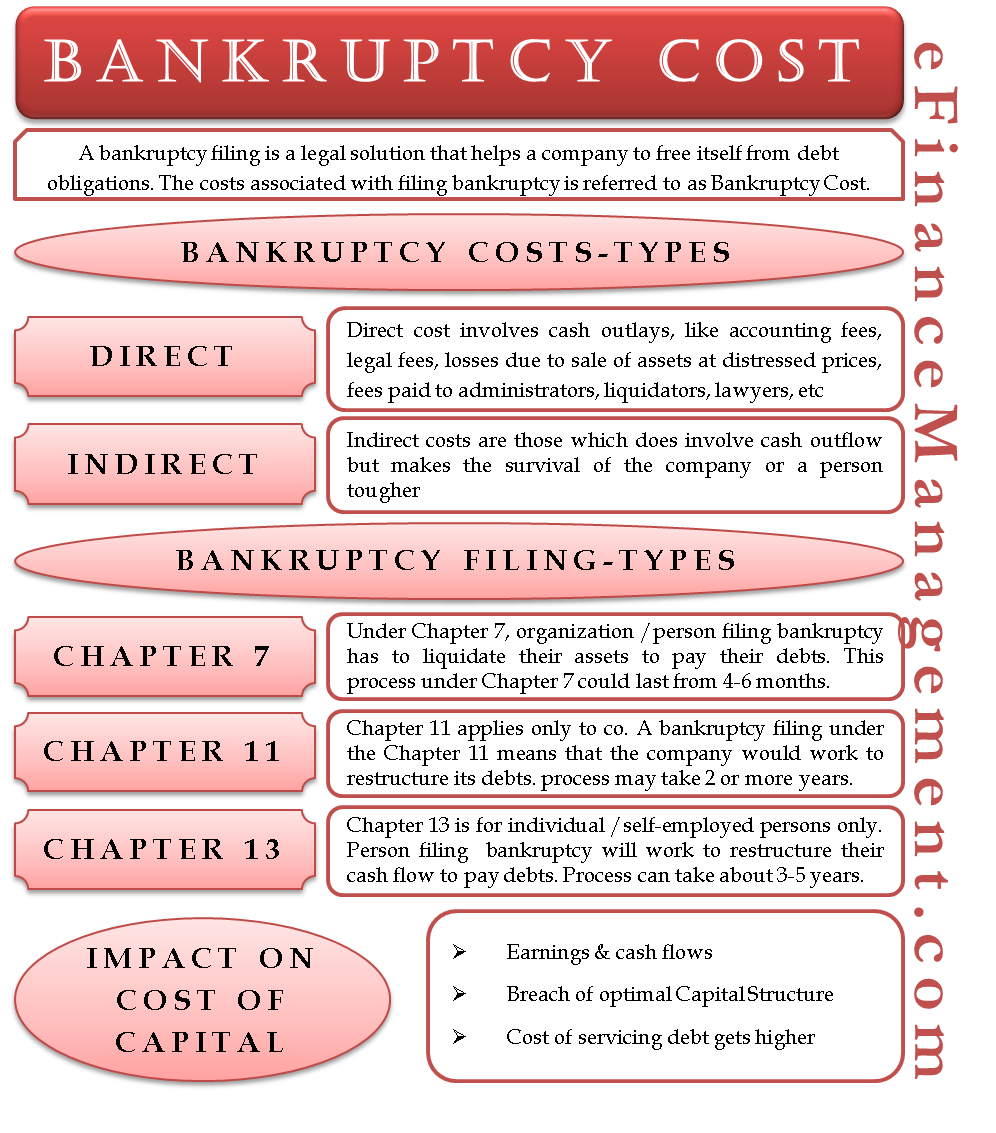

When a company is unable to honor its financial obligations, it files for bankruptcy. A bankruptcy filing is a legal solution that helps a company free itself from debt obligations. The cost associated with filing bankruptcy is referred to as bankruptcy cost.

For a company, this cost is a deadweight economic cost for going bankrupt. Bankruptcy Cost includes costs incurred before and after filing the bankruptcy, like legal fees, documentation fees, etc.

Bankruptcy cost – Direct And Indirect

This cost could vary for different types of firms, but they fall under two heads – direct and indirect.

Direct Costs

These are the costs that one can directly relate to bankruptcy. Some examples of these costs are accounting fees, legal fees, and fees to administrators, liquidators, lawyers, accountants, investment bankers, losses due to the sale of assets at distressed prices, and the rise in the borrowing cost due to the poor credit rating, and more.

Indirect Costs

Indirect costs are those which does not involve cash outflow but make the survival of the company or a person tougher. This type of bankruptcy costs can impact intangible assets, like staining the goodwill of the company, loss of market share, loss of customers’ trust, and suppliers tightening credit terms.

Also Read: Bankruptcy

Further, filing for bankruptcy also makes all your information public, including your personal information and mistakes. When you file for bankruptcy protection, you need to complete a lot of paperwork called the bankruptcy schedules. These schedules will ask for all the information related to the debts, assets, recent financial transactions, sources of income, and expenses.

Also, a person filing for bankruptcy may have to attend a meeting of the creditors. The Bankruptcy Trustee and the creditors can ask any related question in the meeting. Such meetings can get intense if the creditors are unsatisfied with the answers they get.

Impact on Cost of Capital

Bankruptcy cost impacts the cost of capital of a company as a company takes up more debt to get tax benefits. It has to service the debt by making a regular interest payment. Such interest payment affects the earnings and cash flows of a firm. Each company has its own optimal capital structure, i.e., a mix of debt and equity.

But, as the company takes on more debt, breaching its optimal capital structure, the cost of servicing debt increases as the debt will now be riskier to the lender. The rise in the debt load also increases the bankruptcy risk and also the expected cost of bankruptcy. A company must always consider the expected cost of bankruptcy when evaluating the amount of debt.

Also Read: Chapter 11 Bankruptcy

Also, a company can calculate its bankruptcy cost by multiplying the expected cost of bankruptcy with the probability of bankruptcy. Bankruptcy Costs can easily run into millions of dollars. For instance, Enron, who filed for bankruptcy on Dec. 2, 2001, is believed to have spent more than $1 billion towards these costs, including total legal and accounting costs.

It must be noted that honesty is very important in bankruptcy. So, one must disclose all needed, including property, debts, and creditors. If the court finds out any unrevealed fact, one may not only lose the bankruptcy discharge but also face an FBI investigation.

Continue reading about What is Bankruptcy & its Types.

RELATED POSTS

- Chapter 11 vs Chapter 13 Bankruptcy – All You Need to Know

- Bankruptcy – Chapter 7 – Process- Advantages and Disadvantages

- Voluntary Bankruptcy – Meaning, Process and More

- Bankruptcy Fraud – Meaning, Types, Civil and Criminal Bankruptcy

- Involuntary Bankruptcy – Meaning, Features, Requirements and More

- Chapter 12 Bankruptcy