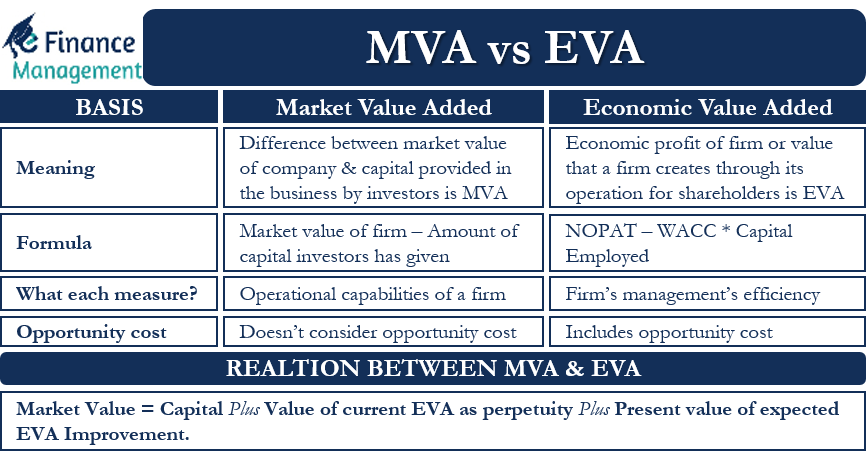

An investor has several ways to value a company, but two of the most popular ones are Market Value Added (MVA) and Economic Value Added (EVA). MVA is the difference between the market value of a company and the capital provided in the business by the investors. On the other hand, EVA is the economic profit of a firm or the value that a firm creates through its operations for its shareholders. Both these measures have their own importance, and it is very important for investors to know and understand them. Thus, it is crucial that investors know the differences between MVA vs EVA.

MVA vs EVA – Meaning

As said above, we get MVA after subtracting the market value of a firm from the capital that investors contribute. Obviously, if the residual value is more than the capital contributed, that means the company has added value or created wealth. However, if this value comes out to be negative, it indicates that the company has eroded the investment value of the shareholders. And the market value of the company has come down.

The formula to calculate MVA is V minus K.

- Here V is the market value of the firm. This includes the market value of both equity and debt.

- And K is the amount of capital investors have given to the firm.

Unlike EVA, which is a performance metric, MVA is a wealth metric that measures the financial value of a firm. If a company continues to perform well financially, its share prices will go up. This would further push up the MVA of a firm, and it creates wealth for the shareholders.

So, it will not be wrong to say that MVA is the premium that investors assign or are ready to pay to a firm for its performance over the years. One drawback of MVA is that its calculation does not consider cash payments that a firm makes to the shareholders.

MVA measure works well for firms that trade on public exchanges. However, small and private companies can also use this measure if they have all the details of the capital contributions from the shareholders.

On the other hand, EVA is the economic profit that a firm makes. The economic profit is the value that a company creates/adds over and above the required return for the firm’s investors. The investors here include both equity and debt holders. In simple words, EVA is the profit that a company makes after reducing the cost of financing. The basic premise of EVA is that the company’s value creation is more than the cost of capital.

Stern Stewart & Co (Stern Value Management) was the first to come up with the EVA concept. Another name for EVA is economic profit. In other words, through EVA, we aim to derive the true economic profit made by the firm from its operations. EVA comparison amongst the firms within the industry is quite easy and possible.

- We can get EVA by subtracting capital charges or financial costs from the NOPAT (net operating profit after taxes).

- We can get the capital charge by multiplying the economic capital and the cost of capital.

Formula to calculate EVA = (r – c) * K = NOPAT – c * K

- Here r s the ROIC (return on investment capital),

- NOPAT is the net operating profit after tax;

- K is the economic capital employed; and

- C is WACC (weighted average of the cost of capital).

MVA vs EVA –Differences

There are many differences between MVA and EVA, and these are:

Concept

EVA’s concept highlights that investors must earn a return that is more than the cost of capital or return from any other investment. MVA’s concept simply means the perceived value of a company in investors’ view should be more than the money they propose to invest.

Also Read: Enterprise Value

Calculation

Calculating MVA is simple as one can easily get a company’s market cap and capital amount. On the other hand, calculating EVA is relatively difficult as it requires more inputs, including the cost of capital, which is not easy to calculate.

Example

Company A has a NOPAT of $200,000, while the invested capital is $2 million. The WACC for Company A is 8.5%. Now, the EVA for Company A will be:

EVA = $200,000 less ($2 million * 8.5%) = $30,000.

Now, let’s see an example of MVA.

Company X has 1.5 million shares and 250,000 preference shares. The market value of the common shares is $10, while that of preference shares is $20. The total capital from the investors is $12 million.

Total market value = (1.5 million * $10) + (250,000 * $20) = $20 million

MVA = $20 million less $12 million = $8 million.

What Each Measures?

MVA primarily represents the operational capabilities of a firm. Or the success of a firm in maximizing the returns of the shareholders. In contrast, EVA is a measure of a firm’s management’s efficiency.

Opportunity Cost

MVA does not consider the opportunity costs of any alternative opportunities that a firm may come across. On the other hand, EVA calculation includes opportunity cost in the form of the required return that investors expect.

Micro Level

One can easily calculate the EVA for departments and product lines. This helps and adds to the Management in making various key investment decisions with regard to these departments. On the other hand, it is not possible to calculate MVA for departments and product lines. It is calculated for the company as a whole.

MVA vs EVA – Relation

There are many differences between MVA and EVA, but both share a relation as well. One way to calculate EVA is to get the net present value of all the current and future cash flows of a company. So, this means MVA is the same as NPV (net present value), and thus, one can get it by calculating the present values of all future EVAs. This is because discounted EVA and discounted FCF are mathematically the same.

Since the market value of a firm depends on how investors expect a firm to perform in the future, so in a way, market value is sensitive to the changes in the current EVA and expectations regarding EVA improvement.

So, we can represent the market value of the firm in terms of EVA as well.

Market Value = Capital Plus Value of current EVA as perpetuity Plus Present value of expected EVA Improvement.

Final Words

Both MVA and EVA are very useful metrics for the management as they tell how well a company is performing. Moreover, both also assist management in evaluating possible strategies for boosting the value of a firm. But, since MVA involves the use of EVA as well, many experts believe MVA is a better measure of a company’s performance.

Frequently Asked Questions (FAQs)

Market Value = Capital plus Value of current EVA as perpetuity plus Present value of expected EVA Improvement.

One way to calculate EVA is to get the net present value of all the current and future cash flows of a company. So, this means MVA is the same as NPV (net present value), and thus, one can get it by calculating the present values of all future EVAs. This is because discounted EVA and discounted FCF are mathematically the same.

MVA primarily represents the operational capabilities of a firm. In contrast, EVA is a measure of a firm’s management’s efficiency.