Yankee Bonds are bonds issued & traded in the United States by foreign entities. They are traded & denominated in U.S. Dollars. Yankee bonds are registered & monitored by the Securities & Exchange Commission (SEC). Foreign banks, corporations & governments usually issue these bonds. Debt-rating agencies rate these bonds & their interest rates are determined by their ratings.

In 2017, a popular Yankee bond was issued by Italian corporation Enel, which raised USD 5 billion.

Foreign entities usually issue Yankee bonds when U.S. interest rates are low. In this manner, they can borrow funds at a cheaper rate than if they were to issue the bonds in their own country.

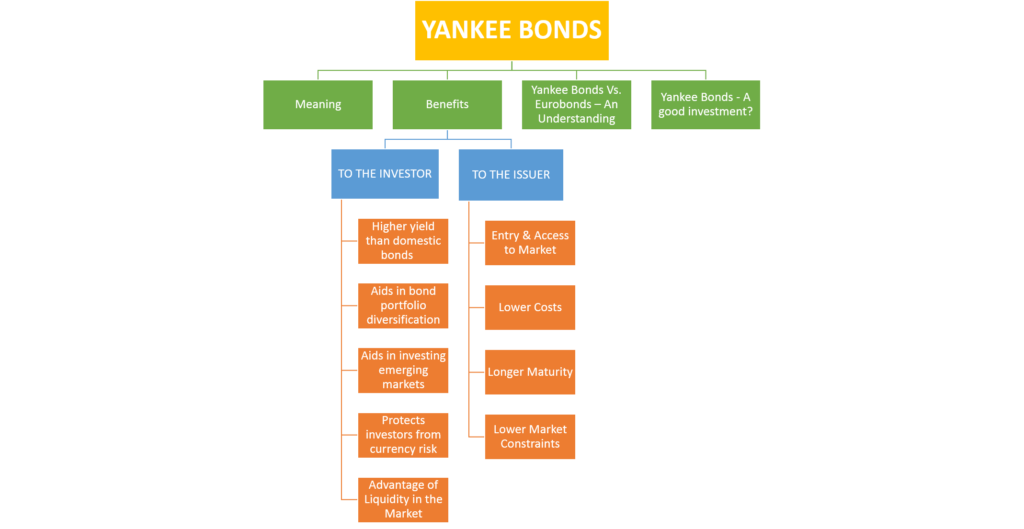

Benefits of Yankee Bonds – TO THE INVESTOR

Higher yield than domestic bonds

Yankee bonds usually provide higher yields than similar rated U.S. bonds. This gives the investor an advantage in earning higher returns on their investments.

Aids in bond portfolio diversification

Yankee bonds also provide an element of asset diversification within bonds portfolio. This is because the performance of these bonds is not dependent on the performance of the U.S. economy. Their price & value won’t always move in the same direction as U.S. bonds. So even when the U.S. economy is bearish or not showing signs of growth, Yankee bonds can generate a decent return on investments.

Aids in investing in emerging markets

Yankee bonds also aid investors in investing in markets outside the U.S. For example – investing in an emerging market Yankee bond will allow the investor to tap into the growth story of that emerging market (developing country).

Also Read: International Bond Market

Protects investors from currency risk

Investing in other countries’ instruments in domestic currency is always advantageous for investors. If an investor invests in foreign currency, he will eventually have to convert the proceeds from that investment into U.S. dollars. The risk fluctuation in currency is inherent in such investments. As Yankee bonds are denominated in U.S. dollars, this risk becomes negligible for investors.

Advantages of Liquidity in the Market

Yankee bonds are actively traded by a large number of investors in the U.S. foreign debt market. This provides liquidity in both primary & secondary markets, thereby creating a major advantage for the investors. A liquid market facilitates the investor to easily buy or sell the bond at a fair price at any time. Entry & exit becomes an easy & transparent process.

Benefits of Yankee Bonds – TO THE ISSUER

Entry & Access to Market

Issuing Yankee bonds gives borrowers access to one of the world’s largest & most sophisticated capital markets. Even though initial registration with SEC is a lengthy & painful process, once registered, the advantages are manifold. Once registered, the foreign entity can access a broad range of U.S. capital markets.

Lower Costs

The Yankee bond market can frequently provide funds at a lower cost than those available elsewhere. Although the initial cost of market entry is higher, the interest rates are comparatively lower when compared to Eurobonds.

Longer Maturity

Issuers can issue Yankee bonds from maturity lasting up to 25 years, while the longest maturity obtainable for Eurobonds is 15 years. Because of longer maturities, issuers can get access to sustainable debt capital, which makes Yankee bonds very attractive.

Lower Market Constraints

Outside the U.S., domestic public bond markets have not been a major source of financing. For example, before 1980, Japanese firms were prohibited from raising debt in domestic public markets. Until very recently, Japanese firms still faced many constraints on public bond issuance. The Yankee bonds market provides non-U.S. firms an avenue for raising public debt that is often unavailable in their own domestic market.

Yankee Bonds Vs. Eurobonds – An Understanding

People often get confused between Yankee bonds & Eurobonds. It is easier to understand Yankee bonds if this confusion is removed. As opposed to Yankee Bonds, which are U.S. foreign market bonds, Eurobonds are a global phenomenon. A novice can confuse Eurobonds as bonds issued in “Euros.” This is actually a misconception that comes from the name. In reality, Eurobonds can be issued in any currency. A Eurobond is a bond issued in any currency other than the currency of the country in which it is issued. For example – A Eurosterling bond is a bond to borrow sterling from outside Germany, or, say, an American MNC can issue a Eurodollar bond in Britain to raise U.S. Dollars.

Yankee Bonds – A good investment?

Even though Yankee bonds, with their higher yields, look very tempting to investors, it is necessary to realize that they come with their own risks. Firstly Yankee bonds are affected by the economy of its home country. So if the home country has a shaky economy, the returns will topple. It is important for investors to select appropriate Yankee bonds issued by entities of many countries ranging from Britain to Mexico to India. Also, it is good to notice that even though Yankee bonds eliminate direct currency risk for the investor, they are still indirectly affected by currency risk. This is because the entity that issued bonds is borrowing in U.S. Dollars but earning in its domestic currency, so if the domestic currency depreciates, it will affect the valuation of Yankee bonds.

Also, read – All the 21 Types of Bonds.