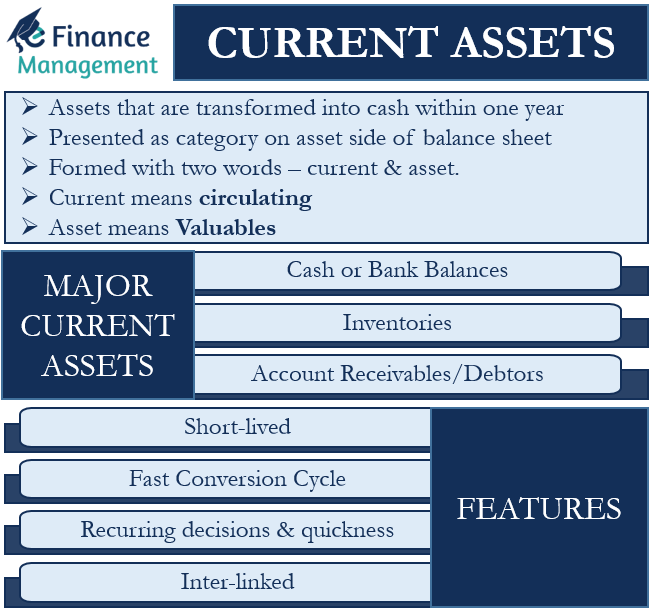

Current assets are those assets that are transformed into cash within one year. These assets include cash, marketable securities, account receivables/debtors, all types of inventory/stock, and any other asset which can be converted into cash within one year. It is presented as a category on the asset side of the balance sheet. The key features of the current asset are their short-lived existence, fast conversion into other assets, recurring and quick decisions, and, lastly, interlinked. Virtually, current asset management is almost as good as working capital management.

The term current asset is formed with two words – current and asset. Current means circulating, and asset means valuables. These are those assets or valuables of a business that keep circulating. The typical time frame for circulation is the financial period which is usually one year.

Major Current Assets

There are three main components of current assets that require the finance manager’s considerable attention. Without effective management of these components, the manager cannot achieve effective working capital management. These are

Cash or Bank Balances

Cash and bank balance are the balance that a company holds for its urgent needs. This balance would keep fluctuating, and a particular balance would not last for more than a week or two. The balance will be high when the customer does the collection, and it will again reduce when payment is made for purchasing raw materials. It is also known as cash and cash equivalents.

Inventories

Inventories form all kinds of inventories, whether raw material, work-in-progress stock, or finished goods. The time frame of their conversion is normally between 2 to 60 days, and the rest depends on the industry a company operates in.

Account Receivables/Debtors

These are the customer accounts to whom goods are sold at credit. This money is circulated generally within 30 to 60 days. This depends on many credit terms and the industry standards of such credit terms. (Read Is Account Receivable an Asset? For more clarification).

Features of Current Assets

Short-lived

In the definitions of all the major current assets, we saw that they are very short-lived, especially when we compare them with their counterpart, i.e., Fixed Assets.

Fast Conversion Cycle of Current Asset

These assets are quickly converted into other current asset forms in a cyclic manner. The current asset cycle works as follows:

Cash converted into raw material, which again converts to finished goods, further that converts into account receivables, and finally, account receivables are converted back into cash.

Also Read: Working Capital Management

Decisions are Recurring and Require Quickness

Since the current assets are very short-lived and are frequently converted into other current assets, the decisions relating to such assets are also recurring in nature and require quick decision-making.

Inter-linked

A manager cannot consider one component individually and decide on it. That will not work in favor of overall working capital management if that is done. These components are interlinked, as seen in the current asset cycle. For example, if a business needs cash, it will have to offer a discount to debtors for their faster realization. In contrast, if a business has too much-finished goods inventory, it will try to sell it to debtors with liberal credit terms.

Is Working Capital Management as good as Current Asset Management?

In general, working capital management would involve the effective management of current assets and current liabilities. But if we think from a different angle, we may find the statement correct. It would not be too wrong to assume working capital management is as good as current asset management due to two reasons. One is that the investment in current assets is a substantial part of the company’s total assets. Secondly, the current liabilities are created only because the firm wants to create current assets.

Continue reading – Liquid Assets.

Beautifully summarized! And has all the important key factors as needed!

Can we consider FDR(Maturity period less than 12 Month) kept as margin for bank Guarantee as current assets.