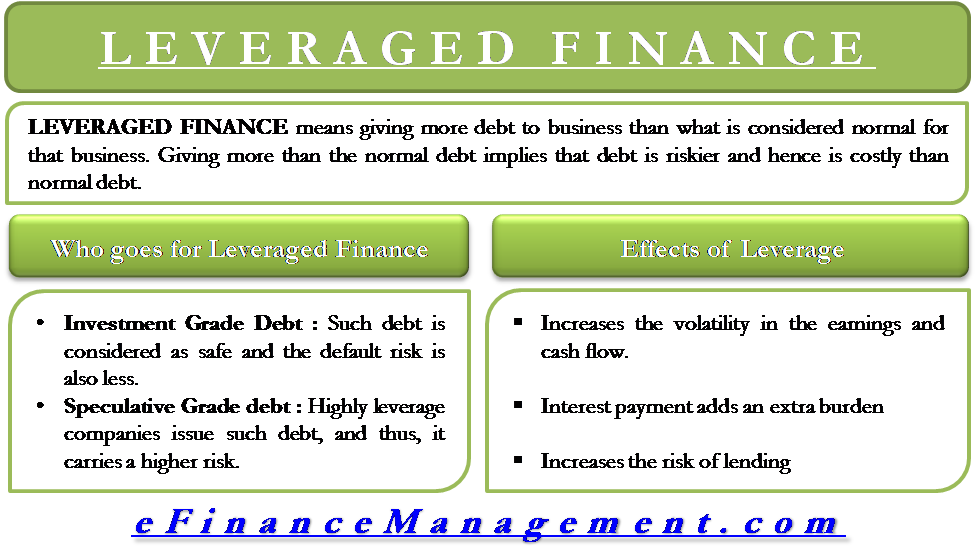

Leveraged finance means giving more debt to a business than what is considered normal for that business. Giving more than the normal debt implies that the debt is riskier and hence, is more costly than the normal debt.

Therefore, leveraged finance is primarily used for specific purposes, such as repurchasing shares, paying a dividend, buying an asset, carrying an acquisition, etc. So, it basically means acquiring debt to grow the company or increasing an investment’s potential returns.

Most businesses prefer such type of financing as it requires little funding on the part of the businesses. But, if the asset for which the debt was taken did not perform as per the expectations, the same financing becomes a big headache for the business. The interest expense has to be paid regularly regardless of how the asset performs.

Thus, the bigger the debt amount, the higher the financial leverage, and the higher the risk.

Who goes for Leveraged Finance?

To understand who goes for such financing, we need to understand one type of debt. There are two kinds of debt on the basis of debt financing:

Also Read: Leverage and its Types

Investment-grade debt

Companies with strong credit profiles issue such types of debt. Such debt is considered safe, and the default risk is also less.

Speculative-grade debt

Highly leveraged companies issue such debt, and thus, it carries a higher risk.

Understandably, leveraged finance focuses on Speculative-grade debt, which means companies issuing lower-rated debt go for leveraged finance. Specifically, leveraged buyout and private equity firms try to get as much leverage as possible to boost their investment’s internal rate of return or IRR.

Effects of Leverage

Leverage finance increases the volatility in the earnings and cash flow of a company. As such type of debt financing is costly, the interest payment adds an extra burden on the company’s limited resources.

Also, such a type of financing increases the risk of lending to the said company. A company that goes for this option is already perceived as riskier. And, after availing of such financing or debt, the company gets even riskier.

Thus, it is essential for the analysts to understand the use of leverage by a company to accurately create its risk and return profile. Further, understanding the leverage also helps to accurately forecast cash flows.

Also Read: Debt Financing

Mezzanine Debt – a Useful Tool

A major tool that comes under leveraged finance is the mezzanine or “in-between” debt. A company uses such debt as an alternative to high-yield bonds or bank debt. Investors in mezzanine debt take on higher risks than bond investors, but they get higher returns as well. Returns for mezzanine debt investors are somewhat closer to the equity returns.

Traditionally, small companies that we’re unable to tap the bond market prefer to go for mezzanine debt. Now, companies or investment banks increasingly use such an option as part of a bigger financial package to fund big acquisition deals.

A Specialist Job

Leveraged finance is a specialist job, and thus, the investment banking division of a bank has a separate unit, called LevFin or LF, to handle such debt. Such a unit is responsible for offering assistance to the companies who go for leveraged finance. Some of the best names in the LevFin segment are JP Morgan, BAML, Credit Suisse, Citi, Goldman Sachs, and more.