Capital Profit and Revenue Profit: Meaning

Profit is a financial gain that commercial organizations make by performing business activities. The very basis of running a commercial organization is to earn profits from its activities. The profit is the difference between the cost price and the selling price of the goods and services.

Capital Profit

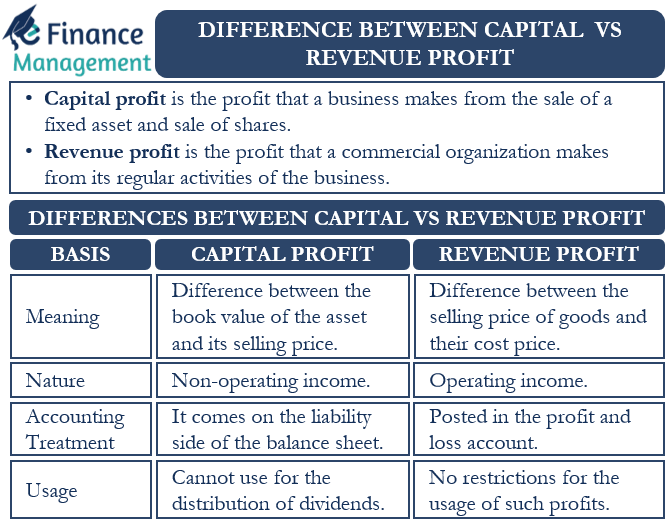

Capital profit is the profit that a business makes from the sale of a fixed asset. Also, it includes the profit from the sale of shares. Such profit is not a regular source of income for a business. It is non-recurring in nature. Organizations do not make such profits through their regular business activities.

Some common examples of capital profit include profit that a business makes by selling its fixed assets such as plant and machinery, land, etc. In the case of the sale of shares, the premium that a company earns on the issue of shares over its face value is a capital profit.

Revenue Profit

Revenue profit is the profit that a commercial organization makes through its regular business activities. Hence it is frequent and recurring in nature. Businesses make such profit by the sale of goods and services.

Also Read: What is the Best Definition of Profit?

A business can earn revenue profit by way of selling its products and services at a higher price than its cost price. Discounts, commissions, and interest also come under revenue profits. Businesses usually load the cost price with the profit margin, which is how the selling price is arrived at.

Capital profit and revenue profit both are important for any business organization. Though both result in an increase in the cash flow, there remain several differences between the two streams of profits.

Differences between Capital Profit and Revenue Profit

Meaning and Nature

As discussed above, the two types of profits differ in their basic nature. A business organization makes capital profits when it sells off a capital asset. And, of course, this could not be a regular feature. This profit is the difference between the book value of the asset as it is appearing on the balance sheet and its selling price. Also, a business can make capital profits by the sale of shares. Capital profit, in this case, will be the issue price of the shares less the face value of the shares multiplied by the number of shares issued. Or the premium collected over and above the face value of the shares is the capital profit.

Revenue profits are the profits that a business organization makes from its regular business activities. This profit is the difference between the selling price of the goods and services and their cost price. However, the revenue profits are not restricted to the selling of goods and services alone. This will also include profits or revenues from commissions, leases, rentals, etc. Therefore, revenue profit is the difference between the operating income and the operating expenditure over a period of time.

Type and Frequency of Activities

A business enterprise earns capital profits through activities that are non-operating in nature. They are irregular and infrequent in nature. Also, a business cannot be sure how often it will receive this type of profit.

But a business earns revenue profits through its general operating activities. They are frequent in nature, and a business earns them regularly. Hence, it can rely upon this source of income as it will receive such income very often and regularly.

Accounting Treatment

As we discussed, capital profit is infrequent and is not part of the routine operating activities of the business, or we can say it is non-trading profit. Hence, capital profit does not flow to the profit and loss statement or income statement of any entity. Instead, it flows to the balance sheet directly. In the balance sheet, we put it under the head “capital reserve” or “securities premium” or “share premium account,” which comes under the broad head “reserves and surplus.” And finally, this comes on the liability side of the balance sheet. Also, we record and pass a separate entry for every individual capital profit instance.

But we post the revenue profits in the profit and loss account. This is so because they are a part of the regular operating activities of a business. The profit from the profit and loss account is later transferred to the general reserve or retained earnings in the balance sheet. We do not record revenue profit entries distinctly. We record them on a daily or regular basis which eventually goes to the P&L account.

Usage

Companies cannot use the capital profit for the distribution of dividends to their shareholders. We transfer them to the capital reserve account that is a part of the equity in the Balance Sheet. Companies use funds from this reserve to offset capital losses or to meet contingencies. Similarly, share premium accounts or securities premium accounts also have certain restrictions on their usage. Companies can use it for specific purposes such as buyback of shares, writing off preliminary expenses, or providing a premium that a company has to pay on the redemption of preference shares or debentures.

On the other hand, companies pay out dividends to their shareholders from revenue profits. There are no restrictions for the usage of such profits. Companies can use it for further investments, meeting daily expenditures, and for other regular business needs.

Example

Let us now look at the accounting entries for these two types of profits with the help of some examples.

Capital profit

Let us assume that a company sells off its spare machinery for $10,000. The book value of machinery at that date is $8,000. Therefore, the capital profit for the company will be $10,000 – $8,000 = $2,000. The journal entry for the same will be:

Bank A/c Dr. $10,000

To Machinery A/c Cr. $8,000

To Capital reserve A/c Cr. $2,000

Thus, the capital profit of $2,000 is transferred to the capital reserve account.

Similarly, now we look at the accounting treatment for the issuance of shares at a premium. A company issues 10,000 shares of the face value of $10 each at $12. The capital profit, in this case, is 10,000 shares x ($12 – $10)= $20,000. The journal entry, in this case, will be:

Bank A/c Dr. $120,000

To Share capital A/c. Cr.$100,000

To Securities premium A/c. Cr. $20,000

Thus, the capital profit of $20,000 is posted to the securities premium A/c.

Revenue profit

In the case of recording of revenue profit, no special account needs to be taken care of. For example, if a business sells goods worth $5000, the journal entry for the same will be:

Bank A/c. Dr. $5,000

To Sales A/c. Cr. $5,000.

These amounts will go to the profit and loss A/c, from where we will calculate the overall profit from all activities of the organization over a period of time. Therefore, the revenue profit will not affect any special account.

Conclusion

Business organizations should correctly identify capital profit and revenue profit so that they can streamline their usage. Also, it is necessary so as to comply with the reporting requirements. Stakeholders should understand that capital profit is irregular and rare. It cannot be relied upon for meeting the regular funds requirements of a business. Hence, it should be used for special purposes that can help replace capital assets in the future or meet contingencies and emergencies. Revenue profits are very important because they are the basis on which companies meet and plan their day-to-day expenses. Regular revenue profits are absolutely essential for the smooth and uninterrupted functioning of any business organization.