Owner’s Equity: Meaning

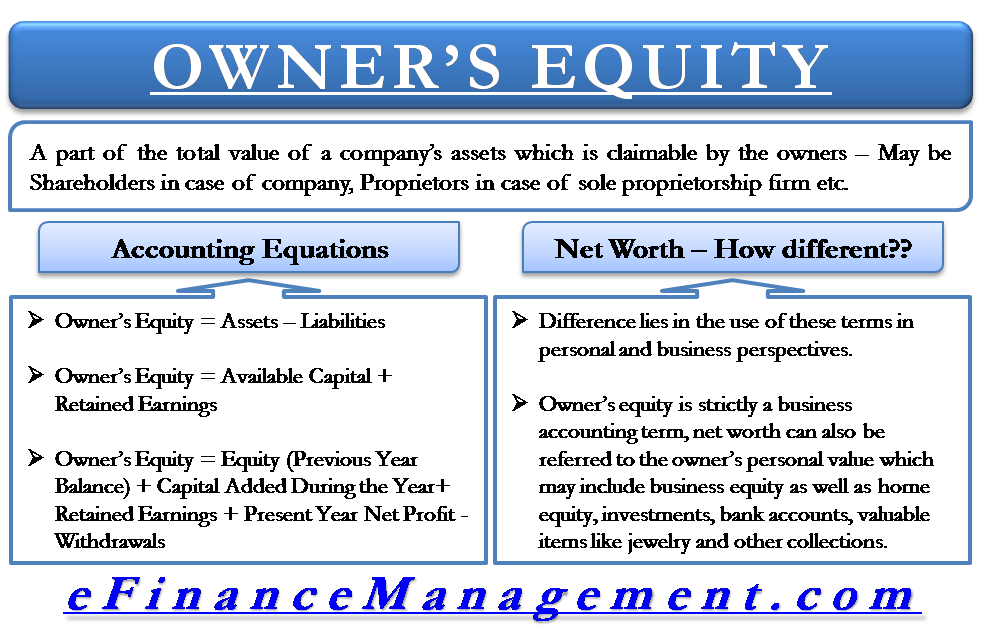

In simple terms, the definition of owner’s equity can be stated as “A part of the total value of a company’s assets which is claimable by the owners (in case of sole proprietorship and partnership firm) and by the shareholders (in the case of a company)”. However, it is better known as stockholders’ equity or shareholders’ equity in the latter case.

Accounting Equations

Numerous accounting equations can be used to define the term in a better way. Here are some of them:

Owner’s Equity = Assets – Liabilities

This is the most common equation used for understanding the meaning of owner’s equity. It is the value obtained by subtracting the liabilities that the owner owes to lenders, creditors, investors, and other sets of individuals from the company’s total assets.

Owner’s Equity = Available Capital + Retained Earnings

In this equation, the owner’s equity is defined as the sum total of business capital and the earnings retained after paying all the liabilities. Let’s take an example in which the capital available to a company at the beginning of a new financial year is $500,000. Now suppose that the owner contributes an additional $30,000 to the capital. And the company’s net income (retained earnings) by the end of the year is $70,000. At the end of the financial year,

Owner’s Equity = $500,000 + $30,000 + $70,000 = $600,000

Suppose that the owner withdraws $20,000 for his personal use during the year. The result would be,

Owner’s Equity = $600,000 – $20,000 = $580,000

So, what is owner’s equity finally?

Owner’s Equity = Equity (Previous Year Balance) + Capital Added During the Year+ Retained Earnings + Present Year Net Profit -Withdrawals

For stockholders’ equity/owner’s equity, withdrawals could be the dividends that are distributed in the case of a company or personal drawings done by proprietor/partners in the case of a firm.

Owner’s equity is also referred at times as the book value of the company as it comes from two main sources, the first being “investment is done in business in the form of capital” and the second being “profits that accumulate in the business.” It represents the current stake held in the business by equity investors of the business.

It is worth mentioning that the owner’s equity may at times be negative. A negative value generally represents the bad business position of the company. While a yearly increasing positive value represents a healthy financial state of business supported by business growth.

Also, read – Other Comprehensive Income.

Owner’s Equity Vs. Net Worth

In general, the owner’s equity and net worth refer to the same value. However, finance or accounting experts should understand the comparison of owner’s equity with net worth. The difference lies in using these terms from personal and business perspectives. While owner’s equity is strictly a business accounting term, net worth can also be referred to as the owner’s personal value, including business equity and home equity, investments, bank accounts, valuable items like jewelry, and other collections.

Generally, increasing owner’s equity year by year indicates a better business position (except in a case where an addition to capital is more than accumulated profits during a period compared). Moreover, it helps keep the companies in the good books of bankers, lenders, investors, and other associates.

Continue reading – Balance Sheet.