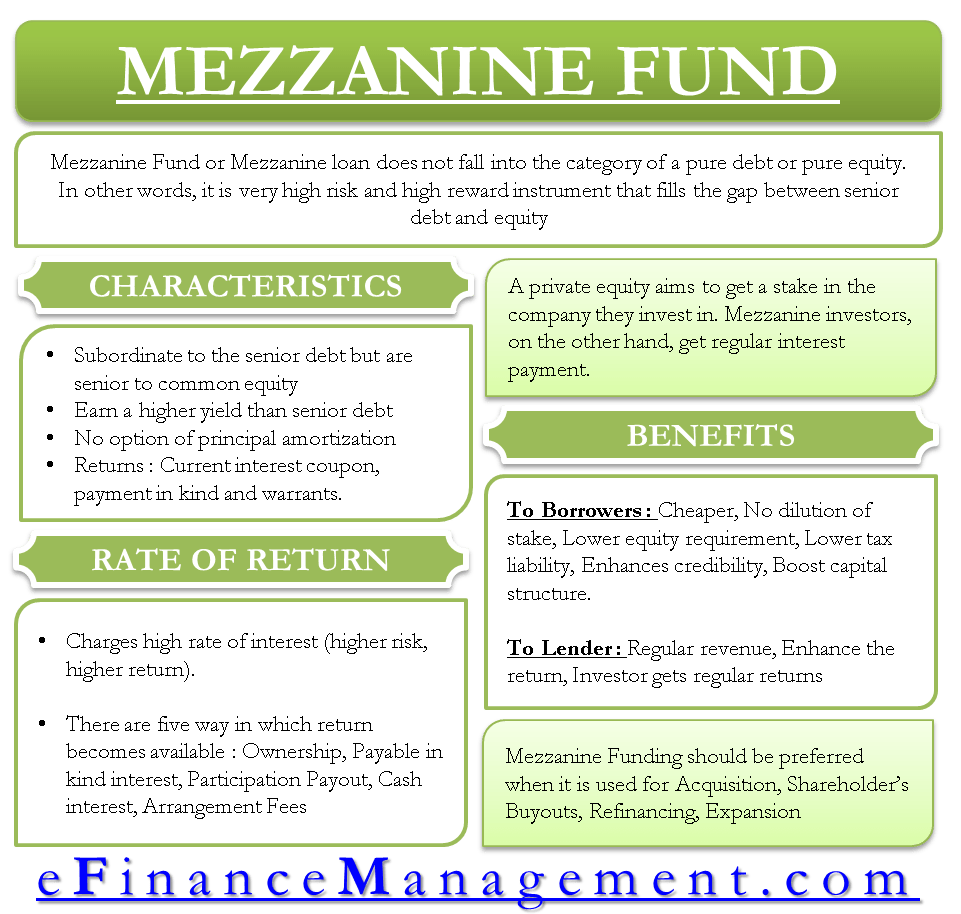

Mezzanine Fund or Mezzanine loan does not fall into the category of pure debt or pure equity. In other words, it is a very high-risk and high-reward instrument that fills the gap between senior debt and equity. A company uses such type of funding to raise money for specific purposes rather than the traditional use cases.

Mezzanine finance is fundamentally the bridge between equity and debt. While its structure and form are more inclined towards debt, it replicates equity in terms of performance and growth. Mezzanine finance sits between own funds and senior debt on the balance sheet.

Just like any other fund, a mezzanine fund pools the capital of the investors and use it for various purposes such as acquisitions, recapitalization, or management/leverages buyouts. Companies usually treat this fund as equity on their balance sheet.

Characteristics

For a better understanding of the concept, let us look at the characteristics of a mezzanine fund:

- These are subordinate to senior debt but are senior to common equity when it comes to the priority of payments.

- Mezzanine loans earn a higher yield than senior debt but are usually not secured.

- No option for principal amortization.

- Return is in the form of a current interest coupon, payment in kind, and warrants.

How They Are Different from Private Equity and Direct Loans

One must not confuse the mezzanine fund with private equity. Private equity aims to get a stake in the company they invest in. Mezzanine investors, on the other hand, get regular interest payments. However, such a loan may come with an option to convert into equity at a later date.

Mezzanine funds are different from direct lenders in the way that the latter invest in first-lien and senior-secured loans. On the other hand, mezzanine investors play a junior role.

Example

A food company is looking to acquire another restaurant in the town. Assume that the restaurant has an operating income of $200,000 per year, and owners have agreed to sell it for $1 million. Now, the food company is in negotiation with a senior lender, who can invest up to 60%.

