What is Take or Pay Contract?

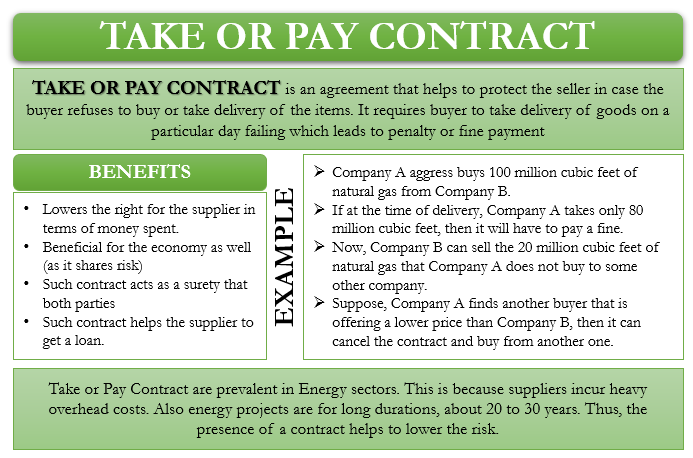

A take or pay contract is an agreement that helps protect the seller if the buyer refuses to buy or take delivery of the items. It is an agreement in writing between the buyer and seller. The objective is to protect the seller if the buyer refuses to take the delivery of the items. Many also call this the “killing clause.”

Usually, the seller inserts such a clause if the goods are perishable. Also, the provision acts as a fine and protects the seller from any potential loss if the seller produces the items specifically for the buyer.

The take or pay contract requires the buyer to take the delivery of the goods at a specified date. If the buyer fails to do so, they need to pay a fine.

Take or Pay Contract -Benefits

Following are the benefits of the take or pay contract:

- Such contracts lower the risk for the supplier in the form of money or capital spent to produce the good.

- Such contracts are beneficial for the economy as well because it shares the risk between buyers and suppliers.

- The presence of such contracts acts as a surety that both parties would try their best to honor the agreement.

- The presence of such a contract also helps the supplier to get a loan. If the supplier needs a loan to complete any order, the lender will insist on the presence of a taking or pay provision. Such a contract would ensure that seller would be able to repay the loan even if the buyer does take the delivery of the goods.

Example

Let’s consider an example to understand a better take or pay contract:

Company A agrees to buy 100 million cubic feet of natural gas from Company B. If Company A takes only 80 million cubic feet at the time of delivery, then it will have to pay a fine. The fine will be based on the pre-agreed terms.

Also Read: Hire Purchase Agreement / Contract

Usually, the fine or penalty is less than the purchase price. It is because the objective of the take or pay contracts is not to give any party undue advantage but instead to reduce the risk. In the above example, Company B can sell the 20 million cubic feet of natural gas that Company A does not buy to some other company.

For the buyer, such contracts are also helpful as there is no obligation to take the delivery. In the above case, suppose Company A finds another buyer that is offering a lower price than Company B. In this case, Company A will use the take or pay contract to cancel the agreement and pay the fine.

For Company A, the agreement will only be profitable if the difference in price that it is getting from Company C is more than the fine amount that it would pay to Company B.

In such a case, the take or pay contract is helpful for both buyer and seller. Company A gets a lower price, while Company B receives the fine amount and the chance to sell the produce at full or less cost to another buyer.

Also Read: Hire Purchase

Take or Pay Contract in Energy Sector

A take-or-pay contract is standard in the energy industry. It is because the suppliers incur high overhead costs to offer energy units, such as natural gas or crude oil. The overhead costs are usually in the form of pipelines, oil, or natural gas to produce electricity. Along with the overhead costs, the volatility in the prices of commodities also takes a toll on the supplier.

Thus, take or pay contracts encourage energy suppliers to invest in the business. Such agreements act as an assurance to the suppliers that they would get back the cost. If there is no such contract, the supplier has to bear all the risks, including the buyer canceling an order due to price volatility.

Along with the overhead cost, there are two more reasons why energy projects go for such take or pay contracts:

- Usually, the energy projects are for long durations, about 20 to 30 years. Thus, the presence of a contract helps to lower the risk.

- Since energy projects are big projects, they require debt or loans to finance them. Thus, the presence of a taking or pay provision acts as a surety for the lender that the buyer will be able to pay the interest.

Risks

Since take or pay contracts are generally for long-term contracts, they are vulnerable to future events that the agreement does not cover. These events could be political, geological, commercial, or more. It may happen that after the event, the contract may no longer be feasible for one or both parties. Thus, the buyer or seller may end the contract.

However, they may continue with the contract as well by renegotiating the terms when external events cause disruption. Keeping with the agreement may benefit both parties if both sides are reasonably cooperative in renegotiating terms.

Often take or pay contracts to include clauses that detail the circumstances under which the parties will renegotiate the terms of the agreement. These clauses are:

Force Majeure Clause

This covers unforeseen natural events. We also call it the “act of God.” Both parties need to decide the type of circumstances that will constitute force majeure. Also, the parties need to determine the obligations of each side after the happening of such events.

Price Clause

such a provision tries to protect the buyer and seller from any unforeseen fluctuations in the price.

Review Clause

This clause states when the parties need to renegotiate long-term contracts.

I agree to this