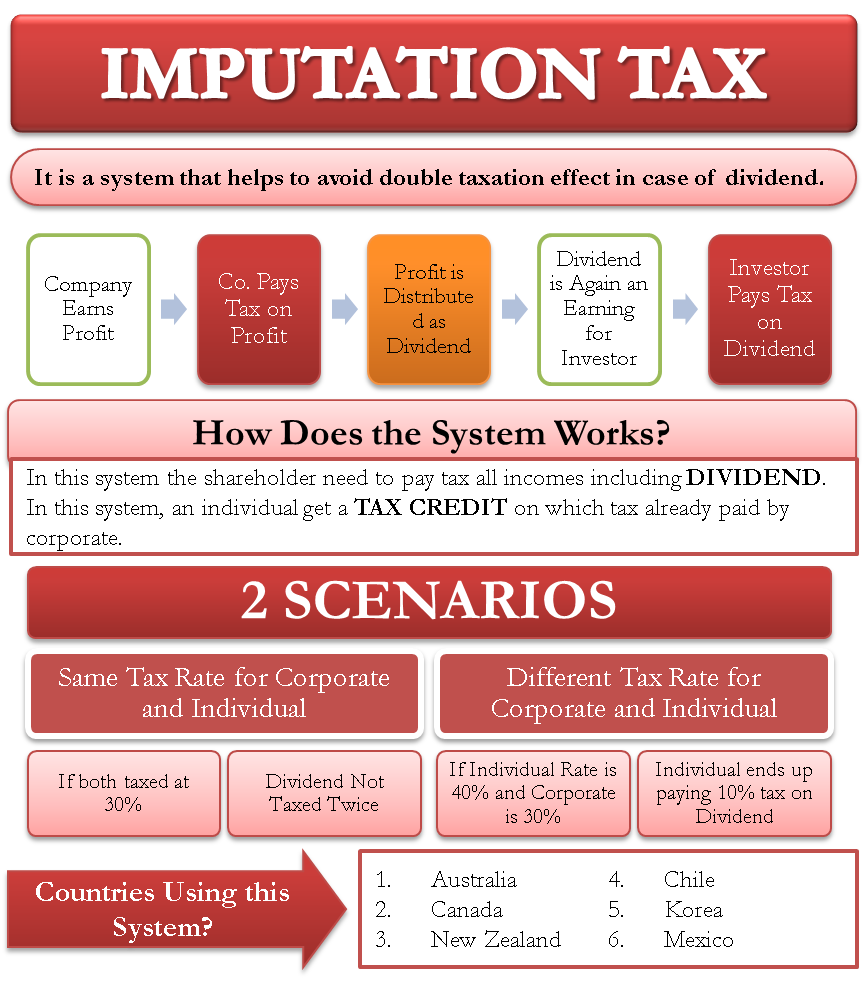

Imputation tax is a system that helps to avoid double taxation in the case of a dividend. We can also call it Dividend Imputation or Franking-credit. Basically, the system ensures that the investors who get dividends are not taxed twice. One while receiving the dividend and the other when reporting their dividend income in their individual tax returns. In a way, such a system allows a corporation to pass on the benefits or share of taxes already paid at the corporate level to the shareholders.

The argument in favor of such a system is that the company already pays taxes (corporate tax) on the earnings that it distributes as dividends. This income (after-tax) for the investors is taxed again when an investor files their personal taxes. Thus, the same dividend income is subject to taxation twice. Thereby tax paid income is again getting taxed.

To avoid this, the imputation system gives a tax credit to the investors to compensate them for the tax already paid by the corporates on their behalf. We call such a system imputation because it ‘imputes’ the taxes that a company owes to its shareholders. However, the calculation of the credit amount usually considers the personal tax rate of the shareholders.

Imputation Tax – How it Works

Dividends are an income for the investors. So, like other usual types of income, tax authorities use dividend income to come up with the total taxable income of an individual.

An investor gets a dividend from a company, which gives it from its profits. Tax authorities tax this profit as well.

So, in the absence of an imputation tax system, the tax authorities would collect taxes twice – one by taxing the corporate profits and the other by taxing at the personal level.

However, if the imputation tax system is in place, the tax authorities would tax the dividend income only once. Or, we can say that the shareholder gets the tax credit for the taxes already paid at the corporate level.

There is, however, one scenario when the shareholder may need to pay taxes twice. This is when the personal income tax rate is more than the corporate tax rate. Even in such a situation, the taxpayer only needs to pay the difference between the two tax rates.

For example, suppose the corporate and personal tax rate in your country is the same at 35%. In such a case, the investor won’t have to pay taxes on dividends again, instead they would get the tax credit.

But, if the personal tax rate is 40%, but the corporate tax rate is 30%, then the taxpayer would have to pay 10% more tax on the dividend income.

Not All Countries Use it

Not all countries follow this system. Some of the notable countries that use this system are Australia, New Zealand, Canada, Chile, Korea, and Mexico. Many countries that earlier were in favor of such a tax system have changed their approach. Some of these either did away with such a system completely, while others favor partial credit. For instance, if the corporate tax rate is 30%, then countries favoring partial credit give a tax credit of only 10% or 20%.

If you live in a country following this system, then your dividend statement would include the tax credit value. So, when an investor files their annual tax, the corporate tax already paid is given as credit to offset the impact of double taxation.

Frequently Asked Questions (FAQs)

The imputation tax system helps avoid double taxation in the case of a dividend.

Corporate profits are taxed twice in the following manner:

Once when a company already pays taxes (corporate tax) on the earnings that it distributes as dividends. This income (after-tax) for the investors is taxed again when an investor files their personal taxes. Thus, the same dividend income is subject to taxation twice. Thereby tax paid income is again getting taxed.

The imputation system gives a tax credit to the investors to compensate them for the tax already paid by the corporates on their behalf.

The shareholder may need to pay taxes twice when the personal income tax rate is more than the corporate tax rate. Even in such a situation, the taxpayer only needs to pay the difference between the two tax rates.

RELATED POSTS

- REIT Dividend – Meaning, Tax Impact, Types, and Difference

- Cash Dividend Vs Stock Dividend: Meaning, Differences and More

- Deferred Tax Liabilities – Meaning, Example, Causes and More

- Preference Shares and its Features

- Dividends – Forms, Advantages and Disadvantages

- Foreign Tax Credit – Meaning, How to Claim and More