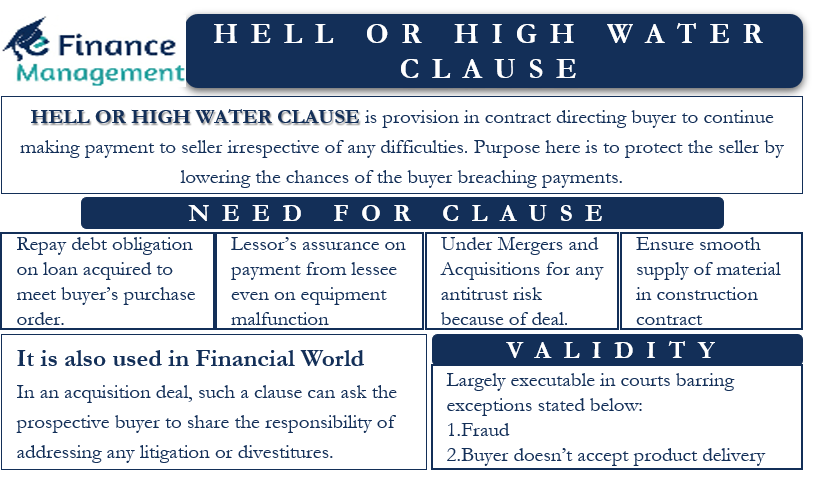

Hell or high water clause is a provision in a contract directing the buyer to continue making the payment to the seller. The buyer must make the payment irrespective of any difficulties. In other words, the payment to the Lessor or Seller should continue as per the stipulated terms of the contract regardless of any issues or problems. A buyer may encounter difficulties such as failure or damage to equipment, financial losses, cash flow issues, and more. The basic purpose of this clause is to protect the seller by lowering the chances of the buyer breaching the payment terms by giving excuses.

Such a clause is common in lease agreements and aviation contracts. Another name for such a clause is a promise-to-pay contract. The name “hell or high water” implies that the buyer must continue with the payment no matter whether “come hell or high water.”

Reasons for Having Hell or High Water Clause in Contracts

Usually, such a clause comes into play when the seller is taking a big risk on behalf of the customer. This risk could be financial, such as capital. Or, the risk could be of customizing the product or service such that any other buyer won’t buy it. And thus, the seller has to incur heavy expenses that may or may not include some CAPEX also.

There are many grounds why a supplier may want to have such a clause in the contract. These are:

- If the seller took a loan so as to complete the purchase order, then the seller would need assurance of a timely payment. In such a case, the payment would allow the seller to meet the debt obligations.

- A lessor may require the lessee to continue with the payment even if the equipment malfunctions. The payment would allow the lessor to carry out the repair work in such a case.

- In case of a merger or acquisition, either party may insist on having such a clause to require the other party to take responsibility for any antitrust risk that may arise because of the deal.

- Such a clause is common with construction industry contracts as well. In such contracts, the clause ensures that the suppliers are able to smoothly supply the materials.

How Hell or High Water Contracts Work?

This clause ensures that the purchaser makes the payment even if the product or service is not working as intended. Or the contract remains effective and enforceable regardless of anything wrong or default with the item or service. For example, if a seller rents equipment under such a clause, then the buyer is responsible for the payment even if the equipment malfunctions.

Usually, in contracts with such a clause, the lessee decides the equipment they want. The lessor becomes the funding entity that then buys the item. And then provide it on lease to the lessee. Now, if there is any defect with the equipment, the lessor is usually not at fault because it is the lessee who chose the equipment.

It is possible that the equipment manufacturer directly shipped the equipment to the lessee without the lessor getting a chance to inspect it. In such a case, it is possible that there was a manufacturing defect in the equipment.

Hell or High Water Contracts in Finance

Such a clause is also in use in the financial world, such as in high-yield indentures, acquisition deals, and project finance transactions. For instance, in an acquisition deal, such a clause can ask the prospective buyer to share the responsibility of addressing any litigation or divestitures. Moreover, an acquisition deal may be made dependent on the ability of the buyer to address such issues.

Are They Valid in Courts?

Such a clause is largely executable in courts barring a few exceptions. Since a hell or high water clause can have major ramifications, it is very crucial to draft them properly. Thus, it is crucial that the parties to a contract employ a good lawyer to take care of it.

Also Read: Hire Purchase Agreement / Contract

Following are the situations when this clause is not enforceable in the court:

Fraud

The presence of such a clause could not force a buyer to make payment in case of any fraud on the seller’s side. Colonial Pacific v. McNatt case in Georgia in 1997 is a good example of this.

The buyer doesn’t accept the product delivery

If the contract does not specify, then such a clause is not enforceable unless the buyer accepts the delivery of the product. For example, a supplier of mobiles supplies defective units to a retailer. After inspection, the retailer rejects the supply and informs about the same to the supplier. The supplier, in this case, can not force the retailer to pay for the mobiles.

Coronavirus and Hell or High Water Clause

The coronavirus pandemic is having a negative impact on businesses. Several nonessential businesses were asked and ordered by the government to shut down to prevent the spread of the virus. This made it difficult for businesses to honor their obligations.

In such a scenario, the execution of the hell or high water clause would depend on several factors. These factors could be the language of the contract in question, the conduct of the parties regarding the agreement, and the governing law.

During such a pandemic, a well-crafted and firmly negotiated clause could prove immensely important for the supplier to avert or reduce their financial risk. For instance, such a contract proved to be a lifeline in the aviation industry.

Such a clause is common in aircraft lease agreements. These agreements clearly say that the airline taking a plane on a lease must make the payments unconditionally. Thus, a thoroughly drafted and firmly negotiated agreement already considers several situations, such as the coronavirus pandemic.

So, it is the responsibility of the airline company, even during the outbreak, to make the lease payment. Even the law would hold that the financial hardships and losses of the lessee during the pandemic are an insufficient excuse to deny the payment under the aircraft lease agreement.

Other Similar Clauses

Apart from the hell or high water clause, there are many other clauses of similar nature that protect the seller (or the buyer) when it comes to payment. Two such popular clauses are:

Hardship Clause

This clause ensures that the parties keep their end of the deal despite hardships.

Force Majeure Clause

Force Majeure Clause pardons one or both parties from carrying their part of the deal if natural disasters render execution impossible. And the circumstances are beyond the control of the parties.

RELATED POSTS

- Incentive Contract: Meaning, Types, Advantages, Disadvantages and More

- Types of Ocean Bill of Lading

- Soiled Bill of Lading – Meaning, How to Prevent and More

- Cost Plus Contract: Meaning, Types, Advantages, Example, and More

- Restrictive Debt Covenants on Term Loan Agreement

- Inland Bill of Lading – Meaning, Importance and More