Definition of Net Operating Profit after Tax (NOPAT)

As the name suggests NOPAT is the net operating profit after adjusting it for the tax liability. Every company raises funds to start, sustain and grow its business operations. The funds could be arranged either through equity or a mix of debt and equity. The funds so raised are used for the creation of assets for the business operations. Therefore, investment by the company could be in operating as well as non-operating assets. Operating assets are those short-term or long-term, liquid or illiquid, assets acquired for use in the conduct of the core business operations of a company. And these usually include inventory, prepaid expenses, account receivables, and fixed assets – property, plants, and equipment. The revenue generation by these operating assets over a financial period is reported in the Profit and Loss Account (P&L) or Income Statement according to the accounting principles.

And the net difference between the revenue generated by the core operations and the expenses directly relating to generating this revenue is called the Operating Income or Operating Profit.

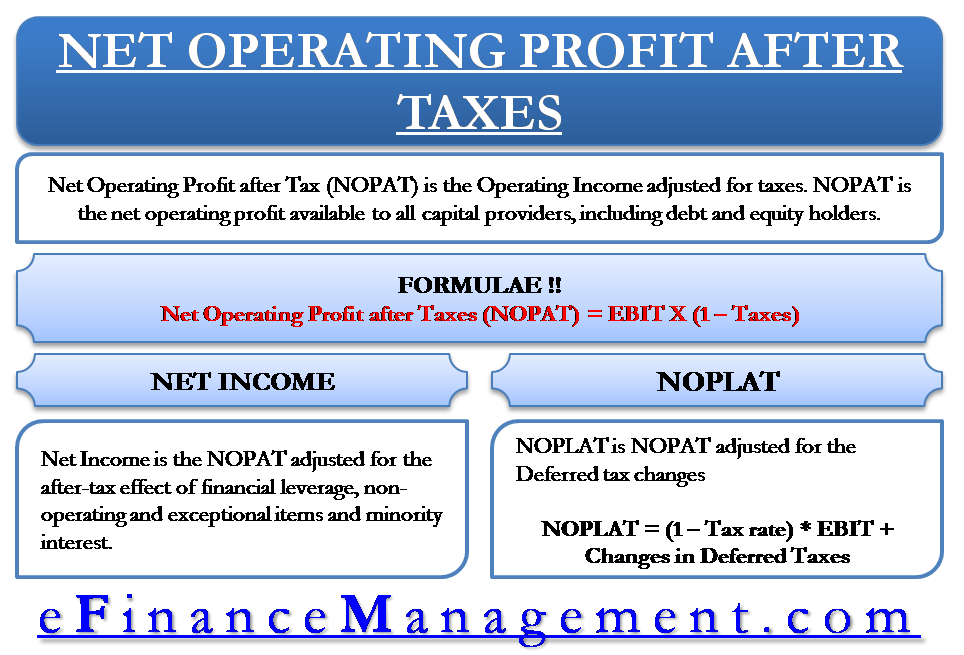

Therefore, the Net Operating Profit after Tax (NOPAT) is the Operating Income after the deduction of taxes. And all non-core operational activity-related income and expenses of the company remain outside of this calculation.

Structure of P&L Account For Calculation of Net Earnings

In accounting and Financial Management, there are various stages and ways to calculate earnings. Each stage and methodology has its own significance and purpose for which it is calculated. Therefore, each stage and method has been given a different nomenclature. So there are several similar terminologies there like NOPAT. And these are EBIT, EBIDTA, EBT, and so on. For the calculation of NOPAT, one needs to well understand those stages or levels to avoid any confusion with similar terminologies. Further, all these calculations and final numbers are derived from the details available in the Profit & Loss Account or Income Statement.

Also Read: Net Operating Profit After Tax Calculator

Hence, it would be appropriate to glance over the structure of the Profit & Loss Account and learn a bit about these look-alike terminologies as well.

The table below provides a typical structure of any P&L Account and it is the starting basis to calculate NOPAT.

| STRUCTURE OF PROFIT & LOSS ACCOUNT | ||

| Gross Revenue | ||

| Less: Sales Return | ||

| Net Revenue | ||

| Less: Cost of Goods Sold | Gross Profit | A |

| Less: Operating Expenses | ||

| Sales & Distribution Expenses | ||

| Administrative Expenses | ||

| Staff Salaries and Contributions | ||

| Rent and Lease Expenses | EBITDA | B |

| Less: Investment Expenses | ||

| Depreciation | ||

| Amortization | EBIT or Operating Profit | C |

| Less: Financing Costs | ||

| Interest on Loans | EBT (Operating) | D |

| Add/Less: Non-Operating Income & Expenses | ||

| Add: Exceptional Income & Profit | ||

| Less: Exceptional Expenses & Loss | EBT | E |

| Less: Taxes | ||

| Net Revenue / Earnings | ||

EBITDA

It stands for Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA). And is used as a proxy for the company’s profitability and operating cash flows. For the calculation of this, all the cash operating expenses are deducted from the total revenues. And this value becomes the base to compare the profitability of companies across different industries. Because this value is not impacted or influenced by the level of capital expenditures and depreciation policies.

EBIT

This is Earnings Before Interest and Tax (EBIT) or operating profit. It is the revenue generated by a company through its core operations and commercial activities. And after deducting cash operating expenses, and non-cash depreciation and amortization expenses. It can be viewed as the EBITDA adjusted for the capital intensiveness of the business.

