When starting a business, one of the fundamental decisions to make is determining the type of business ownership. The choice of business ownership structure can have significant implications for various aspects, including legal responsibilities, tax obligations, management control, and liability protection. Understanding the different types of business ownership is essential for entrepreneurs and aspiring business owners to make informed decisions about their ventures.

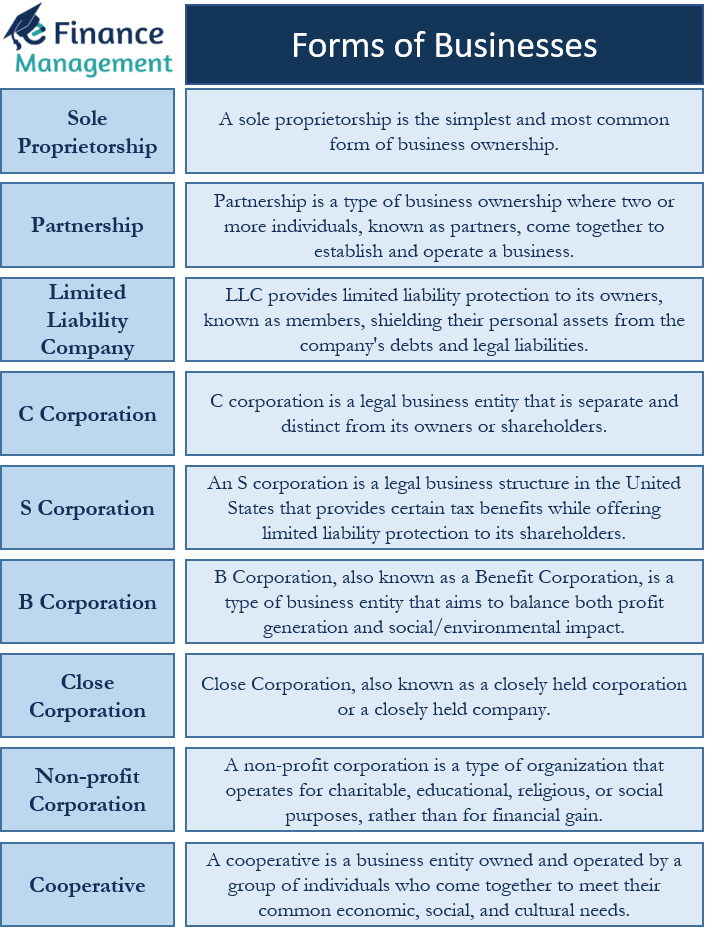

9 Forms of Businesses

Forms of Business Ownership In this guide, I will explore the various forms of business ownership commonly encountered in the business world. I will delve into the characteristics, advantages, and disadvantages of each ownership structure to help you gain a comprehensive understanding of your options. By exploring the types of business ownership, you’ll be better equipped to choose the structure that aligns with your goals, preferences, and the nature of your business.

Sole proprietorship

A sole proprietorship is the simplest and most common form of business ownership. In this structure, a single individual owns and operates the business. Here’s an overview of a sole proprietorship, along with its advantages, disadvantages, and an example:

Advantages

- Easy and inexpensive to set up

- Direct control over business decisions

- Retention of all profits

- Simplified tax reporting

Disadvantages

- Unlimited personal liability for business debts.

- Limited access to external funding.

- Sole responsibility for all aspects of the business.

- Lack of continuity without a succession plan.

Example

Sarah runs a small bakery called “Sweet Delights.” She owns and operates the business on her own, preparing and selling a variety of pastries and baked goods. Sarah is responsible for everything, from baking to marketing, managing finances, and interacting with customers. All profits and losses from Sweet Delights are reported on Sarah’s personal tax return, and she has unlimited liability for any debts or legal issues the business may encounter.

Also Read: Partnership

Partnership

Partnership is a type of business ownership where two or more individuals, known as partners, come together to establish and operate a business. Let’s delve into the concept of partnerships, exploring their advantages, disadvantages, and real-life example.

Advantages

- Shared responsibilities and decision-making.

- Access to a wider pool of skills, knowledge, and resources.

- Shared financial burden and risk.

- Ability to bring complementary expertise and perspectives.

Disadvantages

- Shared liability for business debts and legal obligations.

- Potential for disagreements and conflicts between partners.

- Lack of centralized decision-making authority.

- Limited ability to raise capital compared to corporations.

Example

John and Mary form a partnership to open a marketing agency. They contribute their respective skills and expertise, share the workload, and make joint decisions. Both partners are personally liable for the agency’s debts, but they benefit from shared responsibilities and the pooling of resources to grow their business.

