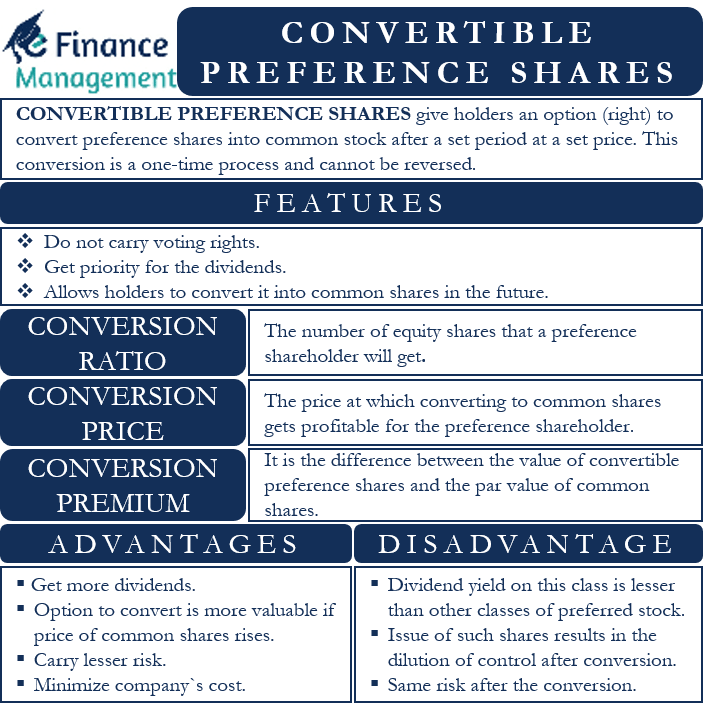

Preference shares are themselves a special type of stock that gives investors some preference over the common stockholders. Convertible preference shares are even more special. They give holders an option (right) to convert preference shares into common stock after a set period at a set price. We can say that they are hybrid instruments having features of both preference shares and common shares.

A point to note is that the conversion is a one-time process, which means you can convert preference shares to common shares once. Or, once you exercise the option, you won’t be able to convert common shares back to preference.

Usually, it is up to the investors to decide when to convert the preferred stock. In some cases, however, the issuer or the company can also enforce the option. Or, while issuing the preference shares, the company clearly states when and how the conversion would take place.

Features of Convertible Preference Shares

Normally, preference shares do not carry voting rights like a common stock. Or, we can say that the preference shareholders do not participate and nor have any say in routine company management decisions. That is why we also call such shares as non-voting stock. Their involvement and participation come only where their rights are getting affected.

Also Read: Types of Preference Shares

To compensate for this, the preference shareholders get priority for the dividends. They get a dividend before the common shareholders. And this is what makes them attractive.

Convertible preference shares are the types of preference shares that carry the same benefits as well. In addition, they have a feature that allows holders to convert it into common shares sometime in the future.

Let’s take an example to better understand the concept of convertible preference shares. Investor A holds a convertible preference stock costing $100 with an option to convert to 10 commons stock one year later. After one year, the value of the common shares is $9. In this case, the investor would be better off by not converting preference shares into equity.

However, if the value of shares reaches more than $10, then it would benefit the holder to exercise the conversion option.

Conversion Ratio, Conversion Price, and Conversion Premium

Conversion Ratio

The number of equity shares that a preference shareholder will get depends on the conversion ratio. It is the issuer that sets this conversion ratio before the issue of the preference shares. For instance, a conversion ratio of 2 implies that the preference shareholder will get 2 common shares for each preference share.

Also Read: Preference Shares and its Features

Conversion Price

There is also a concept of the conversion price. It is the price at which converting to common shares gets profitable for the preference shareholder. Logically, for an investor, the conversion is profitable if the price of common shares they get is more than the amount they invested in preference shares.

For example, a preference share costs $100 and features a conversion ratio of five. This means the conversion price needs to be more than $20 to be profitable for an investor to go for conversion.

Conversion Premium

There is another concept related to convertible preference shares, and it is conversion premium. Similar to common shares, investors can buy or sell convertible preference stock on the secondary market. The market price of the convertible preference shares usually remains the same as the prevailing common stock price.

Basically, the conversion premium is the difference between the value of convertible preference shares and the par value of common shares. The conversion premium shows the correlation between the convertible preference share’s market price and the common stock’s price. The less the premium, the more are the chances of the convertible’s price following the value of the common stock.

We can say that convertibles with more premiums are like bonds, giving investors fewer chances to make a capital profit.

For example, the stock of Company A trades at $25.05. The company has issued convertible preference shares with a conversion ratio of 20 and at a par value of $1000. This means the value of convertible preference shares is $501 (20*$25.05). Conversion Premium in this case will be – $1,000 less $501 = $499 or 49.9%.

Advantages and Disadvantages of Convertible Preference Shares

Buying convertible preference shares give an investor several benefits than directly investing in common shares. These advantages are:

- They get more dividends than the common equity. Also, after conversion, it allows investors to take part in the company’s earnings.

- The option to convert into common stock becomes more valuable if the price of common shares rises. This enables investors to realize some capital appreciation as well.

- Preference shares carry less risk than common stock and also get priority over common shares when it comes to claiming on the company’s assets.

- In case the company goes bankrupt, and the holder doesn’t exercise the option, then the preference shareholder will get preference over the claim on assets.

- To the company, such type of shares helps them to raise capital. Also, since they don’t carry voting right until the investor goes for conversion, it helps the company to keep investor interference in the company’s decision-making at a minimum.

- They are a good option for companies who want to minimize their cost. The convertible stock comes with a relatively low dividend yield.

- Issuing convertible stock enables companies to raise funds at better terms and conditions than equity and bond. Such a source of finance becomes extremely useful for companies with a not-so-good credit rating.

Following are its disadvantages:

- The dividend yield on this class of preference shares is less than other classes of preferred stock.

- After conversion, these shares carry the same risk as other common shares.

- After conversion, the preference shareholders get the same treatment as other equity shareholders in terms of dividends and claim on assets.

- For the company, the issue of such shares (after conversion) results in the dilution of control.

Final Words

Convertible preference shares are both good for the company and investors. For investors, they carry lower risk, along with the potential for more returns in the future. Thus, convertible shares are an attractive option for investors who wish to benefit from the company’s growth and remain insulated from the drop in share price (before conversion). For a company, it is a cost-effective way to raise funds.

However, they suffer from some drawbacks as well. So, while exercising the conversion option, the investors must consider the yield they would get.