Asset Management Ratios: Meaning

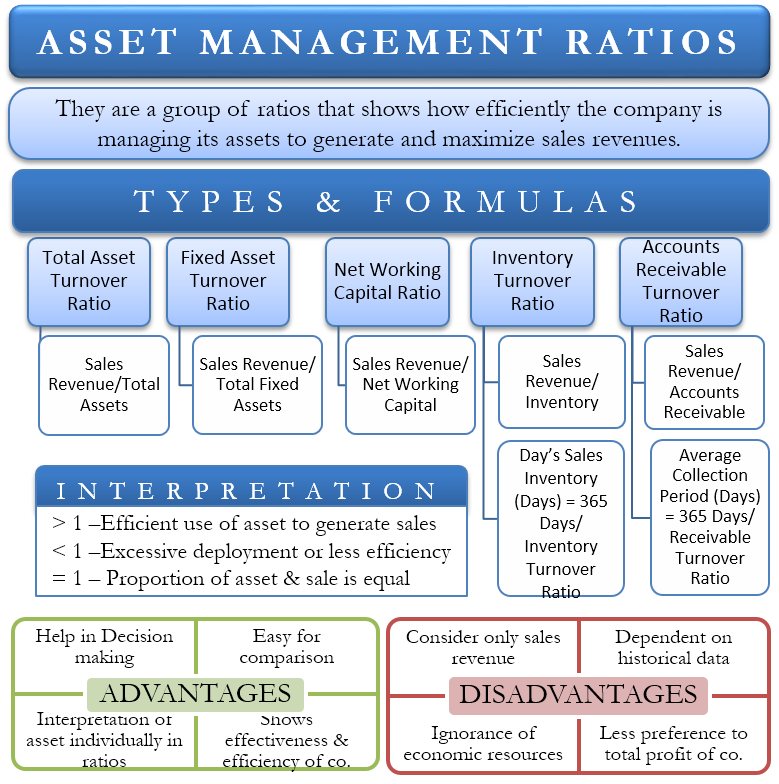

A group of ratios that shows how efficiently the company manages its assets to generate and maximize sales revenues is known as Asset Management Ratios. And these ratios directly compare the assets of the company with the total sales revenue of the company. Moreover, the purpose is to analyze how effectively the company is able to deploy productively its assets to derive its revenue. And these ratios show the operating efficiency of the organization. Financial Analyst uses a bunch of Asset Management Ratios to analyze the operating efficiency of the company. Thus, these ratios give a picture of how effectively and efficiently the management and the company are able to exploit its assets to achieve the ultimate objective of generating maximum sales revenues.

There are many types of Asset Management Ratios. And all of these individually represent and suggest the utilization status of different types of asset classes. Further, these ratios are very useful in Financial Ratio Analysis, conducted by the various stakeholders of the company and the outsiders like investors and lenders. Relying on just the profits of the company would be misleading. Hence, these ratios play an important role in interpreting the exact operating situation of the company.

- Asset Management Ratios: Meaning

- Interpretation of Asset Management Ratios

- Types of Asset Management Ratios

- Advantages of Asset Management Ratios

- Disadvantages of Asset Management Ratios

- Conclusion

Asset Management Ratios help the company to decide on how many assets are required in the company. If there is too much investment in assets, there won’t be full efficiency. On the other hand, if there is very little investment in assets, it would hamper the sales revenue and the profitability of the company. It is of immense importance to have the right amount of investment in assets and use them with almost 100% productivity.

The other name for Asset Management Ratios is Asset Turnover Ratios, or Asset Efficiency Ratios, or Activity Ratios.

Interpretation of Asset Management Ratios

Mostly, the formulas of all the Asset Management Ratios have sales revenue as their numerator and assets as their denominator. Here the asset class would change according to the formula in usage.