Limited Liability Company

A Limited Liability Company (LLC) is a legal business entity that combines elements of a corporation and a partnership or sole proprietorship. It provides limited liability protection to its owners, known as members, shielding their personal assets from the company’s debts and legal liabilities.

Advantages

- Limited personal liability for business debts and obligations.

- Flexible management structure and decision-making.

- Pass-through taxation, avoiding double taxation.

- Ability to attract investors by offering ownership interests.

Disadvantages

- More complex and costly to establish and maintain compared to sole proprietorships or partnerships.

- Formalities and regulatory requirements vary by jurisdiction.

- Potential for disputes and conflicts between members.

- Limited ability to raise capital compared to corporations.

Example

Jane and Mike form an LLC to open a restaurant. As members of the LLC, they enjoy limited liability protection, shielding their personal assets from business liabilities. They have flexibility in managing the restaurant and can allocate profits and losses according to their agreed-upon ownership interests. The LLC structure provides them with favorable tax treatment, and they can also bring in additional investors by offering membership interests in the company.

Also Read: Sole Proprietorship

C Corporation

C corporation is a legal business entity that is separate and distinct from its owners or shareholders. It is one of the most common forms of business structure in the United States. The name “C corporation” comes from the subchapter C of the Internal Revenue Code, which outlines the tax rules for this type of entity.

Advantages

- Limited liability protection for shareholders, separating personal assets from business debts and liabilities.

- Ability to raise capital by selling shares of stock to investors.

- Perpetual existence, allows the corporation to continue its operations even with changes in ownership.

- Potential for tax advantages, such as deductible business expenses and the ability to provide employee benefits.

Disadvantages

- Double taxation is when a company is taxed on the money it makes, and then the people who own shares in the company are also taxed on the money they receive as dividends. It’s like getting taxed twice on the same money.

- More complex and costly to establish and maintain compared to other business structures.

- Formalities and compliance requirements, including regular shareholder meetings, record-keeping, and filing separate tax returns.

- Less flexibility in profit allocation and ownership structure compared to other entities.

Example

Examples of well-known C corporations include large publicly traded companies like Apple, Microsoft, and Coca-Cola.

S Corporation

An S corporation, or S corp, is a legal business structure in the United States that provides certain tax benefits while offering limited liability protection to its shareholders. It is named after Subchapter S of the Internal Revenue Code, which governs the tax rules for this type of entity.

Advantages

- Pass-through taxation is a system where the profits and losses of a company are directly included in the tax returns of its owners. This helps to prevent paying taxes twice on the same money. It’s like when you share a pizza with your friends and each person only pays for their own slices, instead of paying for the whole pizza separately.

- Potential tax savings by avoiding self-employment taxes on the portion of income classified as distributions.

- Ability to have up to 100 shareholders who must be U.S. citizens or residents, allowing for a more closely held and controlled business structure.

Disadvantages

- Stricter eligibility requirements include restrictions on the number and type of shareholders, only one class of stock, and specific ownership limitations.

- Limited ability to raise capital compared to C corporations, as S corporations cannot issue different classes of stock or have non-U.S. resident shareholders.

Example

XYZ Corporation is an S corporation in the consulting industry with actively involved shareholders. The structure provides limited liability protection, safeguarding personal assets. The corporation benefits from pass-through taxation, avoiding double taxation and potentially reducing self-employment taxes for shareholders. However, eligibility requirements limit the number and type of shareholders, affecting capital raising and foreign investments. Despite these restrictions, the S corporation structure proves advantageous for XYZ Corporation and its shareholders in the consulting industry, offering tax benefits and liability protection.

For more details, refer to C Corporation Vs S Corporation

B Corporation

B Corporation, also known as a Benefit Corporation, is a type of business entity that aims to balance both profit generation and social/environmental impact. Here are the advantages and disadvantages of a B Corporation, along with an example:

Advantages

- B Corporations have a legal obligation to consider the impact of their decisions on various stakeholders, including employees, communities, and the environment. This allows businesses to align their mission and values with their operations, promoting sustainable practices and positive social impact.

- By becoming a B Corporation, businesses gain legal protection for their social and environmental commitments. Shareholders and directors are shielded from legal action by stakeholders if decisions are made in line with the company’s stated mission and values.

Disadvantages

- Corporations typically have additional reporting and transparency requirements compared to traditional business entities. They are required to undergo a rigorous assessment and meet specific performance standards set by B Lab, the nonprofit organization that certifies B Corporations.

Example

The popular ice cream company Ben & Jerry‘s is structured as a B corporation.

Close Corporation

Close Corporation, also known as a closely held corporation or a closely held company, is a type of business entity that combines features of both a corporation and a partnership. Here are the advantages and disadvantages of a Close Corporation, along with an example:

Advantages

- Close Corporations provide more flexibility and control compared to larger publicly traded corporations. Shareholders have greater involvement in decision-making and can maintain a close-knit ownership structure.

