Incentive Contract: Meaning

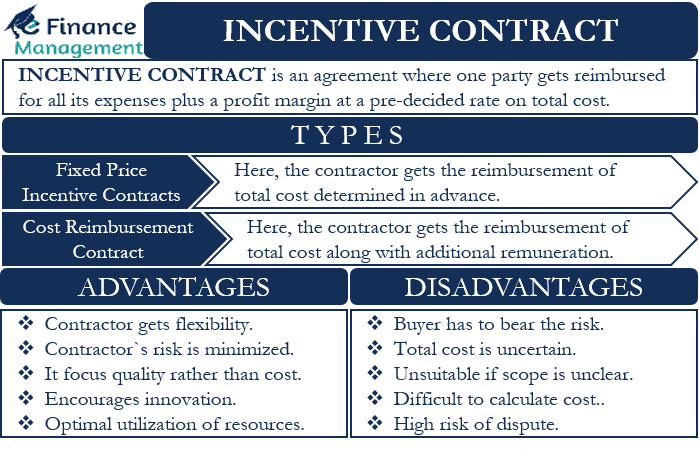

An incentive contract is a contract between two parties in which one party promises to grant an additional remuneration to another party for outstanding performances. Here the outstanding performance can be for outstanding quality, cost reduction, early completion of the project, safety measures, etc., depending on the terms of the contract. And these incentives are in addition to fixed payments to the executing party. Usually, such contracts are popular and preferable in construction projects where there are two parties, the contractor (performing party) and the client or buyer. Moreover, incentives can be positive or negative, depending on contractual terms and the contractor’s performance.

Further, these contracts have positive incentives for outstanding results and negative incentives for below-average performance. In other words, negative incentives are like penalties. These incentives can be monetary or non-monetary.

Understanding Incentive Contract

Each incentive contract differs from other incentive contracts. Therefore these contracts are not standard ones; instead, they are custom-made. And each contract has a different incentive structure, triggers, and indicators. Moreover, the variation depends upon the type of contract and work involved. Here, the contractors and the clients decide on the terms according to the requirements of the project. The contractor usually remains positive and confident of meeting those laid down requirements. And thus hope to earn the incentives as per the contract.

Sometimes the duo decides to target profit and target costs in advance as part of this contract. Simply put, under this type of contract, communication of achievable targets easily occurs.

There are three basic rules for Incentive Contracts. They are as follows: –

- The first rule is to relate direct incentives to the results, performance, or cost of projects. And the incentives should be easy to communicate and calculate and should avoid subjectiveness to the extent possible and feasible.

- The second rule is that the costs and benefits of the project should be at the level where incentives are provided, and the incentives should explain the costs and benefits of the project for both parties.

- The third rule is that it is necessary to create a legal contract containing all the contractual details. Hence, documentation on incentives should take place.

These are some basic rules for the incentive part.

Types of Incentive Contract

There are two main types of Incentive Contracts. They are as follows:

Fixed Price Incentive Contract

Within the Fixed Price Incentive Contract, the contractor forecasts the total costs of the project and submits the quotation. Then the client will select the lowest quotation out of all bids. Finally, the contractor and the client negotiate the price cap of the contract and determine the final costs. Such finally negotiated costs should include all sorts of costs related to the project, that is, labor costs, material costs, and overheads. Therefore, if the actual project costs are below the final costs, the contractor generates a profit. Similarly, the contractor makes a loss if the actual cost of the project is higher than the final cost.

In most such cases, the contractor and the client are aware of the project requirements and approximate costs under a fixed-price incentive contract. However, these fixed-price contracts are usually unsuitable when the cost of the project is uncertain, and the outlay of the project is not decided.

Cost Reimbursement Contract

Unlike the fixed-price incentive contract, the nature and scope of the project under the reimbursement agreement are uncertain. Hence, it is not possible to accurately predict the total cost of the project under the Cost Reimbursement Contract. Therefore, it is a contract in which the customer promises to pay the total cost of the project and to offer the contractor an additional incentive when the project is completed. Further, usually, these types of contracts are risky in nature. Hence, the legal contract should specify all types of costs that the client reimburses. The contract seeks to increase the level of service as best as possible within the Cost Reimbursement Contract.

The other name of the Cost Reimbursement Contract is Cost Plus Contract.

There are other less popular incentive contracts such as performance incentive contracts, Delivery Incentive Contracts, Structuring Multiple-Incentive Contracts, etc.

Advantages of Incentive Contract

- Incentive Contracts encourage the contractor to put in their full and best efforts. Mostly under this type of contract, full utilization of resources takes place.

- The contractor gets full ownership of the project until its completion. The contractor gets full control over design, system, input factors, etc.

- Incentive contracts encourage innovation in the industry.

- In this type of contract, there is strong communication between the Contractor and the Buyer.

- This contract prevents inefficiency or waste by the contractor.

- An incentive contract strongly motivates the contractor to provide quality services at lower costs.

- This contract gives the contractor the opportunity to achieve higher profits by achieving objectives.

These benefits are non-exhaustive in nature.

Disadvantages of Incentive Contract

- One of the major limitations of the incentive contract is that there might be high administrative costs because of high accomplishment targets. As a result, there is a possibility of an increase in the overall cost of the project.

- It takes a lot of time to negotiate the incentive conditions.

- Due to incentives, there is a high risk of disputes between contractor and client.

- Such a contract requires a lot of written work and data compilation at the level of the contractor to claim reimbursement and incentives too. Various communications between the parties also need to be stored and referred to while submission of final bills and payments.

- This project is unsuitable if the scope of the project is unclear.

- Sometimes it becomes difficult to calculate the exact incentive value in relation to benefits due to various subjective aspects.

These drawbacks are non-exhaustive in nature.

Conclusion

Despite the many disadvantages of the incentive contract, it is one of the most popular construction contracts. It boosts the morale of the contractor by providing positive incentives for performance. It gives the contractor the opportunity to make a higher profit on this type of contract. Incentive contract generates innovations in the industry that lead to growth. This contract takes full advantage of resources by avoiding waste. As a result of all these factors, Incentive Contracts mostly get preference from clients and contractors. The client is also sure that the margin of profit is at a reasonable level, and he can verify all expenses and discard what is not reasonable.

Frequently Asked Questions (FAQs)

The incentive contracts are focused on quality performance rather than cost. Particularly suitable where either the scope of work, design, or cost can not be ascertained with reasonable accuracy or where the design may undergo changes, etc.

The two types of incentive contracts are:

1. Fixed price incentive contract

2. Cost reimbursement contract or cost-plus contract

There are a few drawbacks of incentive contracts. Some of them are listed below.

a. High administrative costs may lead the contractor to losses.

b. Disputes may arise between contractor and client.

c. If the scope is not clear, this type of contract is not appropriate.

d. Difficult to compute exact incentives.

e. Lot of paperwork and documentation is involved.