Definition Of Liquidation

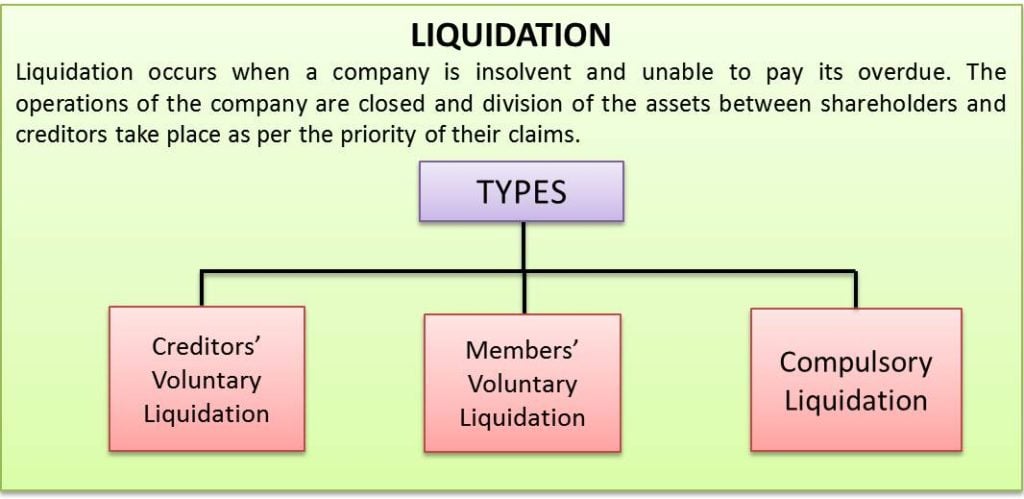

Liquidation occurs when a company is insolvent and unable to pay its overdue. The operations of the company are closed, and the division of the assets between shareholders and creditors takes place as per the priority of their claims. In rare cases, solvent companies also file for liquidation. Not all bankrupt companies eventually lead to liquidation; some companies rehabilitate the entity and opt for corporate restructuring.

Reasons For Liquidation

Reasons why a company is forced into liquidation:

- The business was started and run for the wrong reasons

- The business owner lacks skill sets

- Inadequate working capital

- Week financial skills

- The location is wrong

- Lack of planning

- Over-trading or under-trading

- Poor marketing

- Failing to set any strategic direction

- Inflexible business model

These are a few of the reasons for the liquidation of a company. After gaining an insight into the reasons for liquidation, let us understand the types of liquidation for a clearer view of the concept.

Types Of Liquidation

The following are the three types of liquidation:

Creditors’ Voluntary Liquidation

The creditors’ voluntary liquidation occurs when the company’s shareholders decide to terminate a company they hold shares. However, at times the company is unable to pay back all the creditors. The directors of the company initiate creditor’s voluntary liquidation.

Members’ Voluntary Liquidation

The shareholders of the company initiate the member’s voluntary liquidation despite the company being solvent. The company holds enough cash to close operations without owing money to any creditors. In this type of liquidation, the court will conduct the hearing for the closedown of the company. A qualified insolvency practitioner will commence the process of liquidation. The directors will have to prove the company’s worth to pay all debts.

Compulsory Liquidation

The court can pass an order for winding up and forcefully shutting down an organization. This is known as compulsory liquidation. If someone connected to the business files a petition, this action could be done. This could be a director of the company or a creditor awaiting payment. However, in cases of more than one director, all directors need to jointly file the petition—a creditor at first files a petition in the court. Despite the statutory warning, the creditor may opt for liquidation if the debt owed to him has remained undisputed, ignored, or unpaid.

After having a deep understanding of the types of liquidation, let us look at the process of liquidation.

Process Of Liquidation

The process of liquidation results in the company being legally dissolved. The process followed for liquidation depends on the type of liquidation. However, it can be summarised as:

- Company concludes trades

- The liquidator takes the proprietorship of the company, assets, including records and property.

- Liquidator scrutinizes company affairs

- The liquidator prepares a list of creditors and dues owed

- The liquidator prepares a list of debtors obliged to contribute to the value of assets

- Liquidator realizes the value of the assets owned by the company to meet outstanding debts

- Creditors are reimbursed in accordance with established guidelines

- Any surplus funds are distributed to the members

- Liquidator delivers a report to the registrar of companies

- The company is dissolved after 3 months of filing the report

Conclusion

The process of liquidating the firm depends on the type of liquidation. However, it includes the sale of all of the company’s holdings and property. Complete dissolution and closure of the company follow. The liquidation might be voluntary or compulsory; however, the end result is the same. The creditors are paid the maximum amount possible, and the company ceases to exist.

Great work, the details provided have awoken my memory on the subject back to my college days