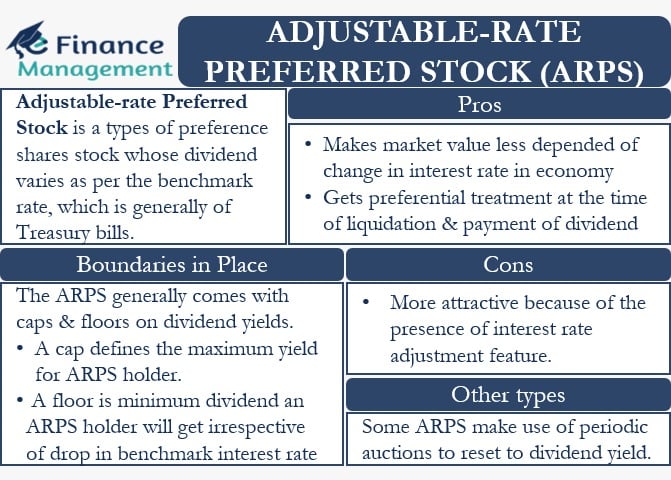

Adjustable-Rate Preferred Stock (ARPS) is one of the various types of preference shares. The dividend from this preference stock varies as per the benchmark rate. This benchmark rate is generally for Treasury bills. Usually, the issuer fixes the calculation method and the benchmark rate at the time of issuing such preference shares. Also, the dividend from such shares comes with a rate cap (and floor). Such a cap ensures that the issuer does not have to pay a very high dividend.

Pros and Cons of Adjustable Rate Preferred Stock

A point to note is that the market value of such preference shares is relatively more stable than basic preference shares. This is because the built-in rate adjustments make the market value less dependent on the changes in the interest rates in the economy. And its impact on the effective yield, thereby containing any major volatility in the preferred stock prices.

Preference shareholders get preferential treatment at the time of liquidation and towards the payment of dividends. But the dividend rate remains fixed irrespective of the changes in the interest rate in the market for basic Preferred Stocks. However, Adjustable Rate Preferred Stock remains even more attractive because of the presence of interest rate adjustment features. The presence of this feature allows the issuer to match the dividend to the existing interest rates. Such adjustments can be made every quarter.

Along with consistent dividends, investors in ARPS also get consistency in dividend payments. This ensures fixed and stable returns, along with capital protection. Apart from these benefits, the ARPS enjoys all the advantages of normal preference shares.

There is, however, a drawback of investing in ARPS as well. And this is a drawback: when the benchmark interest rate drops, the dividend to ARPS holders also goes down. Moreover, the price of these preference shares does not change much with the drop in interest rates. This is unlike the fixed-rate preferred stocks, whose prices go up with the drop in the interest rates.

Boundaries in Place

The Adjustable Rate Preferred Stock generally comes with caps and floors on the dividend yields. These limitations are collectively called collars.

A floor is basically the minimum amount of dividend that an Adjustable Rate Preferred Stockholder will get irrespective of the drop in the benchmark interest rates. This floor will hold even if the interest rate drops below the floor level.

A cap, on the other hand, defines the maximum yield for an ARPS holder. As can be expected, investors do not like caps as it limits their total dividend.

Other Types of Adjustable Rate Preferred Stock

Some ARPS make use of periodic auctions to reset the dividend yield. In this, the current and potential shareholders take part in the auction to ensure the dividend yield from such instruments is in line with the expectations of the investors.

Usually, these preference shares use Dutch auctions to reset the dividend yield. One advantage of auction-rate preferred stock is that the security price does not go below the par value. These securities, however, have lost relevance since the 2008 financial crisis.

Remarketed Preferred Stock is another type of ARPS. In this, a remarketing agent adjusts the dividend rate on these securities periodically to maintain the par value. The remarketing agent gets to choose the length of the reset period. Such type of ARPS ensures that the shareholders are able to auction their shares at the liquidation price. This helps to reduce or eliminate capital losses.

Frequently Asked Questions (FAQs)

The ARPS generally comes with boundaries: caps and floors on the dividend yields. Floor ensures the minimum amount of dividend that an ARPS holder will get irrespective of the drop in the benchmark interest rates even below the floor level.

A major drawback of investing in ARPS is when the benchmark interest rate drops, the dividend to ARPS holders also goes down.

Stability in the market value of ARPS is because the built-in rate adjustments make it less dependent on the changes in the interest rates in the economy.