Dividend Yield Ratio: Definition

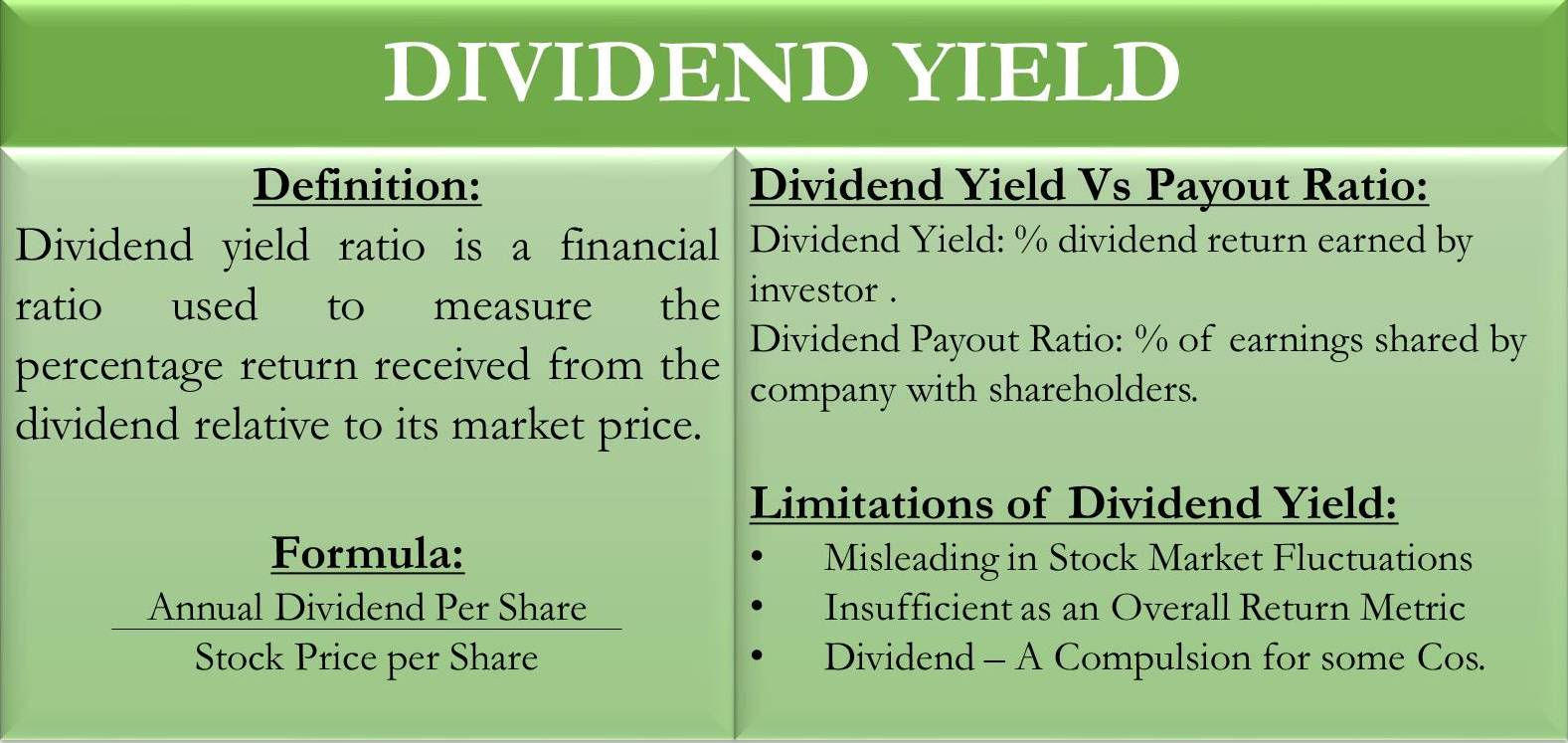

Dividend yield refers to the dividend income earned by the shareholder as a percentage of the market price of the stock. It is a financial ratio that defines the relationship between the dividend per share and the current stock price.

Investments in common stock have two sources of return, i.e.,

- Dividend

- Capital appreciation.

The percentage return received from dividends in comparison to its market price is known as the dividend yield, while the return from capital appreciation is known as the capital gain.

Formula and Calculation

The formula to calculate dividend yield is as follows:

| Dividend Yield = (Dividend per share/Market Price Per Share) * 100% |

Please note that it is always expressed in percentage terms.

By now, we have understood what is dividend yield and the basic formula for the calculation. However, things do not end there. We will go into the depth of the concept and how stock analysts utilize it for their research.

Analysts require even more detailed and prescriptive information about a stock to make a buy or sell recommendation for it. Adequate number crunching goes into the process of determining whether or not the stocks are a worthy buy. The dividend yield is one of those important pieces of information for analysts. Some of the approaches to calculating dividend yield are discussed below:

Also Read: How to Determine Dividend?

Forward Dividend Yields

Forward dividend yields seek to forecast the yield for the coming year. This form of calculation is more accurate if the company has already announced the dividends for a quarter or any other period. Analysts then annualize this dividend to compute the dividend yield for the forthcoming year. If the company has not announced any dividends for the current year, analysts may use the actual dividends declared in the most recent reporting period of the previous year. Analysts may forecast the forward dividend yield assuming the same dividend policy continues.