Calculation of NOPAT

As we discussed and saw the typical structure of the P&L Account of an entity. The calculation of NOPAT is not a direct one like EBIT or EBIDTA. Rather NOPAT value needs to be derived. Of course, to shortcut the process we can use EBIT as a base to start with. Because EBIDTA represents the Operating profit of an entity from the core activities. Whereas NOPAT is the operating profit after deducting the taxes from it.

Also Read: Net Income Formula – Calculation and Example

NOPAT Formula

The detailed formula is:

NOPAT = * (1 – Tax rate)

OR

NOPAT = * (1 – Tax rate)

OR

NOPAT = EBIT * (1 – Tax rate)

NOPAT is the net operating profit available to all capital providers, including debt and equity holders. NOPAT does not take into account the effect of leverage so it is only used when calculating figures or ratios related to the firm value, as opposed to equity value which includes the tax shield associated with debt. NOPAT is often an input component in DCF models.

You can also refer to our calculator: Net Operating Profit After Tax Calculator.

NOPAT Example

Consider the following data of TQM Ltd. to understand the concept of NOPAT.

- Revenue from operations $500,700

- COGS $320,000

- Administration expenses $45,300

- Depreciation $78,400

- Tax rate 30%

| Particulars | Remarks | ($) |

| Revenue from operations | (a) | 500,700 |

| COGS | (b) | 320,000 |

| Gross Profit | (a) – (b) = (c) | 180,700 |

| Admin. expense | (d) | 45,300 |

| Depreciation | (e) | 78,400 |

| Operating expenses | (d) + (e) = (f) | 123,700 |

| EBIT | (c) – (f) | 57,000 |

NOPAT = $57,000 * (1 – 0.30) = 39,900

NOPAT & Net Income – Relation

How to Calculate Net Income using NOPAT?

Net Income is the NOPAT adjusted for the after-tax effect of financial leverage, non-operating and exceptional items, and minority interest, if necessary. Net income is, therefore, the income attributable to equity holders and it’s why sell-side analysts on Wall Street focus heavily on earnings per share. The formula to calculate Net Income from NOPAT is as follows:

Net Income = NOPAT + [ Non-operating Gains – Non-operating Loss – Interest Expense + Interest Income] * (1-Tax rate)

NOPAT vs. Net Income

The difference between NOPAT & net income are listed below:

- NOPAT is calculated by deducting tax on gross profit less operating expenses. While net income is the profit left after deducting tax and taking into account all income and expenses. Whether operational or non-operational.

- NOPAT is a tool for comparing the operating efficiencies of two companies while net income is used to compare overall profitability.

- Investors are the only users of NOPAT whereas net income is used by shareholders, investors, and other stakeholders.

- Formula for calculating NOPAT = EBIT*(1-tax rate). And, to calculate net income, the formula: [(EBIT – Interest)*(1 – tax rate)].

- NOPAT does not take leverage into account while net income does.

| Basis | NOPAT | Net Income |

| Interest | Does not consider interest expenses | Consider interest expenses in the calculation |

| Uses | To compare operating efficiency | To compare overall profitability |

| Users | Investors are the only users | Investors, shareholders, other stakeholders |

| Formula | EBIT*(1-tax rate) | [(EBIT – Interest)*(1-tax rate)] |

| Leverage | Does not consider | Consider leverage |

NOPLAT vs NOPAT

There is a subtle difference between NOPAT and Net Operating Profit Less Adjusted Taxes (NOPLAT) that is nonetheless important. Generally, accounting and tax rules are different so expenses that are deductible for accounting purposes may not be deductible for tax purposes, or the deduction rules may differ.

The most common example is depreciation. In the US, fixed assets are often depreciated on a straight-line basis on the P&L but on an accelerated depreciation basis for tax purposes, resulting in a deferred tax liability. It should be noted however that deferred taxes are usually temporary so NOPLAT and NOPAT should converge in a long-term forecast.

The formula for NOPLAT is:

NOPLAT = (1 – Tax rate) * EBIT + Changes in Deferred Taxes

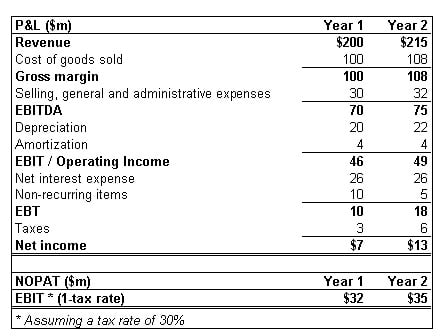

To better understand how these figures are calculated in practice, you can look at the P&L below which provides a line-by-line example of the main items on the top line and bottom line.

Caution

It is very very important to note that the calculation of NOPAT is done mostly on a theoretical or proforma basis. This is to compare the operating efficiencies of firms across the industry without the influence of their capital mix or capital structure. As we know debt has its own cost and interest is tax-deductible. Hence, same-size companies having a different debt-equity mix will show different operating profits due to the tax impact. Therefore, the operating efficiency comparison becomes difficult. So, businesses calculate NOPAT to do away with the capital structure mix effect. In other words, NOPAT is the profit available to all the stakeholders- debt holders, shareholders, investors, and so on.

Except when the tax rules of a country may require a company to pay taxes as per their operating profits.

Read What is the Best Definition of Profit? to learn more.