Meaning of Foreign Exchange

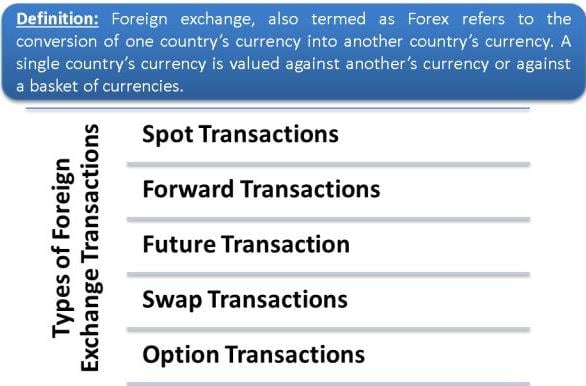

Foreign exchange, also termed Forex, refers to converting one country’s currency into another country’s currency. A single country’s currency is valued against another’s currency or against a basket of currencies.

The global foreign exchange market involves daily volumes ranging in trillions of dollars, thereby making it the largest international financial market in the world. Foreign exchange transactions are executed over the counter, and there is no specific centralized market for the same.

Knowing the meaning of forex, let us now know about the forex market.

Meaning of Foreign Exchange Market

The foreign exchange market is a floor provided for buying, selling, exchanging, and speculation of currencies. The forex market also undertakes currency conversion for investments and international trade. The Forex markets, also termed, Forex markets, consist of investment management firms, central banks, commercial companies, retail forex brokers, and investors.

In understanding the forex market, we will gain an insight into the forex transactions that take place in these markets.

Meaning of Foreign Exchange Transactions

Forex transaction refers to the purchase and sale of foreign currencies. The transactions are done with an exchange of a specific country’s currency for another at an agreed exchange rate on a specific date.

Also Read: Forex Market Participants

Let us move on and know about the types of foreign exchange transactions.

Types of Foreign Exchange Transactions

Forex transactions include all conversions of currencies that may be done by a traveler on an airport kiosk or billion-dollar payments made by financial institutions and governments. The growth in globalization has led to a massive increase in the number of foreign exchange transactions in recent years.

The following are the types of forex transactions:

Spot Transactions

This method of transaction is the fastest way to exchange currencies. Spot transaction refers to the exchange or settlement of the currencies by the buyer and seller within two days of the deal without a signed contract. The Spot Exchange Rate is the prevailing exchange rate in the market.

Forward Transactions

Forward transactions are future transactions when the buyer and seller enter into an agreement of purchase and sale of currency after 90 days. The agreement is framed on the basis of a fixed exchange rate for a definite date in the future. The rate at which the deal is fixed is termed as Forward Exchange Rate.

Future Transaction

Future transactions also deal with contracts in the same manner as forward transactions. However, in the case of future transactions, standardized contracts in terms of features, date, and size should be followed. At the same time, regular forward transactions have flexibility and can be customized. In future transactions, an initial margin is fixed and kept as collateral in order to establish a future position.

Also Read: International Financial Markets

Swap Transactions

Simultaneous lending and borrowing of two different currencies between two investors are called swap transactions. One investor borrows a currency and repays it in the form of a second currency to the second investor. Swap transactions are done to pay off obligations without suffering a foreign exchange risk.

Option Transactions

The exchange of currency from one denomination to another at an agreed rate on a specific date is an option for an investor. Every investor owns the right to convert the currency but is not obligated to do so.

Conclusion

In a nutshell, foreign exchange is the conversion of one currency of a country into the currency of another country in order to settle payments.

Thank You!