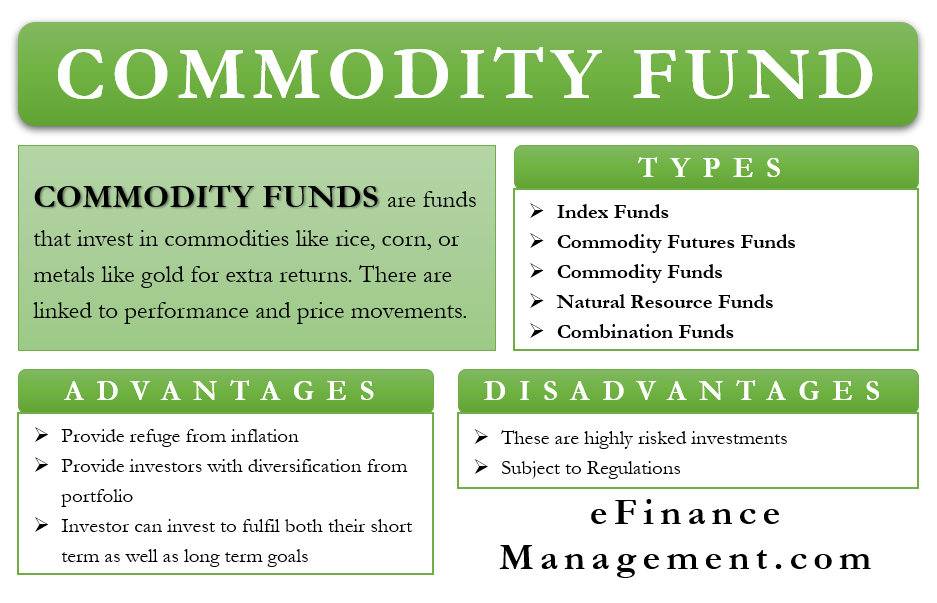

Commodity funds are the exchange-traded funds that invest in commodities like rice, corn, or metals like gold. Investing in commodities is just another way of investing your savings to generate extra returns. Like funds investing in stocks, the returns on commodity funds are also linked to the performance and price movements of these commodities in the market. Commodity Funds can also invest their money into companies that produce these commodities or mining companies in case of funds linked with metals.

How do Commodity Fund Work?

Commodity funds invest in agriculture and non-agriculture commodities. Agricultural commodities generally include food grains such as rice, wheat, maize, soya, etc. Non-agricultural commodities include metals such as gold, silver, copper, nickel, etc. Investment in commodities is subject to the ups and downs in the price or value of the commodities. All price movements or changes in the value of the commodities will affect the return of commodity funds. A change in the price or value of a commodity is due to the forces of demand and supply, besides other factors. Hence, investment in these funds has its own risks and returns.

As is advisable in other investing endeavors, an investor must possess a deep understanding of the commodity market and the future prospects of the commodity’s value before investing his income in such funds.

Types of Commodity Fund

Index Funds

Let’s first learn what an index is. A stock index is a sample of company stocks that represents the performance of the entire stock market. So, a stock index fund invests only in those stocks which make up the index. Now, just like a stock index, there are commodity indexes, for example, the Dow Jones Commodity Index. A commodity index fund, like stock index funds, will invest in commodities that make up that index. The purpose is to match the performance of the index. An investor will invest in such a fund if he believes that the overall prices or values of the commodities will go up in the future.

Commodity Futures Funds

These funds trade on futures contracts. A futures contract is an agreement between a buyer and a seller wherein the buyer agrees to purchase something. The seller agrees to deliver it on a specific future date and at a price ‘already set.’ The fund manager of commodity futures funds invests in such futures contracts.

Investors here do not actually want physical delivery of the commodity. They simply desire to make a profit out of price changes. Experts consider futures commodity funds to be one of the riskiest. These funds, at the same time, can be highly rewarding also.

Commodity Funds

Instead of investing in the equity of companies who trade in commodities, these funds invest directly into commodities by physically purchasing them. A fund purchasing metals in their physical form, say, a bar of gold, will be a true commodity fund. These funds invest majorly in gold, silver, platinum, and other precious metals. People usually invest in commodity funds when they see negative prospects in the stock markets. Hence, during extreme situations like a war between two major economies, or a Covid-19 like a pandemic, investors usually take their money out of the stock markets and invest in commodity funds.

Natural Resource Funds

These funds invest in securities of companies that have access to or deal with natural resources like petroleum, oil, gas. gold, silver, etc. Though these funds invest in equity securities of the companies dealing in natural resources, the performance of these funds primarily depends on the value of commodities that the company deals in.

Also Read: Types of Futures Contracts

As the economies are progressing and the population of countries is increasing, the need to extract and process natural resources is also increasing. This positive future outlook makes investing in natural resource funds promising. Investors also see investing in natural asset funds as a refuge from inflation. With all these promises, natural resource funds also carry high risk because unfavorable political and regulatory developments are common in this sector. Any such development has a significant impact on their profit potential.

Combination Funds

Combination funds invest both in actual commodities and commodities futures. A combination fund, for example, may invest both in physical gold and gold futures.

Advantages of Investing in Commodity Fund

Refuge from Inflation

Commodity funds provide refuge from inflation. Obviously, if the market is witnessing inflation pressures, commodity prices will rise as a result of inflation. Hence, an investor in commodity funds will make capital gains from inflation.

Strategic Diversification

Investment in commodities provides investors with strategic diversification from their portfolios. This means that investors may diversify their portfolios by investing in the different short-term and long-term equities. Still, if the stock market as a whole falls down, all their diversification will be meaningless. On the other hand, commodity funds show a negative correlation with the stock market. This means that when the prices of equities go down, commodities funds often make large capital gains.

Flexibility of Investment Goals

Unlike the equity market, where investors typically invest in fulfilling their long-term goals, investors in a commodity fund can invest in fulfilling both their short-term and long-term goals.

Disadvantages of Investing in Commodity Fund

Commodity Fund is Highly Risky

Commodity funds are highly risky in nature. Their prices are highly volatile, and if they don’t go in your favor, they can erode a chunk of your wealth in a short time. One real-world example of this was Crude Oil, when its prices went down in the year 2015 from around $100 per barrel to $35 per barrel in a relatively short span of time.

Subject to Regulations

Another disadvantage of a commodity fund is that while regulatory authorities do not interfere in the prices of stocks, indirectly, their decisions can have a huge impact on the case of commodities.