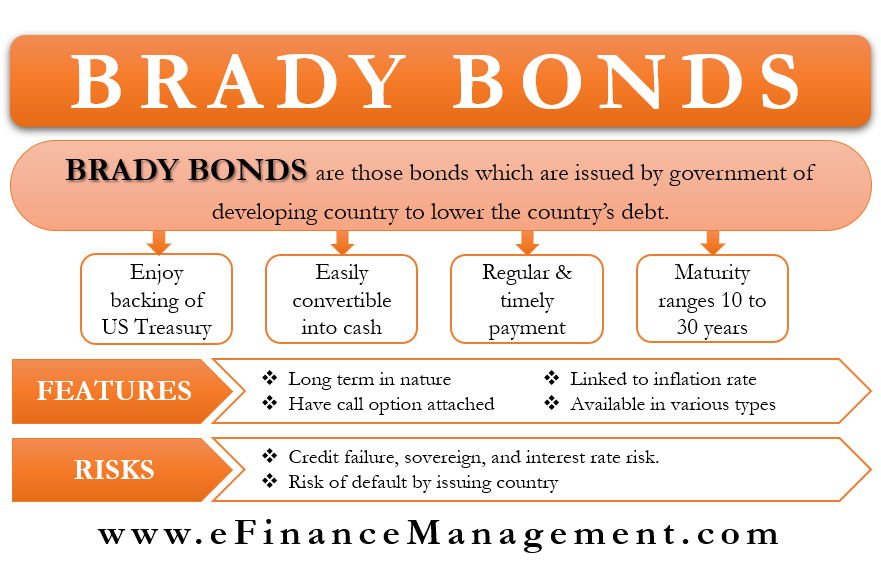

The Government of a country issues Brady Bonds. An emerging or developing country issues such bonds denominated in the U.S. dollar. And the primary purpose of issuing such a bond is to lower a country’s debt.

Even though developing economies issue, these bonds enjoy the backing of the U.S. Treasury. Thus, they are an attractive financial instrument for the investors, promising them a regular and timely payment of the interest and principal. Therefore, it is also loosely called US Treasury bonds.

These bonds are liquid, meaning one can easily and quickly convert them into cash at a fair price. Such a bond helps to restructure debt by converting bank debt into bonds. Each bond is collateralized by the same amount of zero-coupon Treasury bonds. These bonds have a maturity of 10 to 30 years.

History of Brady Bonds

Nicholas Brady is the inspiration for the Brady bonds. In 1989, when Brady was the U.S. Treasury secretary, he came up with a proposal to help reduce the debt of the developing countries. The Latin American countries were the first to use these bonds.

Also Read: Yankee Bonds

The need for such a bond was felt after many Latin American countries started to default on their debt in the 1980s. The first country to use this bond was Mexico. Brazil, Peru, Jordan, Argentina, Venezuela, Vietnam, and Russia, were the early users of these bonds.

Along with the U.S., this program calls for international lending agencies, including IMF and World Bank, to assist commercial banks in restructuring their debt. The program helps countries whose programs and structural adjustments are supported by these agencies.

Talking about if these bonds are a success or not, the results are a mix of both. For example, Mexico was able to retire these bonds in 2003, but Ecuador was unable to pay them back in 1999.

Key Characteristics and Features

A few most important ones are:

- Brady Bonds are quite long-term in nature and have maturities up to 30 years.

- These bonds may have a call option attached to them

- Step-up coupon payments after certain years and linked to the inflation rate could be another feature.

- These can be of various types, like At Par Bonds, Discount Bonds, Debt Conversion Bonds, Front Loaded Interest Reduction Bonds, etc.

Brady Bond – How it Works?

A Brady bond allows the commercial banks to replace their debt with these bonds. This way, developing countries are able to remove their non-performing debt and replace it with new bonds.

Also Read: Plain Vanilla Bonds

Basically, the issuing country buys zero-coupon bonds from the U.S. Treasury. These bonds are of the same maturity as the Brady bonds. Now, these zero-coupon bonds are kept in the Federal Reserve escrow until maturity. At maturity, the issuing country sells these zero-coupon bonds to make the principal payment. In the event of non-payment, the holder of the bond gets the principal at maturity.

We can say that these bonds convert non-performing loans into zero-coupon bonds of the U.S. Treasury. As said above, these bonds are collateralized and could be kept in Federal Reserve escrow till their maturity. The U.S. Treasury zero-coupon bonds serve as collateral.

Risks with Brady Bonds

Even though these bonds are an appealing option for investors, they are not risk-free. Investors in these bonds do face certain investment risks. And these could be credit failure, sovereign, and interest rate risk.

The interest rate risk is unavoidable because of the inverse relation of the bond prices and interest rates. Moreover, such a relation exposes investors to the risk that the current market interest rate would go up, resulting in a drop in the bond’s value.

Sovereign risk in these bonds could be higher if the issuing country suffers from political or economic instability. Also, countries with high inflation, volatile exchange rates, and high unemployment would expose investors to high sovereign risk.

Moreover, investors do face the risk of default by the issuing country. This is because Brady bonds are speculative instruments.

These bonds, however, try to compensate for these risks by offering a higher return to the investors. Also, their long-term maturity makes them appealing as investors can profit from spread tightening. The expectation that the economic condition of the issuing country would improve also encourage investors to go for this bond.

Final Words

Brady bonds are a good way for developing economies to lower their debt and work towards growing their economy. However, investors are exposed to certain risks even though the U.S. Treasury backs these bonds. Also, the price movement of these bonds serves as a good indicator of the market sentiments towards emerging countries.

Also, read – All the 21 Types of Bonds.

Dear Sir /madam

I am please to send you this communication hopping to hear from you soon

I want to have a working relationship with your institution that will enable me to growth my company internationally

I would like to have your contacts person

Thanks, Mr. Hamilton, We are willing to discuss any professional and business relationship mutually beneficial to all of us. Pl share the details and types of relationship you are looking for.

Dear Sir

Compliment of the day hope all is well you and your team,

After coming across your website I have develop great interest

please let me know if my company can have some thing to do will your service

Hamilton

Thanks, Hamilton for such appreciation. Such comments keep us motivated to provide more. Since we do not have the background or any other idea about what kind of service we are talking about, we will not be able to comment. However, we are open to ideas and if any mutually beneficial relationship can be taken forward, we will be willing to discuss, please. Thanks