The formula to calculate forward dividend yield is as follows:

| Forward Dividend Yield = (Future Dividend Payment / Current Market Price) * 100 |

Trailing Dividend Yield

This method is the exact opposite of the forward yield method. In this form of calculation, the actual dividend for the previous 12 months is compared against its current market price. In this manner, the shareholders can set a realistic expectation of the dividend yield in the coming time, irrespective of the share prices. This method is more accurate and gives a better picture of the company’s financial performance. The credibility of this method is higher since it uses actual and not forecasted figures.

The formula to calculate trailing dividend yield is as follows:

| Trailing Dividend Yield = (Total Dividend of Previous 1 Year / Current Market Price) * 100 |

Forward vs Trailing Dividend Yield

| Forward Dividend Yield | Trailing Dividend Yield |

|---|---|

| Uses predictive forecasted numbers on an annualized basis. | Uses actual figures of the dividend declared in the previous year |

| The preferred method when the board has declared a dividend policy for the current year | The preferred method when no information whatsoever is available regarding the current dividend policy |

| It is forward Looking | It is backward-looking |

| It may not be accurate and actual yields may vary | It is more accurate since, based on actual data. |

Explanation with Example

Let us understand the ratio with an example of two companies to understand dividend yield calculation:

| Description | Company X | Company Y |

|---|---|---|

| Earnings per share (EPS) ….(A) | $5/Share | $25/Share |

| Dividend per share (DPS) ….(B) | $2/Share | $12/Share |

| Market Price of Share (MPS) ….(C) | $25/Share | $200/Share |

| CALCULATION OF DIVIDEND YIELD & DIVIDEND PAYOUT RATIO | ||

| Dividend Payout Ratio = (B/A)*100 or DPS/EPS | 2/5 = 40% | 12/25 = 48% |

| Dividend Yield = (B/C)*100 or DPS/MPS | 2/25 = 8% | 12/200 = 6% |

Analysis and Interpretation

A dividend yield of 8% suggests that the investor will get a return of 8% (apart from capital gain) if he buys the stock at current market prices. In the example above, Company X is considered better as it has a yield of 8% compared to 6% of company Y.

The universe of dividend-paying stocks can be divided into high or low-yield stocks. The pattern in which a company pays dividends says a lot about itself. The shareholders and analysts must interpret these signals to grasp what the company wants to convey.

Also Read: Dividend Payout Ratio

High Dividend Yield Stocks

Also known as income stocks, these are famous for yielding a generous rate of return on investment. The investors who prefer these stocks are the ones who require a steady stream of income. Normally pensioners and retired citizens opt for these stocks owing to the regularity of their dividend payments.

However, some investors fail to notice that high-yielding companies are very slow to grow. They pay out a considerable portion of their earnings in the form of dividends. They are left with little to no proceeds to plow back for the growth of the business. One seldom notices significant capital appreciation on such stocks. Established companies or companies in their maturity phase usually go for a higher yield. Utility companies are an example of high-yield stocks.

Low Dividend Yield Stocks

They are also known as growth stocks. Unlike its counterpart, these stocks do not announce high rates of dividends. However, low cash flows from dividend-paying stock do not always mean bad news. A company with stringent dividend policies may indicate that it is diverting earnings to profitable projects. In the face of prosperous opportunities, a high dividend payout is equivalent to throwing away cash. Such companies invest heavily in expansion and development projects. Such projects supplement their bottom line generously in the long run.

Therefore, the investors in these stocks reap their returns in the form of capital appreciation. These are the stocks that go on to become multi-baggers. Investors of low-yield stocks have a larger risk appetite and are in a position to block a number of funds for a considerable period of time.

It should also be noted that the dividend decisions of a company also depend on the company’s industry. For an apple-to-apple comparison, the comparison should be between companies of the same industry.

Disadvantages of Using Dividend Yield as a Metric

Misleading due to Temporary Stock Market Fluctuations

Due to temporary market ups and downs also, the market price of the share may increase or decrease. When prices decrease, the dividend yield ratio would increase and vice versa. So, the investor has to make an adjustment for such fluctuations by taking the average of the last few years’ prices (say, for example, 3 years) so that it does not lead to faulty interpretation.

Insufficient as an Overall Return Metric

Also, it should not be the sole criterion to form an opinion on a company. There are some profitable companies in the market that do not pay dividends as they have profitable investment opportunities, so they choose to reinvest their earnings. These stocks provide a low dividend yield, but they give a better return on capital appreciation.

Dividend – a Compulsion

There are some mature companies that pay a higher amount of their earnings as dividends because they don’t have profitable reinvestment opportunities. These stocks provide a high dividend yield but not necessarily a better return through capital appreciation.

Therefore, only a higher dividend yield does not mean that the company is doing well. You need to use other metrics and criteria for your analysis along with this.

Read Dividend Yield vs Dividend Payout to learn more.

Dividend Yield Fund

Dividend yield funds are mutual funds that largely invest in income stocks. These funds invest money in companies having the ability to pay regular dividends. In this fund, the major part of the portfolio account for companies with a higher yield ratio. These types of funds are generally favored by investors who are seeking steady income and who are less concerned with capital appreciation.

It’s important to note that while these funds can provide regular income, they are not without risks. The underlying stocks in these funds can still experience price fluctuations and market volatility, which can affect the fund’s performance. Additionally, the fund’s fees and expenses can impact its overall returns.

Conclusion

Thus, the investor looking for some regular income through investment should consider dividend yield as a metric for comparison. The usage of this metric is limited to dividends only, as we discussed the flaws of this metric. Hence, for an overall return perspective, it is advisable to look at the larger picture by considering the industry in which the company operates, past dividend patterns, dividend policy, investment opportunities available to the company, etc.