Options are immensely popular derivatives instruments. It allows investors to hedge their risk, as well as make quick gains through speculation. To effectively understand the factors responsible for options pricing, it is vital to understand option terminology and option pricing. A robust understanding of factors affecting option pricing would allow traders and investors to benefit from the price movement, as well as optimize their return. Option pricing depends on several factors. Thus, to understand option pricing, traders and investors need to understand the factors affecting option pricing.

Factors Affecting Option Pricing

The following are the primary factors affecting option pricing:

Current Price of Underlying Asset

The current value of the underlying asset has an impact on the price of the option (both call and put). The following table explains what happens to call and put option prices when the current price change.

| Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|

| Current Price | Increase | Increase | Decrease |

| Current Price | Decrease | Decrease | Increase |

Why Increase in the Current Price Increases the Price of Call Options and Vice Versa?

In the table below, we can see that if you hold an option to buy at 22 i.e., strike price, you have the right to buy shares @ 22. When the price increased from 22 to 24, the payoff for the call option holder increased from 2 to 4. For setting off this higher payoff, the option price will increase. In a similar fashion, if the current price decreases, the option price will decrease.

| Particulars | Assumptions | Increase in Stock Price | Decrease in Stock Price |

|---|---|---|---|

| Strike Price | 20 | 20 | 20 |

| Call Option Price | 2.5 | 2.5 | 2.5 |

| Expected Stock Price at the time of Exercise | 22 | 24 | 19 |

| The payoff from this Option *Note: this is not profit or loss, we need to deduct the price paid for buying the option. | 2 (22-20) | 4 (24-20) | -1 (19-20) |

Why Increase in the Current Price Decreases the Price of Put Options and Vice Versa?

In case you hold a put option, the reverse will work for it because the payoff will be the exact opposite. Suppose you hold a put option; you get a right to sell the stock at 22. If the current market price goes down to 19 at the time of exercise, you can buy shares at 19 and sell at 22 to gain 3 per share and vice versa. To set off the gain, options market, the price of the put option will increase and vice versa.

Also Read: Put and Call Options

Strike Price

It is a pre-determined price at which a trader is willing to buy or sell. Another name for the strike price is the exercise price. With the increase in strike price, the price of calls will decrease, and put options will increase.

| Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|

| Strike Price | Increase | Decrease | Increase |

| Strike Price | Decrease | Increase | Decrease |

Let’s assume the current stock price is 24. There is an Option A, where Strike Price is 22 and the Price (or Premium) is 4. Now, suppose there is another Option B, whose Strike Price is 18. Will the premium for option B be more than 4 or less than 4?

It will be more than 4 because if the stock price at the time of exercising is, say, 25, the value in the form of payoff delivered from

- Option A would be 3 (25-22), and

- Option B will be 7 (25-18)

Therefore, the price of the call option will decrease with an increase in strike price.

Time to Expiry

The more the time to expiry, the more is the price of the option (Call and Put). This is because more time means more chances of the actual price moving away from the exercise price. The value of an option goes down as it gets closer to its expiration.

Also Read: Purpose and Application of Options

Here, we have to note that the relationship will work like this in the case of American options, whereas the relationship is uncertain in the case of European options.

| Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|

| Expiry Time | Increase | Increase | Increase |

| Expiry Time | Decrease | Decrease | Decrease |

Helpful Reading: American and European Options

Implied Volatility of Underlying Asset’s Price

Volatility tells about the rate of change (up and down) in the price of an asset. The more volatile the asset is, the more expensive its option is. We can say that the option of a volatile stock will cost more than an option of a non-volatile or less volatile stock. This is because volatile stocks can result in big profits for investors, and thus, they cost more.

| Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|

| Volatility | Increase | Increase | Increase |

| Volatility | Decrease | Decrease | Decrease |

Risk-free Interest Rate

Two things happen when overall interest rates increase

- Investors’ Expectations of their required rate of return also increase.

- On the other hand, the present value of expected cash flow to the option holder decreases due to a higher discounting rate.