Pre-mezzanine Effect

Let’s assume that the senior lender has put $600,000 at the rate of 8% per year. Now, the food company will have to take care of the remaining $400,000 and the tax rate is 35%.

| Particulars | ($) |

|---|---|

| Operating Profit (EBIT) | 200,000 |

| Less: Interest on Senior Debt @ 8% | 48,000 |

| Earnings before Tax (EBT) | 152,000 |

| Tax @ 35% | 53,200 |

| Earnings after Tax (EAT) | 98,800 |

| Earnings on Equity | 24.70% |

The return on the investment for the senior lender would be $48000 (8% interest). Now, the remaining operating profit after subtracting the interest amount from the senior debt is $152,000. After applying a tax rate of 35%, the profit after tax would be around $98,800. The return on equity at a profit of $98,800 is 24.7% per year.

Post-mezzanine Effect

Now, if the mezzanine fund investor comes in and agrees to invest $2,00,000 at 15%, this would convert into $48,000 to the senior investor and $30,000 to the mezzanine investor. Post-tax profit now comes down to $79,300. Although the overall return fell, the food company will have more ROI, and that too by investing half the amount it was investing earlier.

| Particulars | ($) |

|---|---|

| Operating Profit (EBIT) | 200,000 |

| Less: Interest on Senior Debt @ 8% | 48,000 |

| Less: Interest on Mezzanine Funds @ 15% | 30,000 |

| Earnings before Tax (EBT) | 122,000 |

| Tax @ 35% | 42,700 |

| Earnings after Tax (EAT) | 79,300 |

| Earnings on Equity | 39.65% |

Advantages of Mezzanine Finance

The advantages of mezzanine financing are divided into two broad criterias:

Benefits to the Borrower

- Cheaper than equity.

- No dilution of stake. Since the lender is charging hefty amounts of interest, he settles for little to no share in equity.

- This enables the management to function independently without any interference in strategic decision-making.

- Are comparatively easier to borrow than conventional loans.

- It also lowers the equity requirement.

- Lower tax liability as interest on the mezzanine fund is tax-deductible.

- The mezzanine investors are often Venture Capitalists or Equity investors who share the entrepreneurial spirit of the borrower and are thus willing to take on some risk.

- Boost the capital structure of the company.

Benefits to Lender

- Turns into a regular revenue stream for the lender.

- An option to convert debt into equity could enhance the return if the company performs well.

- Mezzanine investors take a risk that is at par with equity investors. However, unlike equity investors, who have no guarantee for dividends, mezzanine investors get regular interest payments.

- Mezzanine Finance is often structured to incorporate “kicks” for the lenders. Such kicks are nothing but warrants or convertible equity options the lenders can exercise and acquire a stake in the company.

When to Use Mezzanine Financing?

One goes for mezzanine funds only in certain situations, such as when the private equity sponsor is willing only to invest 70% of the total required. In this case, the owner will have to invest the remaining 30%. However, if the owner brings a mezzanine investor who can bring 10%-15%, then their burden reduces. Let us look at the following situations where an investor opts for mezzanine finance.

For Acquisition

Companies usually go for mezzanine funds if they are acquiring another company. If a company knows that acquiring another firm would increase its revenue stream, it would want to acquire it. However, the firm would not have liquid cash available every time, and therefore, it would need quick funds.

Shareholder Buyouts

Usually, family businesses are interested in the keeping majority of shares with themselves. At times, such investors would want to repurchase the company’s shares to strengthen their ownership in the company. The mezzanine fund comes in very handy for such activities.

Refinancing

Organizations at times also go for a mezzanine fund to make their debt capital structure more flexible. Such ready funds ensure that companies have enough funds for opportunities such as shareholder buyouts and acquisitions.

Expansion

Apart from the above three activities, companies can deploy them for expanding into new territory. Rapid growth is important for companies to increase their revenue stream. These funds can help them achieve the same in a short span of time.

The mezzanine fund is a popular source of funding used by companies looking for rapid growth. Therefore, such companies do not mind paying a little higher rate of interest for accessing quick money.

Rate of Return on Mezzanine Financing

The mezzanine investors usually charge high interest on their investment in comparison to the traditional form of debt financing. The rate of return is usually higher because all other forms of debt come above mezzanine debt. This implies that those investing in the company through the mezzanine fund are taking a higher risk and, therefore, deserve a higher return. There are five ways in which the return on the mezzanine fund becomes available.

Ownership

The mezzanine fund acts similar to convertible bonds in a way that, in case of default, the lender has the right to a stake in equity or ownership conversion.

Payable in Kind Interest

Some companies opt for this where rather than getting the periodic interest; the principal amount increases to the amount of the interest.

Participation Payout

The lender of the mezzanine fund can also avail an arrangement where they can claim a certain percentage of the company’s earnings, such as EBITDA, profit, and so on.

Cash Interest

These are interest payments given as a percentage of the outstanding balance. The rate of interest can be either fixed or floating rate or linked to the base rate such as LIBOR.

Arrangement Fee

Mezzanine lenders can also charge an arrangement fee to cover the administrative costs. One has to pay such a fee upfront to close the transaction.