Preferred Stock Vs Bond: All You Need to Know

Preferred Stock and Bond are sources of finance for the companies. Although they both mostly give fixed returns to the investor, there are few differences between them, and so comes the question of Preferred Stock Vs Bond. When companies need money, instead of borrowing through loans or issuing equity stock, they prefer these mostly fixed remuneration giving instruments. In comparison to borrowed loans, issuing preference stock and Bond is a cheaper option.

Understanding: Preferred Stock Vs Bond

Companies give mostly fixed dividends on Preference Shares and fixed interest rates on Bonds. According to the experts, Bonds and Preferences Shares have an opposite relationship with the interest rates. Also, Preference Stockholders and Bondholders do not have any voting right in the corporate. Bondholders and Preference Shareholders both have rights on the assets of the company at the time of liquidation, even before the equity shareholders. In other words, equity shareholders are the voting owners of the company, Preference shareholders are non-voting or partially voting owners of the company, and bondholders are debt holders of the company.

Mostly Preference Shares and Bonds come up with a callable or put option. The preference shareholders and bondholders, as well as the company, can call back their investment anytime they want. Since both these instruments get fixed returns, there is no chance of any appreciation in value despite the development and growth of the company.

Understanding Preferred Stock

Preferred Stock and Equity Stock are types of stocks issued by the company. They both have an ownership stake in the company with differences in dividends payouts, voting rights, and seniority at the time of liquidation. Preferred Stockholders mostly get a predetermined rate of dividend regardless of profit or loss. The seniority in payments of dividends/interest rates and rights over the assets are available to the preference stockholders after the debt holders and before the equity shareholders.

Also Read: Preference Shares and its Features

Sometimes the dividends on the Preference Stocks get carried forward to the next year. If it is a cumulative Preference share, then the nonpayment of dividends for the current financial year will get carried forward to the next financial year. If it is a non-cumulative option, such privilege is not available.

Understanding Bond

Bonds are a debt instrument issued by companies to raise funds. Sometimes these bonds have a backing of collateral and sometimes do not. The creditworthiness of the issuing company plays an important role while investing in these bonds by the investor. The Bond issuing company pays a pre-decided interest rate to the bondholder. The risk is in direct correlation with the interest rate. The interest rate of bonds varies with the risk attached to the Bond. Hence, the interest rates will be higher if the risk level of the bond is high and vice versa.

The central and/or state governments also issue Bonds. But corporate bonds are riskier than government bonds.

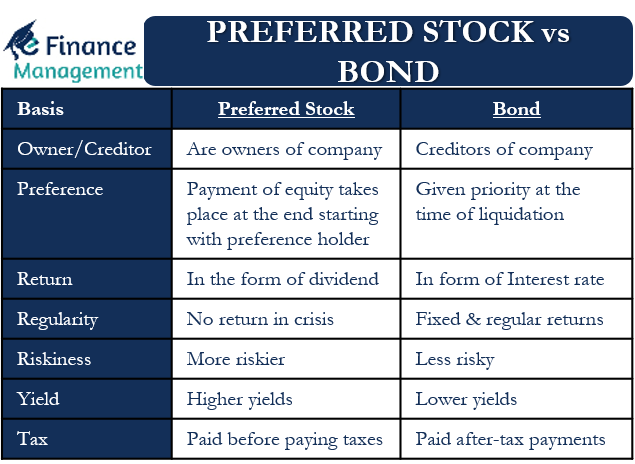

Preferred Stock Vs Bond: Major Differences

Following are a few differences between Preferred Stock and Bond:-

Owner Or Debt Holder

The capital structure of a company is of two components, i.e., Debt and Equity. As we discussed above, preferred stocks are a type of equity instrument, and Bonds are a type of debt instrument. It means the preferred stockholders are the owners of the company together with the equity stockholders. At the same time, Debt holders are creditors of the company and not owners of the company. The money raised through Preference shareholders is an Equity Capital of the company and through Corporate Bonds is a Debt or Loan or Borrowing of the company.