The overall impact of these two points can technically make the call options costlier and decrease the value of the put options.

| Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|

| Interest Rate | Increase | Increase | Decrease |

| Interest Rate | Decrease | Decrease | Increase |

This relationship is a bit hazy because we are assuming an increase in interest rate with all factors remaining the same. Generally, when the interest rate increase, stock prices decrease. If we take both the ‘increase in the interest rate’ and ‘decrease in stock prices’ into account, it will decrease the value of call options and increase the value of put options.

| Factor | Change in Factor | Other Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|---|---|

| Interest Rate | Increase | Stock Price | Decrease | Decrease | Increase |

| Interest Rate | Decrease | Stock Price | Increase | Increase | Decrease |

Expected Dividend

Dividends impact the price of the option because of their effect on the price of the underlying stock. In general, a stock price is expected to lose value by the amount of dividends. So, a high dividend means a lower call price and a higher put price.

| Factor | Change in Factor | Call Option Price | Put Option Price |

|---|---|---|---|

| Dividend | High | Decrease | Increase |

| Dividend | Low | Increase | Decrease |

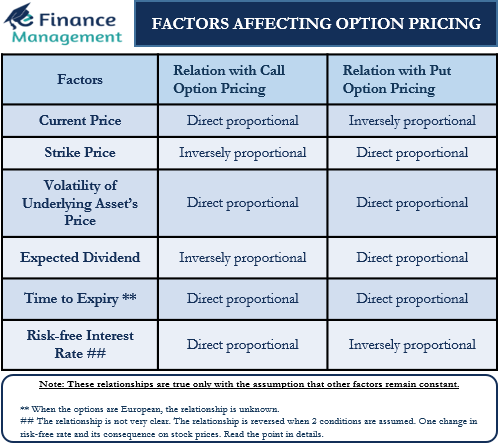

Summary

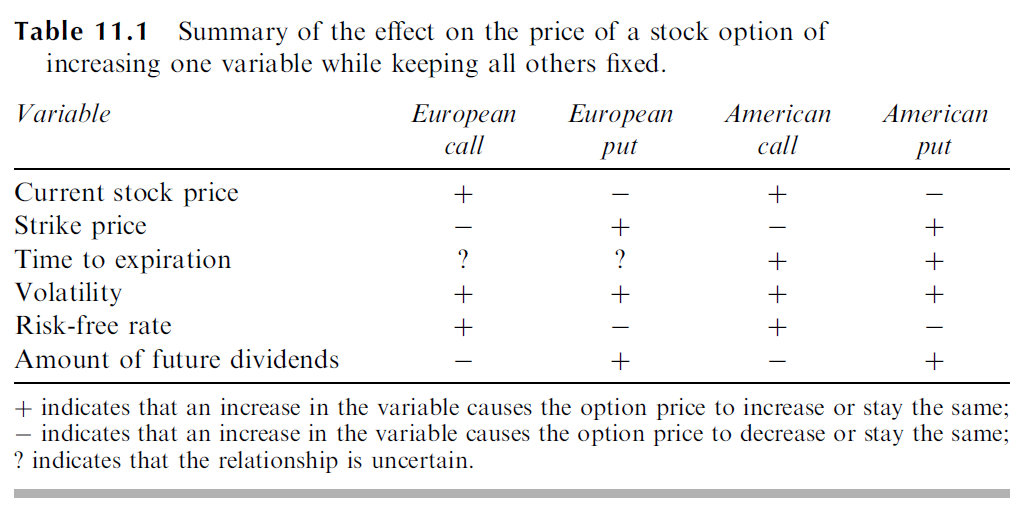

Following is a summary of the impact of these factors on the options pricing. This table has been taken from the 9th Edition of the Book – Options, Futures, and Other Derivatives by John C. Hull.

So, all the above factors have some degree of impact on the price of an option. However, investors and traders don’t have control over all the factors. Rather, they can mainly decide the expiry date of the option and the strike price. Thus, it is important that they select the strike price and expiration that meets their requirements.

RELATED POSTS

- What are Options in Trading – Types, Pros, Cons, and More

- Option Pricing Model

- Put Options – Meaning, How it Works, Strategies, and More

- Call Options – Meaning, How it Works, Uses, and More

- Buying Call vs Selling Put – Meaning, Example, and Differences

- In the Money and Out of the Money – All You Need to Know