Also Read: Importance of Ratio Analysis

There are a few general interpretations of all Asset Management Ratios; they are as follows:-

Asset Management Ratio > 1

A high Asset Management Ratio is always preferable. And that indicates that the company is efficiently using its assets to generate sales. This ratio above 1 claims that the proportion of sales is higher than the total quantum of assets deployed, and the company is productive. The higher the ratio, the better the company is in comparison to its competitors in the same industry.

Asset Management Ratio < 1

An Asset Management Ratio, less than 1 interprets that either there is the excessive deployment of assets in the company or these are not effectively used to generate sales. This ratio of less than 1 says that the proportion of assets in the company is higher than the proportion of sales revenue. And lower the ratio, the worst is the company’s efficiency in comparison to the competitors in the same industry. It may sometimes be due to the ongoing expansion or investments which is yet to be put to use.

Asset Management Ratio = 1

This situation is neither appreciable nor desirable. Asset Management Ratio equals 1 interprets that the proportion of assets and sales is equal in the company.

These interpretations stand true only when applied in the same industry.

Types of Asset Management Ratios

Total Asset Turnover Ratio

This is a basic type of Asset Management Ratio. It considers all assets given in the Balance Sheet and total sales revenue recorded in the Profit and Loss Statement. This ratio helps interpret how productively the firm can convert its assets into sales revenue. Again, the higher the ratio, the better the asset utilization of the firm when compared in the same industry.

Formula

Total Asset Turnover Ratio (In proportion or times) = Sales Revenue/ Total Assets

The above formula helps in interpreting the total efficiency of the firm. If this ratio is not satisfactory, then other ratios like Inventory Turnover Ratio, Fixed Asset Turnover Ratio, Net Working Capital Ratio, etc., are analyzed to identify the actual cause/areas of under-utilization.

Fixed Asset Turnover Ratio

The focus of the Fixed Asset Turnover Ratio is on the Fixed Assets of the firm. This ratio tells how efficiently the fixed assets of the firm are used in generating sales revenue. Mostly, Fixed Assets (like Plant, Machinery, Equipment, etc.) grab the major proportion of Total Assets in the Balance Sheet; this is an important ratio. This ratio is extensively used in Capital Intensive industries where there exists a high quantum of Fixed Assets and turnover remains low as compared to other manufacturing and trading industries.

Formula

Fixed Asset Turnover Ratio (In ratio or times) = Sales Revenue/ Total Fixed Assets

The higher the ratio, the better the company uses its fixed assets. Although it shouldn’t be too high because then it would be over-optimization of fixed assets. Over-usage of fixed assets might lead to higher depreciation and would ultimately be a loss to the company. The best way to interpret this ratio is to compare it with the industry average or direct competitors.

Sometimes the company compares its own Fixed Asset Turnover Ratio for a duration of time like 3 years, 5 years, 10 years, etc. If the ratio is increasing over a period of time, it shows a positive sign, and it shows a negative sign if it is decreasing under normal circumstances.

Net Working Capital Ratio

Net Working Ratio tells how effectively and efficiently Working Capital is used to generate sales revenue.

Formula

Net Working Capital = Sales Revenue/ Net Working Capital

Where,

Net Working Capital = Current Assets- Current Liabilities

A high Net Working Capital Ratio interprets that the firm is productively using its short-term finances to generate sales revenue. A lower ratio interprets that either the inventory is obsolete or lacks net working capital in the organization. Or there is a diversion of the short-term funds and working capital towards medium or long-term uses.

Inventory Turnover Ratio

Inventory Turnover Ratio is slightly different from other Asset Management Ratios. It tells how many times the inventory is sold and stock back again in a year. It is a good indicator of effective inventory management by the firm. This ratio keeps the quantity and quality of inventory in check.

Formula

Inventory Turnover Ratio = Sales Revenue/ Inventory

If this ratio is abnormally high, then there will be a high chance of inventory outage on a regular basis. If this ratio is lower, then it means that either there is an excess amount of inventory or there exists obsolete and/or defective inventory. Thus there is no ideal Inventory Turnover Ratio. And the best way to interpret it is to compare it with an industry average.

