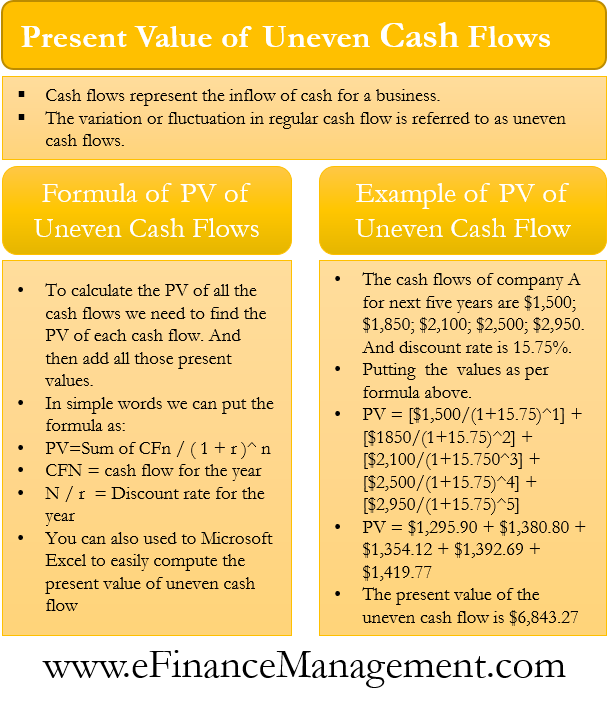

Cash flows represent the inflow of cash for a business. Regular cash flow and proper planning thereof are very crucial for all businesses. However, in the real world, there is no certainty of the amount or the timing of cash flows for an active business. This means a cash flow of one year would not be the same as of other years and can vary month on month, year on year, and so on. This variation or fluctuation in regular cash flow is referred to as uneven cash flows. In order to get an accurate picture of a business, we need to calculate the present value of uneven cash flows. PV calculation will even out this variation and timing of the cash flows.

Apart from a business, one can relate the concept of cash flows with most of the assets. And most assets generate uneven cash flows. One good example of an uneven cash flow is the dividends on the common stock or interest from a floating-rate bond.

Present Value of Uneven Cash Flows

The timing and amount of cash flows can be uneven in the real world. Such cash flows are termed as uneven or irregular. We can also say that the cash flows that don’t adhere to the principles of annuity are uneven cash flows. For example, if the cash flows of a company are $50, $50, $40, $70, and $70, these are uneven cash flows.

So, when cash flows are unequal and irregular, the usual formulas to calculate the present value or annuity won’t work. Therefore in order to calculate the PV (present value) of such uneven cash flows, we need to calculate and arrive at the present value of each cash flow separately. And then finally, add all the resultant values to get the PV for all the cash flows under consideration.

Also Read: PV of Uneven Cash Flows Calculator

This is what makes the calculation of the PV of uneven cash flows cumbersome and time-consuming. However, we do have online calculators and excel to speed up the calculation.

Formula to calculate PV of Uneven Cash Flows

As discussed above, to calculate the PV of all the cash flows, we first need to find the PV of each cash flow. And then add all those present values.

For calculation, you can use PV Uneven Cash Flow Calculator.

Following is the formula to calculate the PV of uneven cash flows:

| CF0 | CF1 | CF2 | CFN | |||||||

| PV | = | —– | + | —– | + | —– | + | —– | + | —– |

| (1 + r)0 | (1 + r)1 | (1 + r)2 | (1 + r)N |

In simple words, we can put the above formula as:

PV = Sum of CFn/(1 + r)^n

In the above formula,

n is the number of years, CFN is the cash flow for the year, and n and r is the discount rate for the year. The discount rate is generally the opportunity rate or interest that an asset could generate elsewhere.

Example: PV of Uneven Cash Flows

An example would help in clarifying the calculation of the present value of uneven cash flows.

Mr. X has installed a machine in his factory with a view to generate higher revenues. Net cash flows due to installing such machinery are as follows:

Also Read: Net Cash Flow Calculator

| Year | 1 | 2 | 3 | 4 | 5 |

| Net cash flows ($) | (1,250) | (1,000) | 1,100 | 1,450 | 1,500 |

He wants to calculate the present value of these cash flows at a discounting rate of 10%

PV of Uneven Cash Flows = (-1,250) (1 + 0.1)1 + (-1,000) (1 + 0.1)2 + (1,100) (1 + 0.1)3 + (1,450) (1 + 0.1)4 + (1,500) (1 + 0.1)5 = 785.39

A clear presentation of the same is as follows:

| Year | Net Cash Flows | PV of Factor $1 @ 10% | PV of Cash Flows |

| 1 | -1,250 | 0.909 | -1,136.36 |

| 2 | -1,000 | 0.826 | -826.45 |

| 3 | 1,100 | 0.751 | 826.45 |

| 4 | 1,450 | 0.683 | 990.37 |

| 5 | 1,500 | 0.621 | 931.38 |

| Total | 1,800 | 785.39 |

Interpretation

The present value of uneven cash flows helps the investor in analyzing the profitability of an investment. In the example above, the total net cash flows are $1,800 while its present value is $785.39 only. If the investor makes a decision on the basis of net cash flows, it may suffer a huge loss. This simply means that the present value of cash outflows may be more than the present value of cash inflows.

Therefore, as the time horizon increases, the present value of future cash flows decreases due to the discounting effect of interest.

Calculation in Excel

In case we find the manual calculation difficult, you can take the help of several online calculators available online. To avail of online calculators, all we have to do is put the details in the relevant boxes, and you will get the result automatically.

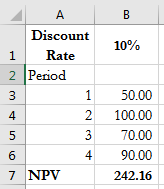

Microsoft Excel can also be used to easily compute the present value of uneven cash flows. In excel, you need to use the NPV function to compute the present value of cash flows. Here, you need to prepare a worksheet with details, including discount rate, cash flows, etc.

Let’s see how to prepare worksheets in excel to get the PV of uneven cash flows by taking a very simple example.

Now, the excel formula will be =NPV(B1, B3:B6) = 242.16. This will calculate and provide us with the present value of these uneven cash flows, i.e., $242.16.

Cautions

One has to be very careful while calculating the PV of uneven cash flows as a small mistake may lead to a huge difference and eventually result in a loss.

mula will be =NPV(B1, B3:B6) = 242.16. This will calculate and provide us with the present value of these uneven cash flows, i.e., $242.16.

Quiz on Present Value of Uneven Cash Flows

This quiz will help you to take a quick test of what you have read here.