What is Specialized Factoring?

In the world of business, cash flow is king. The ability to maintain a steady influx of funds is crucial for sustaining operations, expanding growth, and seizing new opportunities. However, many businesses often face challenges in managing their cash flow due to delayed payments from customers or the need for immediate working capital. There are some industries with typical characteristics where general factoring practice is not very suitable. This is where specialized factoring steps in, offering a tailored solution to address the unique needs of specific industries. In this blog post, we will explore the concept of specialized factoring, its key benefits, various types, potential risks, and tips for optimizing cash flow.

How is it Different from Usual Factoring?

While general factoring caters to a broad range of industries, specialized factoring targets specific sectors with unique invoicing requirements and challenges. By focusing on industry-specific needs, specialized factoring providers possess a deep understanding of the intricacies involved, enabling them to offer customized solutions. Specialized factoring addresses critical pain points faced by industry-specific businesses especially businesses such as real estate, construction, healthcare, transportation, government contracts, and international trade.

Types of Specialized Factoring

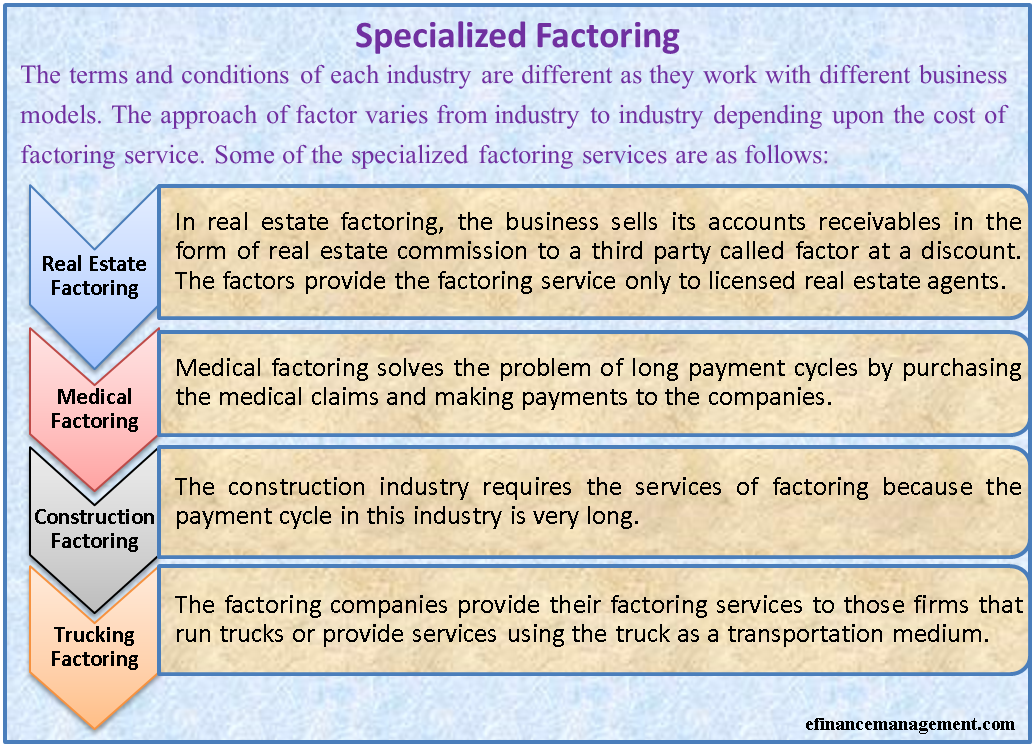

The terms and conditions of each industry are different as they work with different business models. The approach of ‘factor’ varies from industry to industry depending upon the cost of factoring service. Some of the specialized factoring services are as follows:

Real Estate Factoring

In real estate factoring, the business sells its accounts receivables in the form of a real estate commission to a third party called a factor at a discount. The factors provide the factoring service only to licensed real estate agents. Real estate factoring was first introduced in Canada. Later, it made its way to America after the 2007 recession. The real estate factoring model has become global and is followed in almost all countries worldwide.

Also Read: Types of Invoice / Receivable Factoring

Medical Factoring

The healthcare industry has long payment cycles and faces cash flow problems due to the slow payment process. The long time horizon to receive the payment is the biggest challenge that the healthcare industry is facing today. Medical factoring solves this problem by purchasing medical claims and making payments to companies. The factoring agency, in return, charges fees or commissions and holds the claims until maturity.

Construction Factoring

The construction industry requires the services of factoring because the payment cycle in this industry is very long. The average payment cycle is 120 days and sometimes even more. This makes the functioning of the industry difficult. To overcome the problem, the factor purchases the construction receivables from the clients and allows them to function smoothly. This saves the construction industry from the various risks and exposure associated with the business.

Trucking Factoring

The factoring companies provide their factoring services to those firms that run trucks or provide services using the truck as a transportation medium. The trucking factoring services include purchasing their invoices and funding them based on the invoice copies sent by email or text. The factoring services also include providing the truckers with fuel advance cash if they have a confirmed pickup of the load.

Benefits of Specialized Factoring

Specialized factoring takes traditional factoring a step further by catering to specific industries or sectors that have unique financing needs. It offers tailored solutions designed to address the challenges faced by businesses operating in these industries. Let’s explore some of the benefits of specialized factoring:

Also Read: Factoring Companies

1. Improved Cash Flow: By selling their accounts receivable at a discount, businesses can receive immediate cash, improving their cash flow and providing them with the necessary working capital to operate and grow.

2. Risk Mitigation: Specialized factoring companies assume the risks associated with collecting payments from customers, freeing businesses from the burden of chasing down overdue invoices. This allows business owners to focus on their core operations rather than dealing with the complexities of accounts receivable management.

3. Industry Expertise: Specialized factoring companies understand the nuances and specific needs of particular industries. They have experience working with businesses in these sectors and can provide tailored financial solutions that traditional lenders may not offer.

4. Flexible Financing: Unlike traditional bank loans, which often require collateral and have strict eligibility criteria, specialized factoring offers a more flexible financing option. Businesses that may not qualify for traditional financing can still access the funds they need through specialized factoring.

5. Business Growth: By improving cash flow and providing immediate access to working capital, specialized factoring enables businesses to seize growth opportunities. Whether it’s investing in new equipment, hiring additional staff, or expanding operations, specialized factoring can be a catalyst for sustainable growth.

Conclusion

Factoring services have become a critical part of the business as they provide the business with regular cash by purchasing its receivables. It saves the time of dealing with the receivables and helps to focus on their core business areas. With the growing need for factoring, their services have entered into different specialized sectors. This has eased the business’s functioning and helped in meeting its working capital needs.

Read a detailed article on various types of factoring.