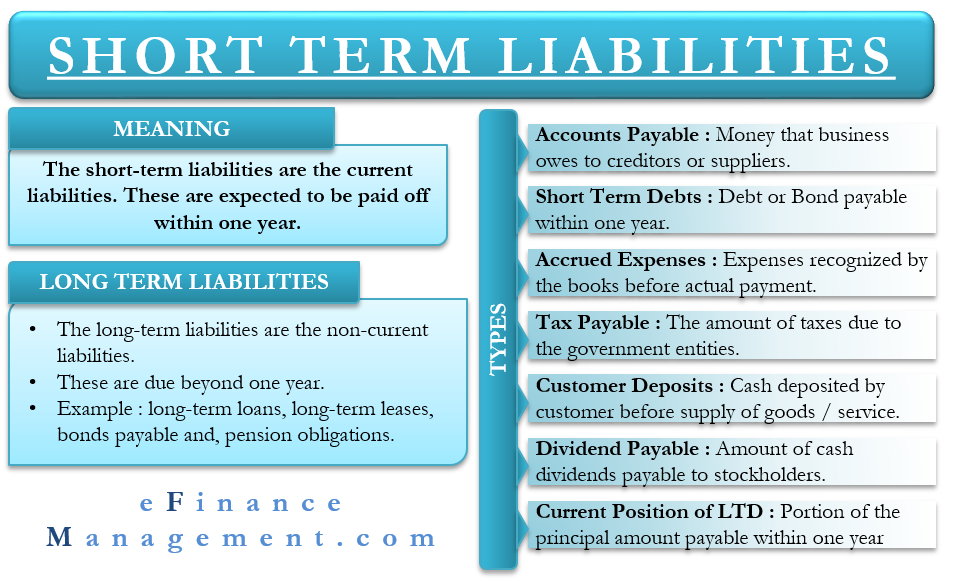

There are mainly two types of liabilities:

- Short-term Liabilities

- Long-term Liabilities

Besides short-term and long-term liabilities, there is another type of liability called contingent liabilities. However, it is not necessary that they take place. They are payable only when some event or contingency occurs.

Meaning of Short-term Liabilities and Long-term Liabilities

Short-term Liabilities

The short-term liabilities are the current liabilities. It means the debts or liabilities that are expected to be paid off within one year—for example, short-term debts, accrued expenses, and customer deposits.

Long-term Liabilities

The long-term liabilities are the non-current liabilities. It means the debts or obligations of the firm that are due beyond one year. These liabilities act as long-term sources of finance. For example, long-term loans, long-term leases, bonds payable, and pension obligations.

Types of Short-term Liabilities

There are many types of short-term liabilities. Some of them are as follows:

Accounts Payable

Accounts payable is the amount of money that a business owes to its creditors or suppliers. It may arise due to the purchase of goods and services from the suppliers on a credit basis. It is also known as trade payable or trade accounts payable.

In the normal course of business, the company pays off the accounts payable within one year. The entry of accounts payable comes under the liabilities section on a company’s balance sheet until the company makes its final payment.

Short-term Debts

Short-term debt is any debt or bond payable within one year from its accrual. On the contrary, long-term debts are those which have long repayment periods beyond one year.

Short-term debts act as a useful tool for a business to address short-term needs.

Accrued Expenses

Accrued expenses refer to those expenses which have been recognized by the books of accounts before the actual payment. Instead, a journal entry records the incurring of an accrued expense in the same accounting period.

Also Read: Meaning and Types of Liabilities

Accrued expenses are the opposite of prepaid expenses. The prepaid expense is one that has been paid in advance, whereas an accrued expense which has been due but not yet paid off.

Taxes Payable

Taxes payable are the amount of taxes due to the government entities. It is a liability on the business until paid. After the final payment, a debit entry is passed to record the money paid as taxes paid in the books.

There are various kinds of taxes payable, such as sales taxes payable, corporate income taxes payable, and payroll taxes payable accounts. The accountant records the liability when they accrue and records their payment when the company settles their payment.

Customer Deposit

A customer deposit refers to the cash a customer deposits with the company before receiving the final goods and services. The company is yet to earn it, and thus, it is a liability on the company. There is an obligation to provide either goods and services or return the money to the customer. The entry in the credit side of the current liabilities account shows the amount of customer deposits.

Poor credit records of the customer can be one of the reasons a company may ask to deposit the cash in advance. Also, it is useful in the case of expensive and customized goods.

After fulfilling the obligation, the company records a debit entry in the liabilities account and a credit entry in the revenues account.

Dividends Payable

Dividends payable is the amount of cash dividends that are payable to the stockholders as declared by the board of directors of the company. It is a liability until the company distributes/pays the dividend among the shareholders.

The company intends to pay the dividend within a year. Therefore, the dividends payable come under the category of current/short-term liabilities.

A large liability in the category of dividends payable reflects upon the good profitability of the firm. However, there could be an adverse effect on the liquidity ratios.

Current Portion of the Long-term Debt

The current portion of the long-term debt is the portion of the principal amount that is payable within one year of the balance sheet. Let’s take, for example, the installment of the loan or debt that is due for payment in the current year will count as this kind of short-term liability.

Creditors, lenders, and other investors have a close look at this liability to understand whether the company is capable of paying its short-term liabilities or not. It helps in knowing the liquidity position of the company.

Conclusion of Short-term Liabilities

So, these were some kinds of short-term liabilities. Apart from that, there could be other short-term obligations that are to be payable within one year. The short-term debts help in meeting the working capital requirements of the firm.

The short-term liabilities impact various ratios, including profitability ratios and liquidity ratios. Consequently, they are useful in determining the overall financial position of the company in the short term and developing business strategies accordingly.