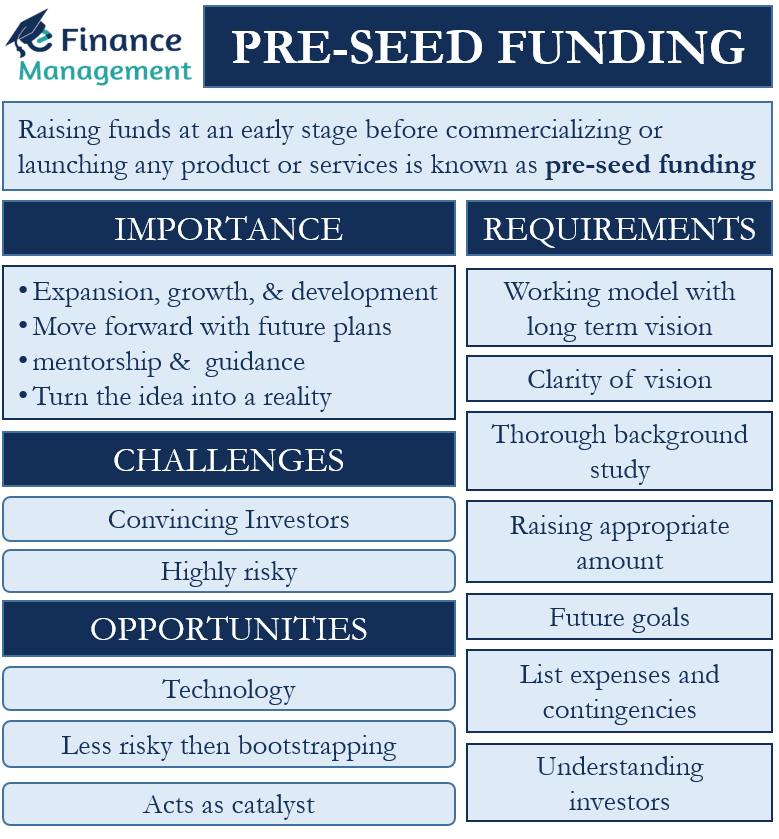

What is Pre-seed Funding?

Pre-seed funding is getting popular nowadays. It is done at a very early stage even before commercializing or launching any product or service. The pre-seed fund is raised for improving the idea, testing market potential and demand. Usually, bootstrapping is a common way to fund a novice business or take loans from friends and family. Incubators and accelerators provide mentorship to the early-stage start-up if they believe in the idea and potential of the business.

Importance for Pre-seed Funding

Every business is fueled by capital. Expansion, growth, and development need money and the right people to set the tone of the business. When a start-up needs funds to move forward with future plans, they are also in need of people who will provide mentorship and guidance to the business. The main demarcation of stages of funding rounds is based on the stage the business is in. In simple words, a firm that requires the fund to kick-start the business and to turn the idea into a real business acquires pre-seed funding. The investors can be family, friends, and even angel or venture capital investors.

A pre-seed funding round is crucial for entrepreneurs as it can either make or break the business. Pre-seed funding’s capital demand is usually lower than the other subsequent rounds. Although, it’s crucial for the firm to have a solid foundation.

Requirements to Secure Pre-Seed Funding

There can be the following requirements for start-ups to secure pre-seed funding:

Working Model with Long term Vision

As the business is currently at a nascent stage and is yet to be developed, the firm will need a solid prototype to attract investors. A working model or prototype is necessary to substantiate the potential of the idea. Along with the prototype they also need to develop a longer-term vision that will prove its potential and scalability. It also depends on how the firm is creating pitches to prove its worth.

Clarity of Vision

When the owner is clear in terms of goals, aspirations, and financial needs, it creates an impression of awareness. Investors want everything crisp clear, and direct. Being able to provide them with clear goals and forecast is a must to gain their confidence.

Thorough Background Study

Researching and digging deeper helps in understanding the situation better. In pre-seed funding, it’s important to dive in deep and analyze factors to decide the amount of funding and forecast the future potential. Research for the top investors making investments, study their background and pitch the right investor. Someone who connects with your business. Let’s say, I have developed a business idea of affordable, environment-friendly packaging. I will lookout for an investor who will connect with the cause. An investor’s mentorship will provide an additional value.

Raising Appropriate Amount

It depends on the firm to raise funds that are appropriate for its current stage. If a firm raises more than what is actually needed, it will become reckless in its expenses. Here, a limited capital will ensure the efficiency and growth of the firm and the extra amount raised will lead the investors to increase the valuation of start-ups. But, if the firm didn’t perform well and needs to raise money again it will have a negative impact on the valuation.

Raising a lesser amount than required will pose challenges in the day-to-day operations of the firm as well as will undermine its potential and scalability. So, in a nutshell, a firm has to work on its demand and crunch numbers which will help them determine the amount of funds required. But this isn’t only about the numbers, but also about the qualitative decisions.

Future Goals

It’s important to decide what is the main purpose, or goal to acquire the funding. It differs from one firm to another, as the models followed by each business are different. A firm would want to raise money to hire employees, start production, buy machinery, etc.

List Expenses and Contingencies

Keeping goals in mind, the firm will plan out all the costs and expenses that will be incurred. Here, if a firm has to raise the amount which is enough till the next funding round.

Understanding Investors

As the firm is acquiring money in the pre-seed stage, it’s crucial to understand the investors well because they are on board for a long time. It’s always preferred that owners approach friends and family or use their own resources to fund the initial stages of business. This is also known as bootstrapping. This saves the owner from extra pressure, gives the liberty to function on its own. Although understanding the investors and their wants, their idea of running a business will also play a role in developing a base for decision.

Challenges in Pre-seed Funding

One of the main reasons why it’s difficult for a firm to raise funds through pre-seed funding is convincing investors to invest in their business. As the business is in its ideation form, it’s important for the owner to paint the potential of the firm in the right manner. As the business has no numbers or financial figures to support the potential of the idea, the game is completely based on one’s conviction. And, it is the owner’s job to make the conviction right.

Opportunities for Pre-see Funding

Technology is transforming the world and giving new opportunities to entrepreneurs in coming up with new ideas and products. Currently, entrepreneurs from a humble background who can’t really raise much from their friends and families will rely more on the pre-seed rounds. Currently, the seed funding stage is competitive and pre-seed funding is still not as famous as it should be. But, with the pandemic taking a toll on everyone’s income and savings, bootstrapping can prove to be a risky affair. So the number of people approaching pre-seed funding has increased. Currently, institutionalizing the pre-seed stage is also acting as a catalyst for further developments. Hustle fund, Seven Seven Six, unshackled ventures, and many more are conducting pre-seed rounds.