Disadvantages

- Close Corporations can have a hard time getting money because they usually can’t sell their shares to the public. They can only ask a small group of people who already own shares or some private investors for money.

Example

A family-owned restaurant operating as a Close Corporation is an example of this business structure. The restaurant is owned and operated by a small group of family members who have direct involvement in the daily operations and decision-making processes. The Close Corporation structure allows the family to maintain control over the business while benefiting from limited liability protection. However, they may face challenges in raising significant capital or expanding the ownership to non-family members due to the restrictions associated with this structure.

Nonprofit Corporation

A nonprofit corporation is a type of organization that operates for charitable, educational, religious, or social purposes, rather than for financial gain. Here are the advantages and disadvantages of a nonprofit corporation, along with an example:

Advantages

- Nonprofit corporations typically enjoy tax-exempt status, meaning they are exempt from paying certain taxes at the federal, state, and local levels. This allows nonprofits to allocate more resources toward their mission and programs.

- Nonprofits often benefit from public trust and support due to their mission-driven nature. People are more inclined to donate or volunteer for organizations that are dedicated to making a positive impact on society.

Disadvantages

- Nonprofit corporations can’t give money or benefits to individuals or shareholders. Instead, any extra money they have has to be put back into their programs and projects. It’s kind of like when you have some extra allowance money and instead of spending it on yourself, you use it to buy things for your school or community.

Example

The American Red Cross is a well-known example of a nonprofit corporation. The organization is dedicated to providing humanitarian aid, disaster relief, and support to individuals and communities in need. As a nonprofit, the American Red Cross benefits from tax-exempt status, which allows them to raise funds and allocate resources to its mission of saving lives and alleviating suffering. However, they must adhere to regulatory requirements and rely on public support to sustain their operations.

Cooperative

A cooperative is a business entity owned and operated by a group of individuals who come together to meet their common economic, social, and cultural needs. Here are the advantages and disadvantages of a cooperative, along with an example:

Advantages

- Cooperatives are democratically controlled, with each member having an equal say in the decision-making process. This fosters a sense of ownership and empowerment among members.

- When a cooperative makes money, the people who are part of it can share in that money in different ways. They can get dividends (which are like rewards) or patronage refunds (which are like getting some money back). This allows members to benefit directly from the cooperative’s success.

Disadvantages

- Cooperatives may face challenges in raising capital as they primarily rely on member contributions and retained earnings. Acquiring external funding can be difficult, which can restrict their growth potential.

- Decision-making in cooperatives can be time-consuming and prone to conflicts among members with differing opinions or priorities. Achieving consensus on critical matters may require extensive communication and negotiation.

Example

Organic Valley is a cooperative society consisting of organic farmers across the United States. It focuses on sustainable agriculture practices, producing organic dairy products, eggs, meat, and vegetables.

How to Choose Suitable Forms of Businesses?

Considering and keeping in mind the following points will assist you in selecting the right form of business:

Debt and Liability

Usually, small businesses and startups go for a sole proprietorship or partnership firm. And obviously takes upon them the entire liability. However, if you are in a high-risk business, or want to limit your liability, then you can go for a more formal structure. A formal structure requires more paperwork and costs more to establish.

Taxes

If one wants to keep the taxes separate from the business, then one should go for a corporation form of business. And, if one does not mind filing the business profits/expenses on his own personal tax returns, then one can go for a sole proprietorship form of business.

Partners or Investors

As we know, a sole proprietorship is a single-owner form. Hence, If there is more than one investor or partner, then the first stage alternate is to go for a partnership form of business. One will have to start a partnership, an LLC, or a limited partnership in such a case.

Hiring Employees

Unlike sole proprietorships, a formal business structure makes it easier to hire more employees down the road. Though an entity can always change its business form whenever they want, it is always better to have a plan ready.

Intentions – Profit or Cause

If the primary objective is to help others and not make a profit, then one should form a non-profit business. Such businesses get tax-exempt status and require less paperwork.

Once we have answered all the above questions and decided on the business form that one wants, the next step should be to check the local and state laws. Knowing the laws fully will help one a great deal in running the business smoothly.

Conclusion

From the simplicity of a sole proprietorship to the complexities of a corporation or a cooperative, each ownership structure offers unique features that can significantly impact the way a business operates and grows. Factors such as legal liability, taxation, decision-making authority, and the ability to raise capital can vary based on the chosen ownership type. Whether you are a sole entrepreneur, considering a partnership, or exploring the idea of forming a corporation or limited liability company, this guide will provide you with the necessary insights to make an informed decision. It’s important to understand that the choice of business ownership is not one-size-fits-all and should be tailored to your specific circumstances and goals.