What is a Callable Preferred Stock?

Callable preferred stock is a type of preference share that gives the issuer or the company the right to call or purchase the share. This recall can be done after a specific future date and at a specific price. And the date and price are usually decided at the time of the issue. These terms may also be put in the prospectus of the company. The investors generally have an assurance of a premium price at the time of the call. This is known as the “call premium.” Any change in this redemption rate cannot be done at a later date by the company.

Callable preferred stock is also known as “redeemable preferred stock.” Large companies generally use it as a means of financing. They have the uniqueness of being a part of equity capital but have the features of debt security. This is so because they can be called or bought back by the company at its will, just like debt security.

What are the advantages of a Callable Preferred Stock?

Advantages to the Issuer

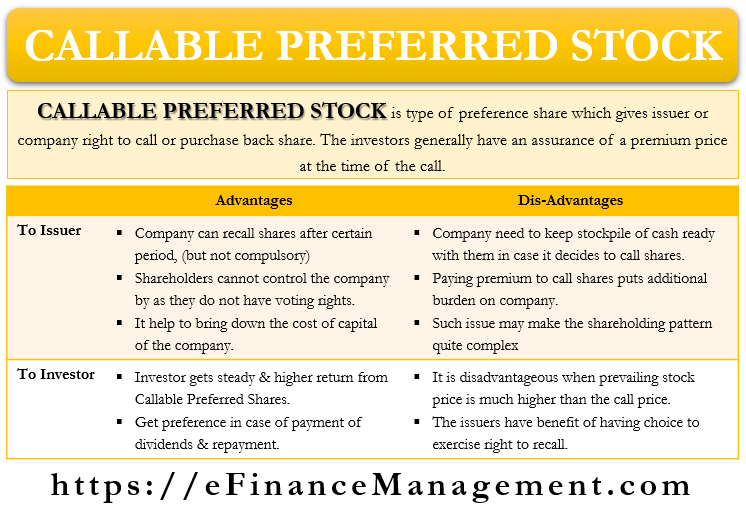

An issuer of a Callable Preferred Stock has multiple advantages. The Company can recall shares after a certain period of time, and thus the management can always stay in control of the ownership of the company. It will not have a fear of losing the ownership rights to the company permanently. These shares do not come with the right to vote. Hence, such shareholders cannot control a company by exercising their voting rights.

These shares can also help to bring down the cost of capital of the company in some cases. Many times, companies issue these shares to meet their fund requirements. They do not opt for raising funds by means of bank loans or by the issue of debentures. These methods of raising funds are mostly more expensive and come at a higher interest rate. Thus, they end up saving a lot of money on interest.

Also, a company has the right to recall such preference shares, but there is no such compulsion for the same. In case the interest rates go up in the economy, the company can continue to pay dividends on such shares at a rate lower than the prevailing interest rate. It shall not exercise its right to recall. Hence, its cost of capital will go down.

Advantages to an Investor

An investor usually gets a steady and higher return from Callable Preferred Shares than other equity shares. They get a preference in the case of payment of dividends and repayment. The issuing company pays a call premium to an investor at the time of the call. This is a form of compensation for the investors for the reinvestment risk they may face. This is so because the investor will have to reinvest the money from the recall in other investment avenues with a lower interest rate or with lower dividends.

Investors face little or no risk in the case of a fall in the equity stock markets. They have an assurance of the buyback price of their shares as the buyback price is already fixed at the time of the issue.

What are the Disadvantages of a Callable Preferred Stock?

Disadvantages to the Company or Issuer

The issuer or the company has to keep a stockpile of cash ready with them in case it decides to call such preference shares. Also, they have to pay a premium price on recall which can be an additional burden on the resources of the company.

Also, the issue of such shares may make the shareholding pattern quite complex and may increase the costs of compliance.

Disadvantages to the Investors

Such shareholders can be at a disadvantage, especially when the prevailing stock price is much higher than the call price. The company will exercise its right to call back the share, and the holders of the shares will have to abide by it. More often, there is an automatic capping on the price of the shares. As soon as the market price of the shares goes up considerably above the call price, the company will immediately call back the shares. Thus, the upside potential for share prices becomes limited.

In the opposite case, if the market price of the share falls considerably below the call price, the issuer may not exercise its option to call only. The issuers have the benefit of having a choice to exercise the right to recall. This proves to be a disadvantage for the shareholders.

What is a Non-callable Preferred Stock?

Non-callable Preferred Stock is a category of preference shares that do not have the option of being called. Other than this, they have all the rights of preference shares- preference in dividend payments, preference in repayment in case of liquidation of the company, and no right to vote.

Such shares generally come with a no-conversion clause. Their conversion into common shares of the company is not possible in such cases.

What is an Example of Callable Preferred Stock?

Let us take the example of a company ABC Pvt. Ltd., that issues Callable Preferred Stock in 2005. The issuer pays dividends @8%p.a. The company has the right to recall the shares at a premium of 5% of the par value after 10 years of the issue.

After 10 years, the company will get the right to recall the issue. The company can pay a “call premium” of 5% and buy back these shares. This will be a good option in case the prevailing market price of the share is higher than this rate.

Also, it has the option of not exercising its call option. This can happen in case the prevailing market rate of interest is more than 8% p.a. In such a situation, the company can continue to pay dividends @ 8% p.a. and save on its interest costs. Thus, these shares will result in a low cost of capital for the company.