In the business world, we would regularly come across the terms: shareholders and equity holders. Both these terms are often loosely used interchangeably. Though the two terms refer to investors having ownership in the company, these two terms are different from each other. Thus, it is crucial to know and understand the difference between shareholders and equity holders.

Both these terms thus simply convey that the holders have an ownership interest in the firm. Hence, both these terms have an association with the ownership concept. However, they are not exactly the same. We can say that shareholders are a specific type of equity holders. Or we can also say that an equity holder is a broader term that includes shareholders and everyone else who owns an interest in the company.

Shareholders

A shareholder is an investor who owns shares in a firm, either public or private. An investor may buy a share through IPO, secondary market, or through private placement. Buying a share in a company means owning some part of the company in proportion to the company’s total outstanding shares/outstanding share capital.

For example, the total outstanding shares of a company are 10,000, and an investor buys 10 shares. In this case, the investor would own 1% of the company.

Also Read: Stocks vs Shares – All You Need To Know

Shares are primarily of two types: common and preferred. Common shares are the stock that is traded on the stock exchanges. The prices of these shares fluctuate regularly. Owing a common share gives shareholders voting right as well. However, the common shareholders, despite being part owners of the company, do not have any control over the operations of the company.

Preference shares, on the other hand, represent an equity interest that usually entitles the investors or holder of preference shares to a set dividend every year. This is why the price of the preference shares depends more on the dividend amount.

Both common stock and preferred stock owners are the shareholders of the company.

Equity Holders

An equity holder is a broad term and refers to anyone who owns an ownership stake in a business. Any kind of ownership in a firm is called equity. Thus, anyone who owns any equity in a firm is an equity holder. Therefore, every shareholder is also an equity holder.

The above description of a shareholder and equity holder may be a little confusing as they more or less refer to the same thing. To better understand the difference between shareholders and equity holders, it is crucial to understand the three concepts below.

Also Read: Shareholders Vs Stakeholders

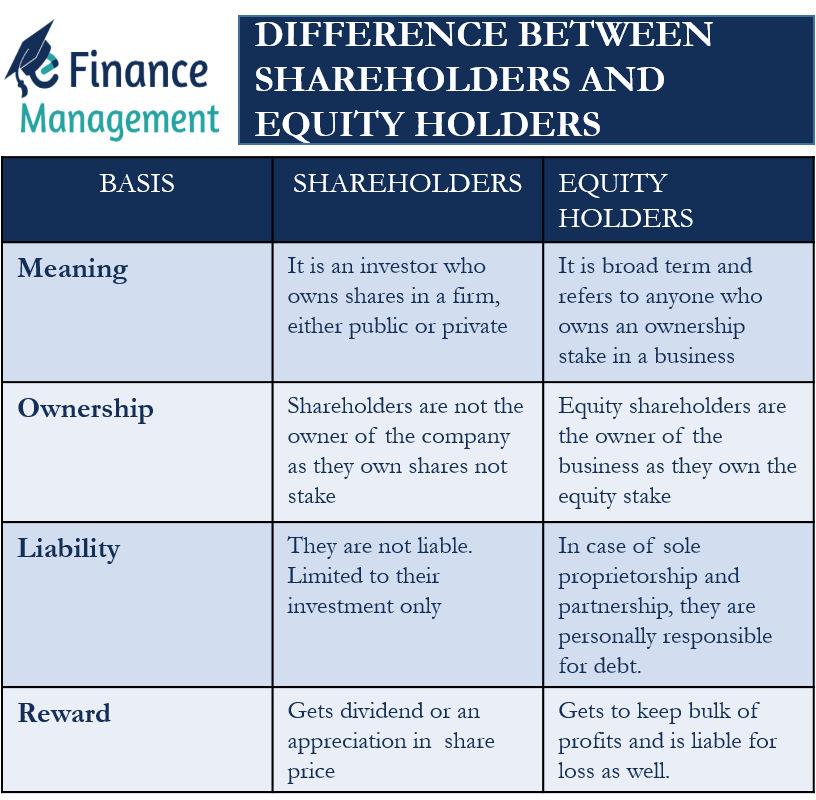

Difference Between Shareholders and Equity Holders

The following three concepts will help to bring out the difference between shareholders and equity holders:

Ownership

To understand the primary difference between equity holders and shareholders, one needs to understand that ownership in a business is not always due to buying shares or stock in a business. Owing to the structure of a business, the owners of the business automatically become equity holders of the business. These are especially true for businesses that do not issue shares. Since such businesses do not issue shares, they do not have shareholders. Instead, they have only equity holders.

Sole Proprietorship or partnership is the business structure that does not have anything sort of shares as part of its capital. In a sole proprietorship, it is the owner who owns 100% of the equity stake in the company. And in partnership, each partner owns an equity stake in the business. In both these cases, the owners own an equity stake in the company but not shares. So, they are not the shareholders; instead, they are the equity holders.

On the other hand, companies could be owned by many people, and these are the shareholders. A shareholder could be a company or an individual. Also, unlike the equity holders who own an equity stake due to the structure of the business, one becomes a shareholder and gets an ownership stake by buying shares of the company.

Liability

Another thing that brings out the difference between shareholders and equity holders is a liability towards business. Usually, if you are an equity holder, you have a personal liability towards the business. But it is not true for the shareholders.

For a shareholder, the risk is limited to their investment. For instance, if a company goes bankrupt, then the most a shareholder can lose is 100% of their investment. So, a shareholder can not be held liable for the debt of the firm. Thus, no other stakeholder can sue the shareholder.

On the other hand, other types of equity holders, such as in the case of sole proprietorship and partnership, are personally responsible for the company’s debt.

Reward

The reward is another thing that differentiates between a shareholder and an equity holder. In terms of rewards, a shareholder may get a dividend or an appreciation in the share price. On the other hand, an equity holder gets to keep the bulk of the profits and is liable for the loss as well.

Final Words

The primary difference between shareholders and equity holders is because of the structure of the business. For instance, a company that issues shares will have shareholders. Also, one can become a shareholder by buying shares of a company. Therefore the key for understanding the difference between these two terms in a simplified manner is “An equity holder need not necessarily be a shareholder, but a Shareholder can be an equity holder. Moreover, by buying shares in a company, an equity holder too can become a shareholder.”

Continue reading – Shareholders Vs. Stakeholders.