A Futures Contract is an agreement between investors wherein both parties agree to buy and sell a specific security at a specific price and a specific date in the future. The security could either be a commodity, currency or stock, or any other. In this article, we will talk about futures contract specifications.

Futures Contract is standardized agreements in terms of expiry and size, and they freely trade on popular stock exchanges. The stock exchange takes the execution guarantee for all these contracts. A buyer and seller may not know the identity of each other.

In a futures contract, a buyer is under the obligation to buy the underlying asset. At the same time, the seller has an obligation to sell the underlying asset at the expiry, without regard to the spot price.

For example, A and B enter into a futures contract, where A agrees to buy one million barrels of oil from B at $69 per barrel after six months. Now, after six months, A would have to buy, and B would have to sell one million barrels of oil at $69, irrespective of the spot price prevailing at the time.

Also Read: Types of Futures Contracts

Since such contracts represent an obligation, therefore, hedgers or those looking to reduce their risk go for such contracts. These contracts are also popular among retail traders as well, but they do not have any interest in buying and selling the underlying asset. For a financial investor, taking delivery of 1,000 barrels of oil is not at all useful.

So, such investors primarily aim to gain from the price movement of the underlying asset. They can do so if they close the futures contracts before the expiry. This way, they do not have an obligation to literally buy or sell the asset when the contract matures at the expiry.

Futures Contract Specifications

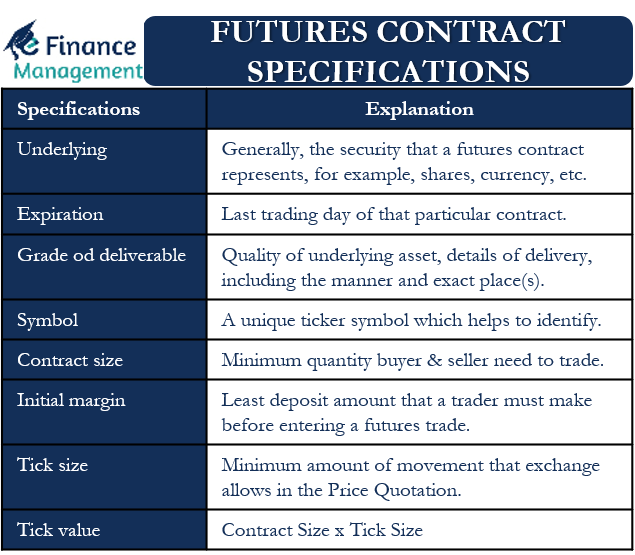

The specifications of futures contracts are primarily the terms that a usual contract includes or the requirements of a futures contract. Knowing futures contract specifications is very important for all investors who plan to invest in such contracts. Following are the specifications of the futures contract:

Underlying Security

As we know, all futures contracts are derivative contracts. Hence, all such contracts are based on and relate to an underlying security or instrument. The pricing, price movement, and settlement, etc., all are linked to security or instrument. Thus, the futures contract is a representation of that security and its expected price movements over the period of the contract. For instance, an underlying could be shares, currency, commodities, interest rate, or more.

Expiration

We can also call it maturity or expiry date. Obviously, this date is the last date of the validity of the contract. And in market terminology, it is the expiration date or expiry day of that particular contract. After the expiry, the two parties need to execute the contract as per the terms of the contract specifications document and thus fulfill their respective obligations under the contract.

Grade of Deliverable

This details the quality of the underlying asset. Also, the grade lays down the details of the delivery, including the manner and exact place(s).

Symbol

Every futures contract has a unique ticker symbol, which helps identify it.

Contract Size

The contract size is basically the minimum amount of quantity that a buyer and seller need to trade. We also call this a lot size. For instance, an exchange may define that one oil contract will cover 1,000 barrels of oil or 5,000 bushels of corn. This implies that to trade 5,000 barrels of oil, a trader will have to trade 5 contracts.

Initial Margin

This is the minimum amount of deposit that a trader must make before entering a futures trade. Since futures contracts involve a large sum of money, the exchange requires parties to submit an initial margin to eliminate or reduce the default risk. We can call it a safety margin. An investor can deposit the margin money in different ways as per the conditions of the exchange. The margin money varies by security and time. Volatility also determines the margin money. The margin money percentage will be more in the case of security having comparatively more volatility and vice versa. Hence, in the case of volatile security, the investors have to deposit more of margin money. (Also read – variation margin and maintenance margin).

Price Quotation

It represents the units in which the trading price of a contract is displayed. A point to note is that a price quotation of a security may be different from its trading size. For instance, one oil contract could be of 1,000 barrels of, but in a local exchange, its price may be in liters or any other measuring unit.

Tick Size

It refers to the minimum amount of movement that exchange allows in the Price Quotation. For instance, an exchange may have a tick size of $0.10 for a futures oil contract.

Tick Value

It means the least amount of gain or loss that an investor can make by executing one contract. As is evident, this metric depends upon the tick size, as well as the size of the contract. Though we can usually find it in the futures contract specifications, if not, we can easily calculate it as well. Following is the formula to calculate it:

Tick Value = Contract Size x Tick Size

Delivery Month

All futures contracts are recognizable by their delivery months—for instance, a May Oil contract or a March Corn contract.

Delivery Date

It is the dates set by the exchange. The seller needs to make the delivery during or by this date, following the futures contract specifications and regulations. Generally, such a date is a few days after the expiry date of a contract, especially if the contract involves commodities. A delivery date could be anywhere from one month to years in the future.

Final Words

It is very important for every investor in the futures contract to know and understand all the above futures contract specifications. Only if they know these specifications will they be able to understand the trade and make better decisions. The profitable disposition of the contract depends upon the clarity and knowledge about all these specifications of the contract.

Continue reading – Cornering the Market.