In this article, we look at what put, and call options mean. We begin with a bit of a background study of future transactions. We then move on to the definitions and examples of put and call options.

What is a Futures Transaction

A trader carries out what is known as a futures transaction when he buys some goods at a predetermined price and at a predetermined date. E.g., an investor may buy wheat before the harvest has happened that year.

- What is a Futures Transaction

- Futures- Commodities Market Example

- Options – Definition

- Options – Features

- Consequences of Trading Options

- Put and Call Options

- Call Option – Definition

- Call Option – Example

- Put Option- Definition

- Put Options- Example

- Which kind of Put should you Buy?

- Reasons for Increase or Decline in Value of Put and Call Options

Futures- Commodities Market Example

A trader may, for example, buy 10 quintals of wheat for $850, which is to be paid after 6 months. During this time, the wheat market may fluctuate, and the price for wheat may go down or up. When there are favorable weather conditions for a wheat crop to grow, the price may increase. Say the global demand for wheat goes perhaps because demand for maize is up, then the price of wheat may go down. The trader needs to be tuned in to this information, and based on it, he can make a profit or a loss when he sells his wheat option.

Options – Definition

Futures transactions are also prevalent in the highly volatile yet very specialized derivatives market. Among the range of diverse derivatives, an option is perhaps one of the most common forms.

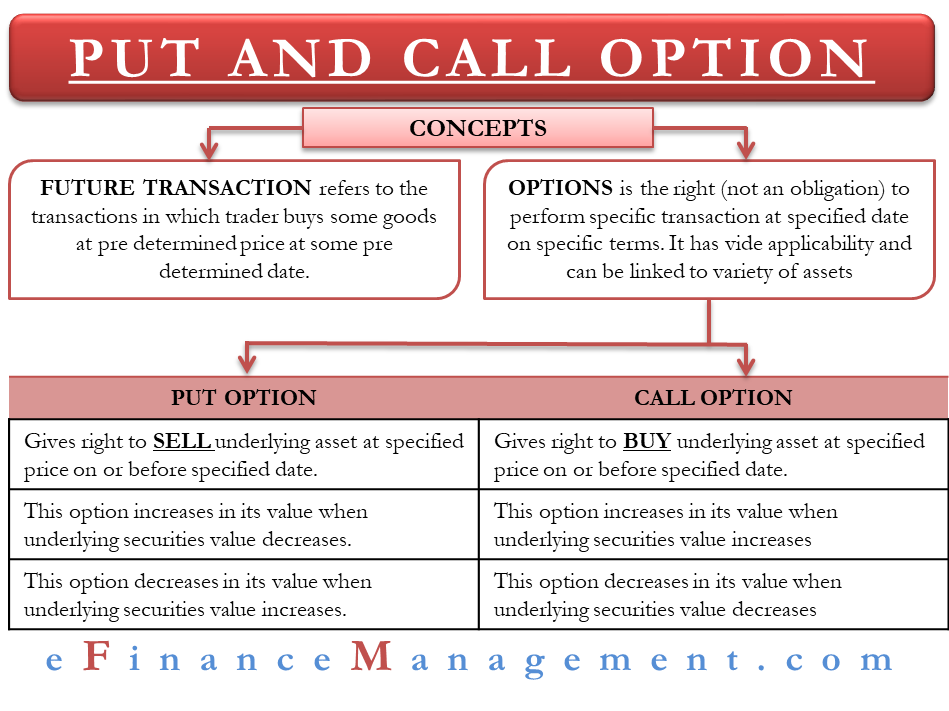

An option is a provisional contract that gives one the right to perform a transaction with the other at a specified date on specified terms. It only gives the right but not the obligation until it’s due.

Options – Features

- Options have wide applicability. A company might issue a contract in the form of a bond. This bond may, for instance, promise to buy back ten years later at a set price. These options are traded as stand-alone instruments on exchanges- also known as OTCs.

- OTCs may be linked to a wide variety of underlying assets. Underlying assets could be stocks, currency, commodities, swaps, bonds, etc.

- Many investors consider options to be an ideal instrument for large institutional investors. However, this is not the case. Individuals, too, can certainly avail of the benefits of investing in options. The flexibility and leverage that these instruments offer are especially beneficial for individual investors.

Consequences of Trading Options

The disadvantage with options is that they come with an expiration date. If you fail to exercise your option or sell your option before the expiration date, you will lose your entire investment.

Put and Call Options

There are two main types of options: Call and put options. In this post, we try to understand what these two options mean. We also consider why their values fluctuate and why they should consider as part of a futures transaction.

Call Option – Definition

A call option gives an investor the right to buy a stock from the individual or institutional investor who sold you the call option at a specific price on or before a specified date.

Call Option – Example

For instance, if you bought a call option on Magna Industries, the option terms would state that you could buy the stock for, say, $50 (the strike price) at any time before the third Friday in January (the expiration date). What this means is that if Magna Industries rises anywhere above $50 before the third Friday in January, you can buy the stock for less than its market value. In case you don’t plan to buy the stock yourself or exercise the option, you can sell your option to someone else for a profit.

The drawback is if Magna Industries never rises above $50, your option won’t be worth anything because nobody wants to buy an option that allows them to buy a stock for a higher price than the market rate.

Put Option- Definition

A put option gives an investor the right to sell a stock to the individual or institutional investor who sold you the put option at a specific price on or before a specified date.

Put Options- Example

For instance, let us assume you bought a put option on TVS Motors. The option would come with terms allowing you to sell the stock for, say, $50 (the strike price) any time before the third Friday in February (the expiration date).

What this means is that if TVS Motors falls anywhere below $50 before the third Friday in February, you can sell the stock for more than its market value. If you are not interested in selling your stock, you can always sell your option to another investor at a profit.

Which kind of Put should you Buy?

Ideally, you shouldn’t purchase a put option on a stock that you own. This is because any gains you might make on the put option would be offset by the losses you would incur on the stock.

Instead, you should buy a put on a stock that you don’t own right before you are ready to exercise the put. For instance, if you have purchased a put on TVS Motors with a strike price of $50, and the stock dropped to $45, you could go out into the open market, buy the stock for $45, and turn around and sell it for $50, making a $50 profit.

Reasons for Increase or Decline in Value of Put and Call Options

Calls increase in value when the underlying security’s value is increasing. Similarly, they decrease in value when the underlying security is declining.

The value of put options increases when the underlying security declines in value. Similarly, when the value of the option declines, the value of the underlying security increases. The key here is to anticipate what is about to happen in the markets. One can then purchase either a put or a call and accordingly profit from it.

RELATED POSTS

- Purpose and Application of Options

- Futures vs Options – All You Need To Know

- What are the Factors Affecting Option Pricing? How and Why?

- Call Options – Meaning, How it Works, Uses, and More

- Buying Call vs Selling Put – Meaning, Example, and Differences

- Interest Rate Options – Meaning, How it Works, Example and More