Preference at the Time of Liquidation

At the time of liquidation or bankruptcy, the Bondholders get the priority or preference even before the Preference Shareholders. First of all, payment of all dues of creditors and debt holders (including bondholders) takes place. And later, payment of Equities takes place, starting with Preference stockholders. In other words, bondholders get a preference for the payment, even before the preferred stockholders.

Also Read: Types of Preference Shares

Dividend or Interest Rate

The returns on Preference Stocks come up in the form of dividends, and Bonds’ returns are in the form of Interest rates. This is because the Preference Stocks are part of equities, and Bonds are part of the debt in the company’s capital structure.

Regular or Irregular Returns

Mostly the returns on Preference stocks and Bonds are fixed and regular in nature. Although the company is in financial trouble, the company can wipe out dividends on preference stocks for a particular financial year. If the preferred stocks are non-cumulative, then the dividends will not be carried forward to the next financial year. The preference dividends get to carry forward only and if only the preferred stocks are cumulative. But still, non-payments on dividends on Preference stocks are rare.

Bonds, on the other hand, receive Interest rates every year, no matter what.

Preferred Stock Vs Bond: Riskiness

At the time of liquidation, the payment of debt instruments like bonds takes place before the equity instruments like preferred stocks. In other words, bondholders have the first right to assets of the company even before the preference stockholders. This makes the preference shares riskier in comparison to the corporate bonds.

Preferred Stock Vs Bond: Yield

As a rule, goes, the high return comes up with high risk, the same applies here. Preference stocks give higher yields as compared to Bonds. This is because; Preferred Stocks are riskier than bonds.

Price Volatility

Mostly the trading of Bonds and Preference Stocks takes place in an open market. The price fluctuation in the open market decides the stability of the instrument. In comparison to Preference stocks, the prices are more stable in nature for bonds. The price fluctuation is lesser for bonds in comparison to preference stocks.

Quantum of Investments

The issuing company mostly issues the Preference Stock and the Bond at a par value. But, always, the par value of a bond is higher than the par value of preferred stock. And so, the quantum of investment is higher for bonds in comparison to preferred stocks.

Legal Obligation

Interest payments on bonds are a legal obligation for the company. The company has to pay a fixed amount on a timely basis no matter what. On the other hand, dividends on Preference shares are not legal obligations, but the company manages to pay these dividends in every possible solution. The preference shareholder cannot take the issuing company to the court on non-payment of dividends for a particular year.

Before or After Tax

Interest Payments on Bonds are paid before paying the taxes, and dividends on Preference shareholders are paid after-tax payments. This difference is because of the basic character of the instrument. Interests on Bonds are debt payments and are to be paid before calculating the net profit or loss. In contrast to this, dividend payments on preference shares are equity payments and so are to be paid out of the net profits.

In simple words, the issuing company has to pay taxes on the preferred dividends and not on the interest rate of bonds.

Growth Potential

Preferred Stock and Bonds are mostly fixed return-giving instruments. These instruments mostly do not get any benefit out of the growth of the company. Only convertible preference shares have little chance of benefiting from the company’s growth.

The above mentioned were few non-exhaustive differences between the Preferred Stock and Bond.

Preferred Stock Vs Bond: Conclusion

The capital structure of a company is mostly of equity and debt instruments, with Preference Stocks and Bonds very popular among them. Companies, according to their requirements, raise funds either through preference stocks or Bonds. Mostly the companies which are not in a position to raise additional debts issue preference stocks. The investors select Preferred stock or Bond according to their investment objective. We cannot directly say which instrument is better; it completely depends on the investor’s goals and the issuing company’s capital structure and needs. Like individuals with high-risk appetites should select Preference Stocks, and individuals with a low-risk appetite should select Bonds. According to their legal obligation, the quantum of investment, and capital structure, the issuing company should decide on the issuance.

Best information about preferred stock vs Bond

Great..!!