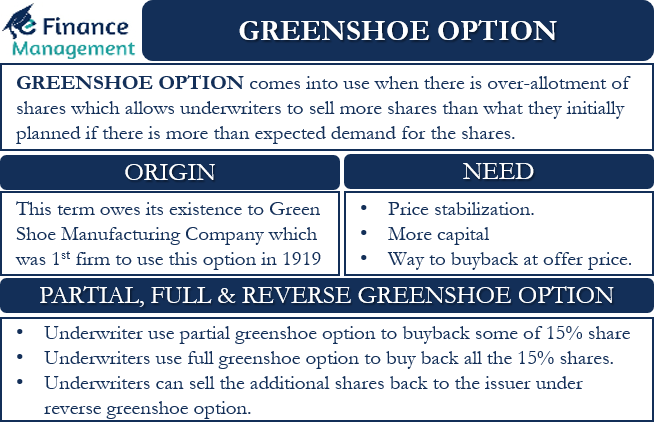

A Greenshoe option is a concept that is of use at the time of IPO (initial public offering). Specifically, it comes into use when there is over-allotment of shares. This option allows underwriters to sell (short) more shares than what they initially planned in case there is more than expected demand for the shares. In other words, it is also called an over-allotment option.

The quantum of the greenshoe options is regulated in various countries. Therefore, the maximum short selling the underwriters can do is as per the permissible limit. However, normally this option limit is about 15% of the initial offering. Therefore, the maximum short selling by underwriters could be up to 15% of the IPO value. However, they need to use this option within 30 days of the IPO. All the details regarding the option – quantum, time period of exercise, and other terms and conditions- are in the underwriting agreement.

Origin of Greenshoe Option

This term owes its existence to the Green Shoe Manufacturing Company. It was the first firm to use this option. Green Shoe Manufacturing Company (now Stride Rite Corporation) used the option in 1919.

The underwriting agreement incorporates this greenshoe option clause. It is the only SEC-approved method available to the underwriters to manage the issue after fixing the offer price. SEC came up with this provision to boost the efficiency of the IPO process.

Also Read: Purpose and Application of Options

Example of Greenshoe Option

Suppose Company A decides to offer 2 million shares in the IPO. Owing to the popularity of Company A, the underwriters decide to sell 15% more shares using the greenshoe option. So, in total, they offer 2.3 million shares to the public. This extra 15% option and quantum of shares help in the stabilization of the share price after the IPO. In other words, it contains the volatility in the stock price by increasing the supply of shares.

It is, however, a short sell, and underwriters will have to buy those shares back. If, at the time of buyback, the market price of the shares is more than the offer price, then the greenshoe option allows the underwriter to buy back at the offer price from the issuer company. Thus, saving them from the loss if the share price has moved upward.

However, if the share price drops more than the offer price, then also underwriters need to buy back. But In this case, the underwriter buys back at the market price rather than getting extra shares from the offering company. And, in turn, make a profit. The buyback, in this case, will also allow the company to stabilize the share price by reducing the supply of shares. Once the underwriter buys back the shares and the share price may stabilize rather than further dropping. Moreover, the underwriters can return those bought back shares to the issuer (Company A).

What’s the Need for Greenshoe Option?

There are several reasons why underwriters use this clause at the time of IPO. Some of the main ones are:

Price Stabilization

Underwriters and companies primarily use this strategy to stabilize the share price of the company after the IPO is over. Suppose underwriters utilize the Greenshoe option to gain from the popularity of the shares. However, after the listing, the share price starts dropping. Thus, to stabilize the share price, underwriters can buy back those additional shares. Once they buy back, it would reduce the supply of the shares, and prices would recover.

More Capital

If the demand for a company’s shares is more than the supply, then this option allows the company to benefit from this. The company will be able to raise 15% more capital than what it initially planned and at no extra cost.

Way to Buyback at the Offer price

It is very likely that the shares of the company will go up after the listing. In such a case, underwriters would incur a loss if they buy back the shares at the market price. They, however, can use the greenshoe option to purchase the additional shares at the offer price from the issuer company. In this case, however, underwriters will make no profit and no loss.

Greenshoe Option Variations

The greenshoe option has three variants – full, partial, and reverse.

Full Greenshoe Option

A full greenshoe option is a usual option that we have been discussing so far. In this, the underwriters use the option to buy back all the 15% shares from the issuer company. This option is exercised by the underwriters when they are unable to buy back any shares from the market. And they need the shares to square off their short sale position. Thus, by taking it from the issuer, they settle their account in the market, of course, at no profit, no loss.

Partial Greenshoe Option

When underwriters implement a partial greenshoe option, it means they are able to buy back only some of the 15% shares from the open market. And they still have a shortfall. Therefore, they approach the issuer and exercise their partial option to buy the balance quantum of shares at the original offer price. Here, their profit is again limited to the difference they could make through the quantum bought from the market because the portion they are buying from the issues is at the offer price, where there can not be any loss or profit.

Reverse Greenshoe Option

In the reverse greenshoe option, underwriters can sell the additional shares back to the issuer later. They generally use this option when the demand for shares drops after the IPO. Or to stabilize the share prices, both when it is rising and dropping. In such a case, underwriters buy back the shares and sell them to the issuer, usually at a higher price.

Greenshoe Option as Call and Put Option

It is important to understand the Greenshoe option to see them from the perspective of the Call and Put Option in the trading terminology. There is, however, a lot much difference between the two, and they should not be treated loosely to replace one another.

What we are discussing here is that the practical execution aspect works more or less on similar lines. Of course, those options work in the market, and amongst the participants, that can be anyone. However, here the Greenshoe option works between the underwriters and the issuer only.

If the price of the shares rises after the IPO, then, like the call option, the underwriters can exercise the greenshoe option to get the additional shares at the same price from the issuer. Similarly, if the share price drops, then the underwriters can buy back from the market and sell it back to the issuer at a higher cost as per the agreement. This is like a put option in normal trading.

Real-World Example

Exxon Mobil used this option to sell more shares to the public. Another very well-known company that utilizes this option is Facebook.

In 2012, Morgan Stanley, who was the lead underwriter for Facebook, sold 15% more shares than the initial allocation as there was robust demand for Facebook shares.

However, after the IPO, Facebook shares dropped (below the IPO price). Thus, Morgan Stanley had covered its short position. And they did not exercise the greenshoe option. In this case, underwriters made a profit by buying the shares at less than the offer price.

Had the Facebook shares increased above the IPO price, Morgan Stanley would have used the greenshoe option to buy back the shares at the offer price and not at the higher market price.

Final Words

A greenshoe option is very useful for companies going for IPO. It helps to reduce the risk for the company, underwriters, as well as for investors. For companies and investors, it helps in stabilizing the share price. For underwriters, it gives the assurance that in case of the share price increases, they have all the right to buy more shares from the company at the offer price, rather than buying the shares from the market at higher prices and incurring losses.

Also, it gives confidence to the investors in IPO. If a company’s IPO document says that it has an arrangement with the underwriter for the greenshoe, it gives confidence to an investor that there would be some stability in the share price.

Quiz on Greenshoe Option

RELATED POSTS

- Put and Call Options

- What are Options in Trading – Types, Pros, Cons, and More

- Call Options – Meaning, How it Works, Uses, and More

- What are the Factors Affecting Option Pricing? How and Why?

- Stock Warrants – Features, Types, Benefits And More

- Put Options – Meaning, How it Works, Strategies, and More