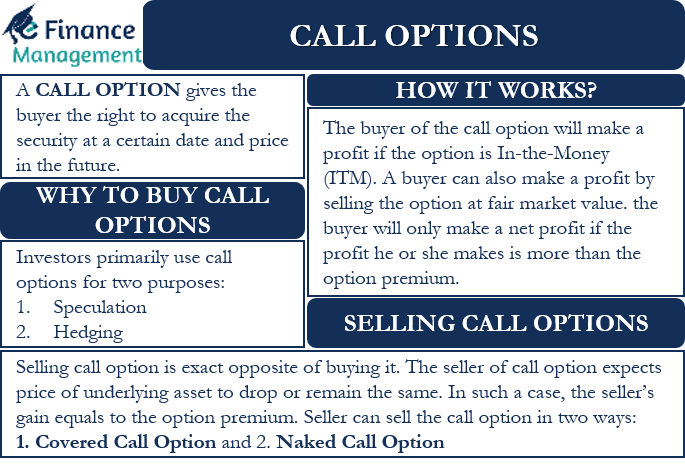

Call Options is one of the two types of options, with the other one being the put option. A call option gives the buyer the right to acquire the security at a certain date and price in the future. The underlying asset could be anything, such as shares, commodities, bonds, or more. The buyer of this option makes a profit if the price of the security goes up. This profit is the payoff for the call option.

A point to note is that the buyer of the option is not under the obligation to exercise the call option. However, here the seller is indebted with an obligation. Because if the buyer elects to exercise the right to buy, then the seller has no option but to sell the contracted security to the buyer of the call option. Further, a buyer can use the option anytime before the maturity of the option.

More About Call Options

A call option or any option per se can have three variants – Out of the Money, At the Money, or In the Money.

A call option becomes Out of the Money (OTM) whenever and wherever the strike price is higher than the market price of the underlying security. In this case, the holder will not exercise the option, and the option would get worthless upon expiry. Instead of buying and honoring the contract, the buyer would be better off buying the security in the open market that is available at a lesser than the contracted price.

A call option becomes At the Money (ATM) if the strike price and the market price are the same. In this case, again the holder will not exercise the option, and it would get worthless upon expiry.

However, whenever the contract’s strike price is lower than the market price of the security, a call option will be called as In the Money Option (ITM). Such options are valuable as the holder would exercise it, or sell it to another buyer to make a profit. An In the Money call option gets automatically exercised at the expiry.

When a buyer buys a call option, we call it a ‘Long Call Option’ while the selling of the call option is a ‘Short Call Option.’

How Call Options Work?

The buyer of the call option will make a profit if the option on the day of expiry becomes In-the-Money (ITM). This means when the rate of the security is more than the strike price at the expiry. In such a case, the buyer will use the option to buy the asset at the strike price and sell it in the open market to make a profit. A buyer can also make a profit by selling the option at fair market value.

A point to note is that the buyer will only make a net profit if the profit they make is more than the option premium. The option premium is the money that the holder pays to purchase the option.

For example, Mr. X buys a call option for 200 shares of Company XYZ at a premium of $100. The strike price is $60, and the expiry date is three months after. This option gives Mr. X the right to buy 100 shares of Company XYZ at $60 at or before three months, irrespective of the market price of the shares at the time.

Now suppose a day before the expiry (three months), Company XYZ shares are trading at $65. Mr. X will now exercise the option and will buy the shares at $60. This way he will make a profit of $500 ($65 * 100 less $60 * 100). However, the net profit will be $400 ($500 less the $100 option premium).

Rather than exercising the option, Mr. A can also sell the option to any other buyer before the expiry. The value of the call option will rise if the price of the underlying asset rises before the expiry. So, this way, Mr. X would also be able to lock a profit.

Selling Call Options

If you have not already given a thought, then for every call option that the holder buys, there is a call option that the other party sells. Selling the call option is the exact opposite of buying it. While the buyer believes that the price of the security will move upwards, the seller of the call option expects the price of the underlying asset to drop or remain the same. In such a case, the seller’s gain equals to the option premium he receives on selling the option contract.

However, the downside risk in the case of selling the call option is theoretically unlimited. This is because the price of the asset can go up to any amount. In such a case, the seller would incur a huge loss. We call the seller of the call option as writers and the call option as a short call option.

For example, Mr. A sells a call option for Company X share at a strike price of $10 and expiry after two months. The option premium is $1. If near to the expiry, the share price drops to $8, the buyer will not exercise the option, and Mr. A will make a profit of $1 equivalent to the option premium received while selling the contract.

But, if near to the expiry, the share price moves up to $12. In this case, the buyer will use the option and Mr. A will have to sell the Company X share at $10. So, Mr. A will first buy it for $12 and then sell it for $10. The net loss for Mr. A will be $1 per share ($2 less $1 premium).

Selling a call option is a risky strategy as the loss potential is unlimited whereas the profits are limited to the quantum of premium. The biggest plus of selling a call is that the seller receives the premium upfront, or there is no initial outflow of cash.

There are two ways in which a seller can sell the call option:

Covered Call Option

In this strategy, the seller sells the option on the stock that he already owns. The seller, in this case, makes a gain equivalent to the option premium. This is because if the price of the stock goes above the strike price, the seller will be able to deliver the shares from his holdings without buying at the market price. We can say that seller will not incur any real loss.

Naked Call Option

This is the opposite of the above option. In this, the seller sells the calls option even though they do not own the underlying share. Such a type of selling is very risky as the seller does not have any cover for the losses.

Why Buy Call Options?

Investors primarily use call options for two purposes:

Speculation

Traders use the option to make a profit by speculating on the price movement of the asset. Such investors do not have any intention to take the delivery of the asset at the expiry. For instance, if an investor expects the price of a particular share to go up in the future, they may buy a call option. If the market price goes beyond the strike price, the investor will exercise the option or simply sell the option to another buyer for a profit.

The investor will only lose the option premium if the stock price drops. The fact that options have limited downside risk for the buyer makes them popular among investors.

Hedging

Investors and businesses use the call option to hedge their risk as well. For instance, if a business expects the price of a crucial raw material (commodity) to rise in the future, it can lock the desirable price by using a call option. Investment banks and other financial institutions also use this option to hedge their risk with regard to interest rate and currency rate fluctuations.

We can say that similar to insurance, using this option opposite to the position one has in an asset, helps to hedge the risk in case of unfavorable market movement. Traders also use this option to hedge their short stock portfolios.

Final Words

Call Options play a crucial in the financial world. They give investors the flexibility in implementing their investment strategies. It also enables them to profit from the price movement of the underlying asset without actually buying it. Moreover, they are a useful financial instrument that businesses and investors use to hedge their risk.

Also, read – Put and Call Options.

Frequently Asked Questions (FAQs)

A call option gives the buyer the right to acquire the security at a certain date and price in the future.

Selling the call option is the exact opposite of buying it. The seller of the call option expects the price of the underlying asset to drop or remain the same. In such a case, the seller’s gain equals the option premium.

A seller can sell the call option in two ways:

1. Covered Call Option: Here, the seller sells the option on the stock that he already owns and makes a gain equivalent to the option premium.

2. Naked Call Option: In this, the seller sells the calls option even though they do not own the underlying share.

When a buyer buys a call option, we call it a ‘Long Call Option’ while the selling of the call option is a ‘Short Call Option.’

The buyer of the call option will make a profit if the option is In-the-Money (ITM). This means when the price of the security is more than the strike price at the expiry.

A point to note is that the buyer will only make a net profit if the profit they make is more than the option premium.