Calculating Day’s Sales in Inventory using Inventory Ratio:-

Day’s Sales Inventory tells the management of the company how many days it will take to completely sell the current inventory or the average level of inventory that the firm maintains. Thus this ratio tells, in order to manage inventory effectively, the frequency and level of ordering the inventory.

Day’s Sales Inventory (Days) = 365 Days/ Inventory Turnover Ratio

The other name for Inventory Turnover Ratio is Stock Turnover Ratio.

Accounts Receivable Turnover Ratio

Accounts Receivable Turnover Ratio tells the management of the company how efficiently, in less time, the company is able to collect its cash from the debtors of the company. In other words, how many days of sales of the company will always remain outstanding. Moreover, it is of immense importance that the company should be able to quickly collect cash from its outstanding accounts receivable and save substantial interest costs on these interest-free credit periods.

Formula

Accounts Receivable Turnover Ratio (In proportion or times) = Sales Revenue/ Accounts Receivable

Mostly, the higher the ratio, the company is quickly able to collect its accounts receivable, and thus less quantum of funds are lying in outstanding debtors. If this ratio is lower, the company might face a cash crunch. When the ratio is low, it means the company is not able to quickly collect the cash from debtors and should review and improve its Credit Collection Policy. Maybe the company needs to come out with some incentive to the customers for faster payments.

Calculating Average Collection Period or Days Sales Outstanding, using Accounts Receivable Turnover Ratio:-

Average Collection Period or Days Sales Outstanding tells the company an average number of days it will take to collect cash from accounts receivables of the company.

Average Collection Period/ Days Sales Outstanding (Days) = 365 Days/ Receivable Turnover Ratio

The other name for Accounts Receivable Turnover Ratio is Debtors Turnover Ratio or Receivable Turnover Ratio.

The types of Asset Management Ratios are non-exhaustive in nature.

Advantages of Asset Management Ratios

- Asset Management Ratios help the company and the stakeholders (including investors) in decision-making.

- These ratios help the company in deciding its quantum of investments in assets.

- It tells the operational efficiency and effectiveness of the company. Because relying on just profits may be misleading.

- These ratios help in comparing two or more firms in the same industry. Sometimes profit of one company could be higher than another, but the former would have the worst Asset Management Ratios than later. Thus these ratios make an inter-firm comparison in the same industry easy.

- These ratios not only depict the situation of total asset classes but also interpret various asset classes individually like, Fixed Asset Turnover Ratio, Inventory Turnover Ratio, Accounts Receivable Turnover Ratio, etc.

These advantages are non-exhaustive in nature.

Disadvantages of Asset Management Ratios

The major disadvantages are:

- One of the biggest limitations of Asset Management Ratios is that it only considers sales revenue and ignores the total profits of the company. Sometimes the company might have high sales revenues, but the net profits and gross profits turn out to be low. Thus completely relying on sales revenue can be misleading.

- The second limitation is that these ratios are completely dependent on historical data and financial statements. As a result, the company is highly likely to manipulate it.

- The third limitation is that these ratios ignore whether the firm is labor-intensive or capital-intensive. If the organization is labor-intensive, then ideally, the assets would be comparatively lower than a capital-intensive firm. As a result, comparing these ratios only in the same industry is feasible. But comparing with other industries or in general may lead to the wrong interpretation.

These disadvantages are non-exhaustive in nature.

Conclusion

Asset Management Ratios interpret the company’s efficiency and effectiveness by comparing the quantum of assets and sales revenue. These ratios help the management and stakeholders of the company at every stage of investment and operational decision-making. Despite so many advantages and triggers these ratios can generate, there are also many criticisms of these ratios. These criticisms can be overcome by analyzing these ratios with other financial metrics and by using them for comparing in the same industry.